The US dollar staged a notable rebound across most major peers, propelled by a blend of mixed signals from Washington and Beijing, and supported by shifts in expectations for monetary policy and trade policy. While there was no single catalyst driving the move, a string of headlines created a mood that favored the dollar’s resilience and kept markets wary of deeper risks on the horizon. At the same time, officials signaled a patience-based approach to policy and a willingness to ease tensions with China under the right conditions, which tempered some of the fears around a looming recession. Against this backdrop, markets turned attention to upcoming PMI releases, earnings trajectories, and the ongoing tug-of-war between growth and policy accommodation.

The Dollar’s Rise: A Complex Web of Triggers and Expectations

The U.S. dollar’s ascent against major rivals unfolded through a sequence of nuanced developments rather than a single, decisive event. Early in the period, comments from a high-level official suggested that negotiations with China would likely be arduous, yet ultimately move toward de-escalation of trade tensions. The notion of a protracted, but constructive, bargaining process helped to stabilize risk perceptions, even as concerns about tariffs lingered in the background. As the day progressed, President Donald Trump publicly backed away from earlier threats against Federal Reserve Chair Jerome Powell, stating that there were no plans to remove him from the post. That reassurance, in turn, contributed to a sense that monetary policy would not be abruptly tilted toward aggressive easing, reducing some of the near-term downside risks to rates markets.

In parallel, Trump’s remarks about China implied that, if a bilateral deal were achieved, the tariff burden could be substantially reduced. Such a scenario would be positive for global growth prospects and for risk assets, yet the impact on inflation and the timing of rate moves remained under scrutiny. Collectively, these statements produced a positive tone for the dollar by reducing fears of an imminent policy pivot that could weaken the currency. The link between tariff progress and dollar strength is nuanced: a potential de-escalation reduces the urgency of aggressive domestic stimulus, which can support the dollar by keeping real yields firmer relative to many peers.

Despite this progress, market participants did not fully embrace a narrative of “closed doors” for the dollar. Traders continued to price in a meaningful amount of monetary easing by year-end, suggesting an 80 basis points of rate reductions were still anticipated by the end of the year. This positioning indicates that investors did not believe the doldrums were entirely behind us. The Put-Call balance and implied volatility measures remained elevated in some corridors, reflecting an undercurrent of caution about how quickly the economy could slow or how trade policy could derail growth. In the U.S. growth outlook, the Atlanta Fed’s GDPNow model continued to point to a contraction in the first quarter of 2025, underscoring that the road to normalization, if any, would not be straightforward.

Looking ahead, investors were poised to scrutinize flash PMIs for April to gauge how the world’s largest economy was transitioning into the second quarter. The data were anticipated to reveal whether business sentiment and operating conditions had grown more cautious in the wake of tariff developments and the evolving dialogue with China. A deterioration in PMI readings could threaten the dollar’s recovery and reintroduce volatility into the FX complex, while stronger-than-expected data might reinforce the case for a more gradual or delayed easing path by the Federal Reserve.

As the situation evolved, the broader market narrative remained highly sensitive to how trade-and-policy headlines interacted with macro data. With the dollar’s strength riding on a delicate balance of expectations for policy support and trade stability, traders would be watching how the next batch of PMIs and related indicators shape the near-term trajectory. The absence of a single, obvious catalyst did not prevent broad-based dollar support, but it did emphasize the importance of the evolving policy and trade backdrop in determining the currency’s direction.

Policy Signals: Powell, Tariffs, and the Central Bank Outlook

A central thread in the market’s discourse concerned the fate of Federal Reserve policy and the role of Jerome Powell in guiding expectations. The possibility of a leadership change at the Fed contributed to a sense of policy ambiguity; however, Trump’s commitment not to fire Powell offered a degree of reassurance to markets, implying that the Fed would remain a steady hand rather than being pulled into a sudden shift in direction. This dynamic helped to stabilize rate expectations, suggesting that a more gradual approach to policy normalization would be favored over abrupt shifts that could destabilize financial conditions.

