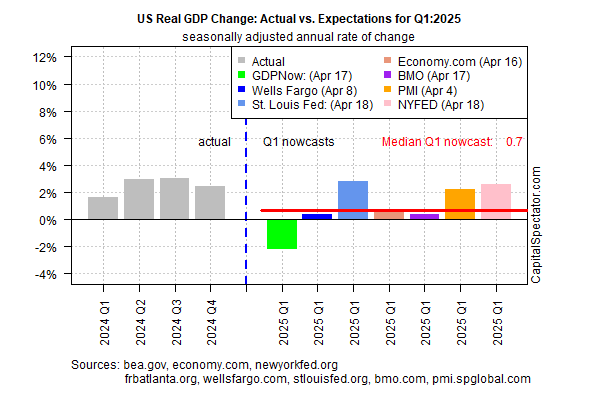

The latest snapshot for U.S. first-quarter GDP points to a notable deceleration in growth, with a median nowcast assembled by CapitalSpectator.com from multiple data sources suggesting annualized real GDP growth near 0.7%. If this trajectory holds, the jump in output that characterized the previous quarter would give way to a marked slowdown, following Q4’s relatively robust 2.4% expansion. The Bureau of Economic Analysis (BEA) remains the authority for the official initial GDP estimate for the quarter, though the timing and sequence of data releases mean that the first read may not reflect the full set of developments currently weighing on activity. Importantly, today’s revised median nowcast does not capture the ongoing, and potentially intensifying, trade-related turmoil that is impacting both the U.S. and the global economy. The broader implication is that the Q2 data could present a clearer, more comprehensive picture of how tariffs and trade frictions are altering economic dynamics.

The economic narrative surrounding these numbers is evolving quickly, with a chorus of international institutions and domestic economists revising expectations downward in response to tariff tensions and related uncertainty. For context, the latest update comes after a prior assessment on Apr. 10, which put the Q1 median nowcast at 0.8%. The downward drift from 0.8% to 0.7% is not merely a statistical footnote; it signals a shift toward softer growth in the near term that may ripple through investment, consumption, and hiring. The concern is that the soft Q1 reading does not yet incorporate the more extreme trade disruption currently roiling markets. In other words, while Q1 looks weak on the surface, the true, more consequential drag may become visible in Q2, when tariffs’ effects are more fully embedded in trade, production, and supply chain decisions.

This article lays out the current nowcast landscape, the role of tariff-driven instability in shaping forecasts, and what the latest readings imply for the broader macroeconomic outlook. It also situates the U.S. growth path within the global context, where the IMF has signaled a more cautious stance on both U.S. and world growth. By examining the viewpoints of leading economists and the mechanics behind nowcasting, readers gain a nuanced view of how near-term GDP may evolve, why uncertainty is unusually high, and what economic outcomes markets should be watching as new data unfold.

Q1 Nowcast Landscape: Reading the Numbers, Interpreting the Signals

The current narrative surrounding U.S. GDP in the first quarter rests on a combination of diverse data inputs, statistical methods, and the synthesis of expert judgment across multiple sources. CapitalSpectator.com’s approach to constructing a median nowcast involves aggregating early indicators and expert assessments from a broad set of data providers. The essence of a “median nowcast” is to identify the middle estimate across many forecasts, dampening the influence of outliers while capturing the prevailing market and analyst expectations about the quarter’s annualized growth rate. In this context, the median nowcast for Q1 at 0.7% suggests a softer pace than what was seen in the prior quarter, indicating a deceleration rather than a continuation of the Q4 momentum.

To appreciate what this means, it is important to compare the current projection with the recent trajectory. The prior update, dated earlier in the month, placed the Q1 median nowcast at 0.8%. The shift to 0.7% represents a downward revision that aligns with a pattern of softer readings in early Q1 data streams. Importantly, these nowcasts are forward-looking estimates that rely on incomplete information; they are not the BEA’s official reading. They serve as a timely signal about the direction and tempo of growth before the BEA’s first formal estimate is published. In this environment, even small revisions can carry meaningful implications for financial markets, business sentiment, and policy expectations.

One of the central considerations in interpreting the 0.7% figure is what it does—and does not—capture. The present nowcast does not yet reflect the broad-based, trade-related turmoil that policymakers and analysts anticipate will influence the economy in the months ahead. Tariffs and heightened trade tensions introduce a layer of uncertainty that can suppress investment, delay hiring, and alter consumer and business spending patterns. These effects often materialize gradually, as firms adjust production lines, re-evaluate supplier networks, and reconfigure inventories. As such, a Q2 update that incorporates tariff-driven adjustments could show a more pronounced drag on growth than the Q1 reading alone would imply.

