In a year already marked by tectonic shifts in geopolitics, finance, and economic policy, global markets are navigating a landscape of outsized risks and equally notable opportunities. Two major international flashpoints intersect with domestic political turbulence, while the United States confronts a debt predicament of a magnitude not seen in generations. Against this backdrop, market participants weigh the resilience of the American economy and the robustness of financial markets, even as valuations reach historically elevated levels. The convergence of geopolitical tension and financial dynamics creates a complex environment in which policy decisions, investor sentiment, and technological tools intertwine to shape outcomes that could resonate for years to come.

Geopolitical Currents and Market Psychology

The international stage this year features simultaneous conflicts and strategic maneuvers that reverberate through assets and risk allocations across borders. One central narrative is the assertion by China’s leadership regarding Taiwan, a stance that has long been a fulcrum of regional stability and global trade. The rhetoric surrounding Taiwan’s status prompts reassessment of supply chains, semiconductor development, and cross‑border investment flows, as investors weigh the probability of disruption against the capacity for diplomacy or containment. In parallel, North Korea’s leadership has issued warnings and threats that surface as a recurring source of geopolitical anxiety for global security, energy markets, and regional defense postures. These developments, though disparate in their immediate aims, share a common consequence: heightened risk premia and a reassessment of macroeconomic forecasts in many economies, particularly those with significant exposure to Asia-Pacific trade routes and technological supply chains.

Domestic political contours compound this uncertainty. The political landscape in the United States features questions about ballot access for a leading Republican candidate, a matter tied to safeguarding democratic processes and public confidence. While the legal and constitutional mechanics of ballot eligibility unfold, the political undercurrents influence investor expectations about fiscal discipline, regulatory posture, and the pace of fiscal reforms. In times like these, markets have a history of pricing in scenarios of policy continuity or abrupt shifts, and the mere possibility of changes to budgetary priorities can alter the risk‑return calculus for equities, fixed income, and real assets.

Geopolitical risk is not merely a headline; it translates into tangible market dynamics. Volatility tends to rise when policy signals are uncertain, and capital typically flows toward perceived safe harbors during periods of acute tension. However, the current environment also reveals a counterintuitive dimension: episodes of tension can be interpreted by some investors as demonstrations of strategic resilience, signaling that a nation can mobilize resources and sustain the capacity to operate on the global stage even amid adversarial forces. This duality—risk and resilience coexisting—creates a nuanced market psychology where traders increasingly seek hedges, liquidity, and diversification to navigate potential demand shocks and supply disruptions.

The interplay between geopolitics and markets extends to currencies, commodity prices, and risk appetite. A shift in the perceived risk of one region can alter capital flows globally, with implications for exchange rates, sovereign yields, and derivative markets. The chorus of geopolitical commentary often emphasizes the unpredictability of outcomes, yet it is precisely this unpredictability that motivates investors to focus on structural factors such as fiscal sustainability, central bank credibility, and the resilience of economic fundamentals. In this sense, geopolitics acts as both a catalyst for short‑term volatility and a teacher of longer‑run risk management principles, reminding market participants that policy choices and diplomatic developments can rewire expectations in ways that persist long after the headlines fade.

Within this complex tapestry, the investment world is watching for indicators of how policy responses may harmonize with, or diverge from, market pricing. A key theme is the balance between defense and diplomacy: how governments allocate resources to security and strategic competitiveness while maintaining room for growth and social stability. The outcomes of these policy choices—whether they emphasize austerity, stimulus, or structural reform—will influence credit conditions, debt sustainability, and the appetite for risk across asset classes. In short, geopolitics remains a central driver of market direction, but its effects are filtered through the lens of policy credibility, macroeconomic momentum, and investors’ willingness to accept or resist the associated risks.

Implications for Investors and Traders

-

Short‑term risk management: In times of geopolitical tension, diversification and liquidity are essential. Investors may seek assets with lower correlation to global risk events, including high‑quality government debt and diversified real assets, while balancing equities with defensive sectors and cash equivalents.

-

Medium‑term policy considerations: The trajectory of fiscal policy, trade relations, and security spending will shape growth trajectories and inflationary pressures. Markets will respond not only to the level of policy but to how credible policymakers are in delivering long‑run plans.

-

Long‑run strategic shifts: Geopolitics can accelerate structural realignments—regional economic blocs, supply chain resilience initiatives, and technology leadership races—that reprice earnings potential and cross‑border investment flows for years to come.