The implication for interest rates was nuanced. On one hand, the absence of a credible plan to replace Powell with a more aggressive easing advocate meant that rate cuts might come more slowly than some investors had priced in. On the other hand, the trade-signal component—the possibility of tariff reductions if a deal with China materialized—introduced a different kind of stimulus that could mitigate some downside risks to growth. The market appeared to interpret this as a source of macro stability that could dampen the urgency for aggressive easing, in turn supporting yields and reinforcing dollar resilience. These parallel threads—policy steadiness domestically and a potential easing of international trade frictions—formed a core part of the macro narrative.

The policy discourse also encompassed expectations around how aggressively the Fed would adjust its stance in response to evolving data. While market participants continued to price in substantial easing by year-end, the tone of communications and the absence of any sharp rhetoric about immediate rate cuts suggested a more measured path. The implications were clear: policy may still lean toward accommodation if growth slows meaningfully or inflation undershoots, but there was an emphasis on patience and data dependence rather than rapid action. The interplay between domestic policy signals and global trade dynamics created a complex environment in which the dollar could strengthen or weaken depending on how the data and headlines evolved.

This section of the market narrative also considered the broader policy picture in Europe and Asia. In Europe, the ECB’s actions and guidance continued to influence global rates expectations, given the cross-border implications of a tighter or looser policy stance. In Asia, trade tensions and tariff discussions fed into global demand expectations, indirectly affecting the dollar via risk appetite channels and the relative attractiveness of dollar-denominated assets. The net result was a multi-faceted policy backdrop where the dollar’s trajectory depended not only on U.S. policy but also on international policy developments and the expected spillovers to inflation, growth, and overall risk sentiment.

Trade Tensions and Tariff Trajectories: A Delicate Balance

Tariffs and trade policy remained at the center of market attention, with investors closely watching the evolution of negotiations between the United States and China. The possibility of a de-escalation in trade tensions was framed as a pivotal factor for global growth, given the enormous scale of bilateral trade between the two economies and the potential ripple effects across supply chains and business sentiment. Statements suggesting that a deal could lead to significant tariff reductions were interpreted as a potential antidote to some of the growth headwinds that had emerged in the prior period.

Nevertheless, the tariff narrative carried with it a degree of uncertainty. While the prospect of tariff relief would be supportive for risk assets over the medium term, it also posed a risk if negotiations stalled or if the political environment shifted in unfavorable ways. Markets tend to price in a spectrum of potential outcomes, and in this context, investors sought to balance the upside of tariff reductions against the downside of renewed tensions or unexpected escalations. The “Liberation Day” reference in market chatter signaled a moment of reflection on tariff policy and its broader consequences for consumer prices, business costs, and overall economic momentum.

The euro area’s reaction to tariff policy also came into focus. The European economy’s sensitivity to external demand meant that tariff announcements and policy shifts in the United States or China could have amplified effects on European growth and inflation expectations. The European Central Bank’s perspective—especially in terms of rate cuts and forward guidance—formed part of the global policy mosaic, shaping how import costs, export dynamics, and domestic demand would respond to a changing tariff environment. The result was a synchronized but uneven global response where the policy stance in one region could influence the currency, bond, and equity markets in others.

From a market mechanics standpoint, the tariff narrative contributed to fluctuations in commodity prices, trading volumes, and risk-on/risk-off dynamics. On a global scale, energy prices, metals, and agricultural commodities often reflect tariff-related risk premiums and displacement effects within value chains. The prospect of policy relief could translate into more stable commodity markets and less volatility in risk assets, while renewed tensions could trigger a flight to safety. As traders navigated this landscape, they balanced the potential for policy easing and growth acceleration against the possibility of renewed friction or delayed resolution.