The key takeaway for readers and stakeholders is that the Q1 reading—if realized—would represent a sharp downshift from Q4’s 2.4% expansion. The jump from a robust fourth quarter to a sluggish first quarter would carry implications for expectations about the year ahead, influencing forecasts for consumer demand, capex, and international trade flows. While the BEA’s initial estimate remains forthcoming, it is instructive to view the 0.7% projection as a probabilistic signal rooted in current data trends, with the caveat that external shocks—most prominently tariffs—could intensify the slowdown in the near term. The nature of nowcasting means that these numbers are inherently subject to revision as additional data are received and incorporated into the models.

Another crucial dimension is the broader comparative framework: how the Q1 nowcast aligns with or diverges from the pattern observed in other advanced economies facing similar trade headwinds. The global economy has been characterized by heightened sensitivity to tariff dynamics, supply chain reconfigurations, and policy responses. The IMF’s global outlook, which has acknowledged the tightening risk environment, adds a layer of cross-border relevance to the U.S. growth picture. In this sense, the 0.7% Q1 signal is not just a domestic statistic; it sits within a larger tapestry of global demand, price pressures, and investment cycles shaped by policy decisions and geopolitical developments.

Within the U.S. data ecosystem, components such as consumer spending, business investment, inventories, government outlays, and net exports have distinct and sometimes offsetting trajectories. A weaker Q1 can arise from softer consumer demand, a pause in capex, or external headwinds affecting net exports. The current reading does not specify the exact contribution of each component, but the confluence of softer indicators across these domains would be consistent with a sub-1% performance in the near term. The Q2 picture, with tariffs and trade risks fully priced into decision-making, is expected to reveal more clearly how these different forces interact and whether the slowdown persists, intensifies, or proves more resilient than anticipated.

In summary, the Q1 nowcast around 0.7% signals a weaker but plausible early-year moment for U.S. GDP, with the caveat that the forthcoming BEA release could adjust this figure higher or lower based on revisions and the incorporation of additional data. The trend from the April update to the present underscores a narrative of softer growth, consistent with the broader concerns about trade tensions and policy uncertainty that have been shaping market expectations. As the data landscape evolves, it remains essential to monitor both the headline growth rate and the underlying composition of demand to gauge how robust the economy is in absorbing external shocks and maintaining momentum through the year.

Tariffs and Trade Turbulence: The Hidden Drag on Economic Activity

Tariffs and related trade tensions represent a critical channel through which the external environment exerts a drag on domestic growth, influencing business planning, investment decisions, and consumer behavior. The Washington-to-global policy conversation surrounding tariffs has been intensifying, and it has become a recurrent theme in discussions of the U.S. growth outlook. The Q1 nowcast narrative, while focused on a relatively modest 0.7% annualized growth rate, must be read against the backdrop of ongoing tariff-driven uncertainty that could manifest increasingly in the months ahead. In this framework, the immediate effects of tariffs may be partially visible in softer payoffs from domestic demand, while their broader consequences—such as delayed capital expenditure, supply chain realignments, and shifts in global demand—are more likely to emerge in the second quarter and beyond.

A fundamental mechanism by which tariffs dampen growth is through the cost channel and the investment channel. Tariffs raise the prices of imported inputs for many U.S. firms, which in turn can squeeze margins or trigger price pass-through to consumers. Firms may respond by postponing or scaling back new investment projects, particularly in highly capital-intensive sectors where the cost of inputs represents a sizable share of total project costs. The investment response can be slow to materialize, especially when firms anticipate policy volatility or expect retaliatory measures that could further complicate international operations. As investment softens and inventories adjust to changing demand patterns, the effect on GDP can become more pronounced in the quarters ahead.

In addition to the direct effects on costs and investment, tariffs contribute to heightened uncertainty, which by itself can dampen spending and hiring. Households facing higher prices for imported goods or more uncertain job prospects may cut back on discretionary spending, while firms may delay expansion plans or hiring until the policy horizon becomes clearer. This uncertainty can also ripple through financial markets, influencing asset prices, credit conditions, and risk appetite. The net effect is a multi-channel drag on growth that may not be fully captured in a single quarterly snapshot but becomes evident in subsequent data releases as the transmission channels play out.