The practical implications for investors were clear: keep a close watch on tariff policy developments, trade negotiations progress, and any shifts in the political calculus that could influence the likelihood and timing of a deal. The interplay between tariff optimism and caution would continue to shape risk sentiment, asset allocation, and hedging strategies in the months ahead. The broader message was that tariff trajectories could act as a powerful catalyst for both the dollar and global markets, depending on how negotiations unfolded and how confidently market participants priced in the probability of a deal.

PMIs and the Global Economic Pulse: The Spotlight on April and Beyond

With the macro calendar in flux, attention turned to the latest flash PMIs from S&P Global, which were expected to shed light on the health of the U.S. economy as it moved into the second quarter. The PMIs serve as a timely read on business confidence, output, orders, and supplier conditions, making them particularly valuable when headwinds from tariffs and political developments threaten to blur the growth picture. A reading that indicated increased caution among firms could signal a cooling economy and potentially reinforce expectations for continued policy support. Conversely, a more robust PMI print would bolster the case for steadier growth and could temper fears of an imminent downturn.

In parallel, the eurozone’s PMIs painted a mixed landscape. The composite PMI had slipped to 50.1 from 50.9, a signal closer to stagnation than expansion. Such readings carried significant implications for the European Central Bank’s policy stance, especially given the bloc’s exposure to external demand and the potential drag from tariff policies. The ECB had previously enacted a 25 basis point rate cut and had warned that the euro area could bear the consequences of tariff measures more acutely than some other regions. The PMIs fed into the market’s pricing for further easing, with markets now anticipating around 65 basis points more of rate reductions in the year ahead, reflecting a belief that the euro area would require more stimulus to sustain growth under the tariff cloud.

The PMIs thus formed a critical barometer for the near-term macro narrative. If the flash readings corroborated a softening trend, investors could expect continued policy accommodation from central banks and a cautious stance from corporate decision-makers. If the PMIs surprised to the upside, it could push investors to reassess the likelihood of a quicker path to normalization in rate policy, particularly for the U.S. and the euro area. The timing of these releases mattered as well, given the window they provided for market participants to recalibrate risk models, reassess currency valuations, and adjust portfolio allocations accordingly.

Beyond the PMIs themselves, the broader market environment continued to be shaped by earnings season and the behavior of equities in the face of macro data. The S&P Global PMIs contributed to the narrative around whether the global growth impulse remained intact or was fading under the weight of policy uncertainty and trade frictions. The reactions in currency and bond markets to PMI outcomes were important, as they signaled how investors were pricing in the risk of a more prolonged period of weaker growth or, alternatively, a reacceleration supported by policy support and improving trade conditions. The complex interactions among PMI data, policy expectations, and trade developments formed a layered picture of the global economy as markets entered a new quarter.

Analysts emphasized that the PMIs were not just numbers on a page; they were a window into business sentiment and real activity. The price of inaction on policy could be weighed against the possibility of faster normalization if growth signs surprised positively, while the tariff backdrop loomed as a persistent risk factor that could distort the trajectory. Investors would need to synthesize these signals with other data points, including consumer spending, inflation, and labor market dynamics, to form a comprehensive view of where the economy stood and where it might be headed.