The broader international environment magnifies these dynamics. Tariffs in one major economy can prompt retaliatory measures, supply chain reconfiguration, and shifts in global demand that affect trading partners and rivals alike. The recent commentary from international institutions emphasizes that global growth risks have risen, and trade tensions could further depress activity if they persist or intensify. In the U.S. context, this means that even if domestic demand remains resilient in isolated pockets, the external headwinds could undermine overall growth momentum. Policymakers and market participants alike must consider not only the current numbers but also the trajectory of tariff-related effects as new data unfold.

From a forward-looking perspective, observers should watch for several indicators that can reveal the tariff-driven drag more clearly. Trade data, such as net exports and the composition of imports and exports, can illuminate how demand is shifting in response to price changes. The costs of imported inputs will influence producer prices, inflation dynamics, and competitiveness, potentially altering monetary policy considerations if inflation remains subdued or accelerates due to tariff dynamics. Additionally, business surveys and sentiment indices can provide timely signals about whether firms are adjusting plans in light of tariff uncertainty. When combined with GDP readings, these indicators can help distill the true macroeconomic impact of tariffs beyond a single quarterly growth figure.

In reflecting on the interplay between Q1 softness and tariffs, it is important to consider how the timing of tariff effects might diverge from traditional seasonal patterns. Some sectors may experience immediate backlash in pricing and demand, while others may display delayed responses as supply chains reconfigure or as long-term contracts renegotiate terms in response to policy shifts. This heterogeneity across industries means that the aggregate GDP number could mask sector-specific dynamics that are nonetheless critical to understanding the overall health of the economy. As such, the Q2 data and subsequent releases will be essential for capturing the full extent of tariff-induced effects on growth, investment, and the broader economic climate.

Ultimately, the tariff story is a central thread in the current growth narrative. The combination of a 0.7% Q1 nowcast, the absence of tariff effects in that early estimate, and the IMF’s global growth downgrade all point toward a more cautious outlook for the near term. Policymakers and markets must prepare for a potential continuation of slower momentum as tariff-related adjustments work their way through the macroeconomy. The path forward will depend on how policy responses, trade negotiations, and business sector adaptations unfold in the coming months, along with any shifts in the global economic environment that could either amplify or mitigate the drag from tariffs.

IMF Global Outlook and U.S. Growth Risks

The international perspective on growth remains a crucial frame for understanding the U.S. trajectory. The International Monetary Fund has recently weighed in on the outlook, indicating that risks to the global economy have increased and that worsening trade tensions could further depress growth. IMF chief economist Pierre-Olivier Gourinchas stressed that tariffs and protectionist trends pose a credible downside risk to both U.S. and global growth. This assessment aligns with the broader sentiment among many forecasters who view policy tensions and global trade disruption as meaningful constraints on near-term expansion.

In this context, the IMF’s stance carries implications for how policymakers and investors interpret domestic indicators. If the global growth environment weakens, spillovers to the U.S. economy can come through weaker international demand for U.S. goods and services, tighter financial conditions, and greater uncertainty among multinational firms. The IMF’s downgrade reinforces a narrative that local dynamics—such as domestic consumption and investment—must contend with a harder global backdrop, a combination that can complicate the path toward a robust recovery or sustained growth.

The IMF’s emphasis on trade tensions as a factor in the global outlook also underscores the interconnected nature of macroeconomic risk. In a world where capital can flow quickly across borders and supply chains span numerous countries, tariff-driven policy shifts reverberate through various channels. This interconnectedness means that even sectors that are not directly exposed to tariffs in their domestic market may experience indirect effects through exchange rate movements, commodity price volatility, and shifts in global demand. The IMF’s commentary invites policymakers to consider both domestic policy levers and international coordination as they navigate an environment of elevated risk.

For readers and analysts, the IMF’s view serves as a checkpoint that aligns with other major forecast updates, including private-sector and academic assessments that have become increasingly cautious about the near-term growth path. The central takeaway is that while a single quarterly number—such as a 0.7% Q1 growth rate—provides a snapshot, the longer arc of the macroeconomy is shaped by a constellation of policy choices, trade dynamics, and global development. In this sense, the IMF’s assessment adds nuance to the interpretation of the Q1 data, reminding stakeholders to calibrate expectations for subsequent quarters against a backdrop of heightened uncertainty and potential downside risks.