Wall Street on the Rebound: Earnings, Sentiment, and the Road Ahead

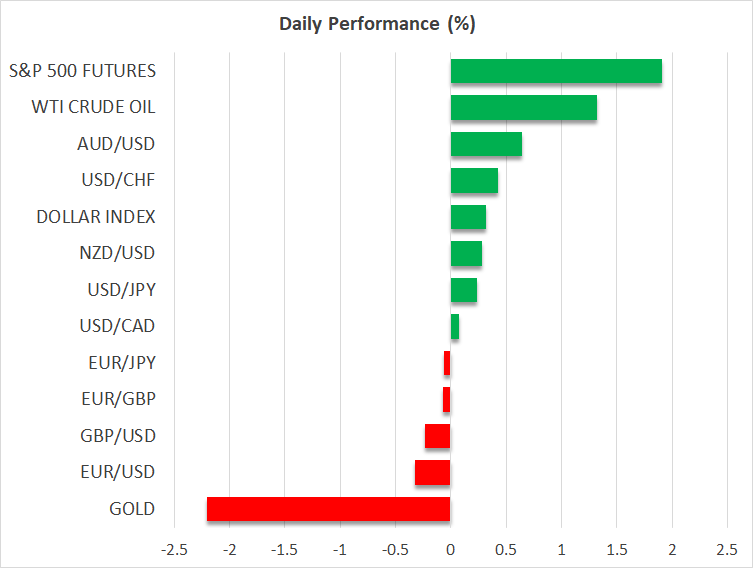

On the equity front, Wall Street managed a broad-based rebound with all three major indices trading in positive territory and rising by more than 2.5% on the session in focus. The positive tilt reflected a blend of factors, including a perceived tilt toward finding common ground with China rather than extending the current trade conflict, which encouraged investors to increase exposure to risk assets. The improvement in sentiment also contributed to a pullback in traditionally safe-haven assets such as gold, while energy prices advanced, signaling renewed risk appetite in the market. This environment suggested that investors were ready to take on more risk in pursuit of higher returns, given the prospect of policy and trade stabilization.

Earnings came into sharper focus as a key driver of the stock market’s direction. With 82 S&P 500 constituents having reported, and a majority—roughly 73%—beating consensus expectations, earnings results served as an important tailwind for the equity market. This phenomenon was interpreted as evidence that corporate performance remained resilient despite headwinds from tariffs and slower macro momentum, reinforcing confidence in earnings growth and the potential for sustained equity gains. Yet, despite this positive earnings backdrop, analysts warned against prematurely declaring a bullish reversal. They pointed out that Trump’s unpredictable approach to policy, including potential hardening of his stance or stalled progress in China talks, could quickly reintroduce volatility and precipitate a shift away from equities toward safer assets.

The market’s dynamic relationship with policy and geopolitics persisted as a defining feature. Investors scaled back some of the most aggressive rate-cut expectations in response to a more balanced stance from policymakers and clearer signals that rate reductions might proceed at a measured pace. Still, the overarching uncertainty surrounding trade policy and growth trajectories meant that risk assets would continue to be sensitive to headline risk. The possibility of renewed escalation in trade tensions or unfavorable developments in negotiations could prompt a swift rotation away from equities and toward cash or high-quality bonds, underscoring the fragile balance between optimism and caution that characterized the market environment.

Within this context, market participants looked for clearer guidance on the path of monetary policy, trade policy, and corporate earnings momentum. The breadth of positive earnings surprises suggested a constructive tone for equities, yet the durability of the rally would hinge on the macro environment’s ability to sustain growth and the resolution of trade frictions. Investors were urged to monitor both macro indicators and company-specific developments, as any signs of deteriorating business conditions or policy missteps could quickly alter the risk-reward calculus. The market’s resilience in the period under review demonstrated that, even amid uncertainty, investors could identify opportunities when the conditions for growth appeared robust and policy signals aligned with the prospects for continued expansion.

The Stock Market, Safe-Haven Flows, and the Oil/Gold Backdrop

As equities advanced, shifts in safe-haven demand offered important context for the broader risk environment. Gold-related positions softened as investors moved toward equities and higher-yielding assets, a behavior consistent with a more favorable risk appetite. However, the safe-haven complex did not disappear; it simply retrenched, ready to reassert itself if headlines tilted toward renewed uncertainty or if data released tomorrow underscored a more pronounced economic risk. The interplay between risk-on behavior in equities and activity in safe-haven assets highlighted the delicate balance investors maintained as they navigated a landscape shaped by policy expectations and trade dynamics.