Economist Perspectives: Uncertainty, “Dancing with Recession,” and the Path Ahead

Beyond institutional forecasts, market economists have been weighing the balance of risks with particular attention to the potential for a softer economic path. Vanguard’s head of global economic research and senior international economist, Kevin Khang, has signaled a need to downgrade growth expectations for the year. In comments reflecting the current mood, Khang told major media outlets that a significantly softer pace of economic expansion is likely in the near term. He emphasized that the outlook is clouded by substantial uncertainty, noting that the variance around forecast trajectories is unusually wide. In his characterization, the economy is in a fraught space—“dancing with recession”—where the baseline may still remain positive, but risks are elevated to a degree that makes recession a non-negligible consideration rather than a distant possibility.

Khang’s assessment underscores the volatility investors and policymakers must contend with as new data emerge. The phrase "dancing with recession" captures a spectrum of scenarios in which growth slows sharply, yet does not collapse into outright contraction. It signals a precarious boundary where small shifts in policy, trade conditions, or financial conditions could tip the economy toward a recessionary path. The degree of uncertainty surrounding the forecast—described as unusually large variance—suggests that conventional modeling assumptions may be less reliable in this particular moment. In practice, this means that businesses, households, and policymakers should prepare for a range of possible outcomes, rather than banking on a single baseline projection.

From a practical standpoint, the Khang perspective reinforces the need for adaptive strategies across sectors. If growth remains fragile and risk spreads widen, firms may adopt more cautious investment plans, adjust inventories in response to evolving demand, and recalibrate hiring and wage strategies in light of uncertainty. Financial markets, in turn, may display heightened sensitivity to policy signals, tariff developments, and quarterly data revisions, as investors reassess risk premia and expected returns. The central message behind these cautious forecasts is not a doom-and-gloom scenario but rather a prudent recognition that the next several quarters could present a wide spectrum of outcomes, with downside risks intensifying if external conditions deteriorate further.

This broader economist viewpoint complements the data-driven nowcast picture by framing the potential trajectories within a risk-management context. The emphasis on uncertainty and the proximity to recessionary territory encourage stakeholders to monitor a broad set of indicators beyond the single GDP headline. For example, employment trends, consumer sentiment, manufacturing activity, and export dynamics can provide early signals about the direction of the economy and how it might weather the current headwinds. In this sense, the conversation around Q1’s 0.7% growth rate becomes part of a larger narrative about resilience under pressure, the resilience of supply chains, and the effectiveness of policy responses in stabilizing the macroeconomy.

Data Release Timing, Revisions, and Key Signals to Watch

The path from the initial GDP estimate to the eventual, definitive assessment is characterized by a sequence of data releases, revisions, and interpretive judgments. The BEA is responsible for delivering the official initial estimate for Q1, which is subsequently revised as more complete information becomes available. The early estimate serves as a critical barometer of the quarter’s momentum, but it is not the final word. Revisions can reflect late-arriving data, improved source data, or changes in how the BEA accounts for complex components such as inventories and net exports. In a period marked by heightened uncertainty, revisions may matter greatly for understanding the durability of growth and for calibrating near-term expectations.

One must keep in mind that the initial GDP reading typically captures broad activity but may omit nuanced, timely developments that later data series illuminate. For example, consumer spending, which often drives U.S. growth, can be revised upward or downward as more detailed monthly and quarterly data become available. Similarly, investment components, which are particularly sensitive to policy and tariff signals, may be subject to substantial revisions as firms adjust to evolving market conditions and supply chain realities. The net effect is that the quarterly GDP figure—the headline measure—can experience revisions that meaningfully alter the perceived strength of the economy.

Beyond GDP, a constellation of leading indicators will be critical for forming a more complete view of the economy’s trajectory. These indicators include, but are not limited to, consumer confidence, retail sales, durable goods orders, manufacturing surveys, employment data, inflation measures, and international trade statistics. Investors and policymakers will closely watch these data points for signs of acceleration or deceleration, as they provide timely feedback on the health of demand, production, and pricing dynamics. In the current climate, where tariff-related uncertainty can exert a lasting influence on decisions across households and firms, the alignment (or misalignment) between the GDP reading and these concurrent indicators will be particularly informative.

From a practical standpoint, market participants should prepare for a period of continued volatility as new information becomes available and revisions unfold. The Q1 0.7% projection—if realized—could influence expectations for monetary policy, fiscal considerations, and sectoral performance across the year. It may also affect debates about the strength and resilience of consumer demand, the pace of business investment, and the capacity of the U.S. economy to absorb external shocks. However, given the acknowledgment that tariffs and trade tensions are not fully captured in the current read, the market’s interpretation will likely hinge on how forthcoming data update the picture of domestic activity and the broader international environment.

In sum, the data release process, with its inherent revisions and uncertainties, remains a critical lens through which to view the evolving growth outlook. The initial Q1 estimate provides a snapshot of the economy at a given moment, but the full story emerges only as the BEA’s subsequent revisions, the release of related indicators, and the unfolding trade dynamics are integrated into the analysis. Stakeholders should remain attentive to both headline GDP numbers and the underlying components, as well as how tariffs, global growth conditions, and policy responses interact to shape the trajectory for the remainder of the year.

Market and Policy Implications: Navigating a Softer Growth Path

A softer Q1 reading, particularly in the context of tariff pressures and global growth risks, has meaningful implications for financial markets, corporate strategies, and policy deliberations. While a single quarterly figure cannot determine policy paths, it contributes to the chorus of signals that influence expectations about monetary policy, inflation, and risk premia across asset classes. If growth remains tepid and uncertain, financial markets may evolve to reflect a greater emphasis on downside risk, more cautious equity allocations, and a preference for safe-haven assets or duration adjustments in fixed income markets. The degree to which tariffs weigh on inflation and pricing power will also influence the policy calculus, as central banks weigh the balance between supporting growth and containing price pressures.

From a policy standpoint, a softer growth trajectory can shape the narrative around the appropriate stance of monetary policy and the flexibility of fiscal initiatives. Policymakers may consider targeted measures to bolster investment and domestic demand, particularly in sectors most exposed to tariff-induced shocks. However, policy responses must balance the goals of stabilizing growth with the need to avoid excessive fiscal expansion in a way that could complicate long-run sustainability. In this environment, the market will be keenly observing how policymakers communicate, what signals they emit about potential adjustments, and how quickly the data justify any shifts in policy posture.

For investors, the evolving data landscape—characterized by a softer quantity of growth and heightened trade-risk awareness—suggests a need for ongoing risk management and horizon diversification. Equities may exhibit sensitivity to sectoral exposure to tariffs and to broader macroeconomic expectations. Fixed income markets could react to revised expectations for interest rates and inflation, with longer-duration assets potentially favored if market participants anticipate greater downside risk and slower growth. Currency markets may respond to relative growth differentials and to policy expectations, with potential shifts in the U.S. dollar’s value depending on how the tariff environment evolves and how global growth prospects unfold.

Investors and businesses should also consider the distinction between “headline” GDP readings and the broader health of the economy. The Q1 projection of 0.7% annualized growth does not necessarily imply a uniform slowdown across all sectors. Some industries may hold up better than others, while some may experience sharper declines. A comprehensive assessment requires looking at the composition of growth—consumption, investment, government spending, and net exports—and evaluating how tariff dynamics are feeding through to the components. This approach helps in forming more resilient strategies that accommodate potential scenarios, rather than anchoring on a single, possibly transient, reading.

Finally, the international dimension warrants attention as well. The IMF’s downgrade of growth and Gourinchas’s warning about rising risks underscore the interconnected risks facing the global economy. U.S. policymakers and markets must stay alert to spillovers from foreign demand, exchange rate movements, and cross-border financial conditions that can influence the domestic growth path. The current moment calls for a balanced, data-driven approach that recognizes the possibility of further revisions and remains adaptable to evolving trade policy and geopolitical developments.

Conclusion

The latest Q1 nowcast for U.S. GDP points to a cooling pace of growth, with a median estimate around 0.7% annualized—marking a clear deceleration from Q4’s strength. Although the BEA will release the official initial estimate for Q1, and while today’s reading does not include the full impact of tariff-related turbulence, the data landscape suggests that the second quarter may reveal a more pronounced drag from trade tensions. The IMF’s global growth downgrade and the concerns raised by Vanguard economist Kevin Khang about elevated uncertainty and the possibility of “dancing with recession” further frame a cautious outlook for the year ahead. Taken together, these elements underscore the importance of monitoring the evolving data, tariff developments, and policy signals as the economy navigates a period of heightened risk and potential volatility. The coming months will be pivotal in determining whether growth stabilizes, accelerates, or faces sustained headwinds as trade dynamics and external conditions continue to shape the domestic economic trajectory.