In the commodities space, crude oil prices recovered alongside risk sentiment, reflecting renewed confidence in economic activity and the prospect of greater energy demand. The energy complex’s performance was closely tied to macro data, geopolitical developments, and the evolving policy backdrop, making it a barometer for the broader economic health. The price movements in oil, along with fluctuations in other commodities, provided an additional lens through which traders evaluated the pace of growth, inflation dynamics, and the potential need for further policy stimulus.

The macro narrative also encompassed the rhetoric around inflation and its trajectory in the coming months. With the inflation backdrop influenced by tariff-related costs and potential supply chain adjustments, investors sought to gauge whether price pressures would re-accelerate or ease as the global economy adjusted to shifting policy and trade conditions. The resulting Price-Plus Growth framework informed portfolio construction and hedging strategies, guiding decisions on currency exposure, fixed income allocation, and equity selection. As the market progressed, the confluence of positive earnings, accommodative policy expectations, and tariff-related optimism supported a constructive tone for equities, while the risk of policy missteps or renewed tensions served as a reminder that the path forward was unlikely to be linear.

Market Outlook: Risks, Opportunities, and the Road Ahead

Looking forward, market participants weighed the potential for continued upside in risk assets against a backdrop of policy uncertainty and trade fragility. The near-term outlook hinged on the next wave of economic data, especially PMI readings, inflation metrics, and payroll figures, which would offer fresh evidence about the pace of growth and the persistence of inflation pressures. Policy expectations would continue to adapt as new information emerged, with investors monitoring for any hints of structural shifts that could alter the timing and magnitude of rate cuts.

From a risk management perspective, it was essential to acknowledge the potential for volatility spikes driven by headlines about trade negotiations and central bank communications. Even as the market demonstrated resilience in the face of uncertain conditions, the possibility of abrupt shifts remained a defining characteristic of the current environment. Investors would need to employ flexible strategies that could accommodate changing expectations, including hedges against interest rate moves, currency swings, and sector rotations that could arise from evolving macro signals.

The global tone would continue to be shaped by the interplay between growth dynamics, monetary policy, and the evolving tariff landscape. While the immediate reaction to tariff relief could provide a short-term boost to risk assets and sentiment, the longer-term impact would depend on the durability of policy commitments and the actual implementation of tariff reductions. In this sense, the market’s assessment was about the balance between optimism for a more stable trading environment and the persistent structural risks that could reassert themselves if negotiations stalled or if growth indicators deteriorated more than expected.

The overarching theme was one of cautious optimism, underpinned by a belief that policy authorities would remain responsive to evolving conditions. The path forward would likely feature a combination of gradual rate reductions, ongoing dialogue with trading partners, and a steady, data-driven approach to responding to shifts in growth and inflation. As investors navigated this landscape, they would continually reassess risk and opportunity, calibrating portfolios to reflect the latest evidence on macro momentum, policy stance, and trade policy developments.

Conclusion

In sum, the period under review showcased a dollar that strengthened in the face of a blended set of news—from easing concerns about a complete policy pivot after Powell’s tenure to more favorable prospects for a tariff-deescalation with China. The perception that policy would remain constructive and that trade tensions could ease supported a cautious yet constructive market tone. PMI data and earnings results reinforced the sense that the growth engine remained intact, even as investors remained vigilant about risks associated with policy shifts and external shocks. The European context remained tethered to expectations of further easing should external demand soften and tariff dynamics constrain growth, which fed into a synchronized global market narrative about growth resilience and policy accommodation.

As the next wave of data arrives, investors will be watching for clear signals on policy direction, trade progress, and the true pace of growth. The balance between risk appetite and safety nets will continue to shape asset allocation, currency movements, and the evaluation of earnings trajectories. While the near-term path remains uncertain, the prevailing view is that policy continuity and a measured approach to trade relations could yield a favorable environment for moderate growth, provided that headline risks do not escalate unexpectedly. The market will remain focused on the evolving interplay between policy, trade, and macro data, with the potential for both continued expansion and periodic corrections depending on how these dynamics unfold.