As these drivers unfold, investors will increasingly rely on disciplined frameworks to interpret signals from policy forums, central banks, and geopolitical milestones, while maintaining an awareness that the risk landscape can shift rapidly in response to destabilizing developments or unexpectedly constructive outcomes.

Valuation Extremes in Equity Markets and the Evolving Equity Risk Premium

A climate of elevated valuations is shaping how market participants interpret risk and reward. Price-to-sales ratios, a gauge of how much investors are paying for every dollar of revenue, have approached levels that, in historical context, have signaled caution about sustainability. In parallel, the overall market capitalization of equities relative to gross domestic product has surged to a level that surpasses long‑term historical averages by a wide margin. These metrics are not mere numbers; they reflect a broad consensus among investors about future earnings potential, discount rates, and the durability of growth trajectories across sectors.

Beyond these valuation measures, the equity risk premium—a metric that contrasts stock earnings yields with the return on risk‑free government bonds—has compressed toward the point where stock yields may lag the yields available on safe treasury assets. In practical terms, this means investors are accepting little, if any, compensation for bearing the additional risk of equity ownership relative to risk‑free cash or short‑term government debt. This compression is a powerful signal: it suggests that, if risk is priced cheaply, any adverse shift in growth or inflation dynamics could require meaningful reevaluation of asset prices.

The implications of a near‑zero or negative equity risk premium are multifaceted. For one, investors may become more sensitive to macro surprises—especially developments that alter the expected path of growth, inflation, or policy rates—since the cushion that typically cushions downside risk is thinner. For another, defensive tilts in portfolios may intensify, with greater emphasis placed on quality, profitability, balance sheet strength, and the durability of cash flows in uncertain environments. This does not imply that equities become inherently unattractive; rather, it underscores the necessity for careful stock selection, preservation of optionality, and strategic risk budgeting.

From a strategic standpoint, the current valuation backdrop calls for a nuanced approach to portfolio construction. Investors may implement diversified exposure across factor styles—value, quality, growth, and momentum—while ensuring that risk controls are commensurate with the potential downside. In addition, active risk management becomes crucial: recognizing that markets can remain overvalued for extended periods, but can also correct rapidly when growth falters, inflation accelerates, or policy credibility is questioned.

The interplay between valuations and macro forces also raises questions about the durability of earnings. If the economy encounters headwinds from geopolitics, tighter financial conditions, or structural shifts in technology and manufacturing, earnings growth may slow or become more uneven across sectors. In such an environment, price multiples may contract, even if some sectors maintain robust top-line growth. Conversely, a timely policy response that supports demand, supply chain resilience, and productivity could sustain earnings momentum in a subset of industries poised to benefit from secular trends.

Investors must also weigh the role of alternative assets and cash within a diversified framework. When equity risk premiums compress and fixed income yields present a challenging trade-off, a balanced allocation to high‑quality bonds, real assets, and inflation‑hedging assets can provide a measure of resilience. In practice, this means not only looking at nominal yields but also considering real yields, inflation expectations, and the evolving risk profile of different fixed‑income instruments, from short-duration Treasuries to inflation‑indexed securities and credit‑quality ladders.

The broader takeaway is that valuations alone do not determine outcomes; the interaction between valuations, policy credibility, global growth trajectories, and inflation dynamics ultimately shapes risk premia and total returns. In a market environment where the stock market sits atop historically high multiples and earnings expectations are conditioned by a delicate balance of demand and policy support, investors should emphasize disciplined risk management, diversified sources of return, and an adaptive approach to portfolio design that can withstand a range of plausible macro scenarios.

The U.S. Treasury Quandary: Liquidity, Debt, and Forward Financing

Historically deemed the safest haven for savers, U.S. Treasury securities are contending with a dramatic reappraisal of risk, liquidity, and the sustainability of debt issuance. The arc of the Treasury market’s health can be traced through a sequence of events that, at first glance, appear paradoxical: instruments designed to preserve liquidity and safety suddenly experience stress during periods of broad market volatility, prompting investors to demand higher liquidity and more robust capital buffers. The pandemic-era crisis underscored a stark reality: even assets traditionally perceived as ultra-safe can behave in ways that surprise the market in the face of extreme systemic stress. The liquidity challenges observed then were accelerated by a confluence of factors, including a surge in funding needs, shifts in cash management behavior, and regulatory dynamics that redefined how dealers and market participants engage with government securities.

The performance of Treasuries over the subsequent period sparked questions about the long‑standing assumption that the federal government could always finance deficits at modest borrowing costs. A striking observation is the substantial decline in the price of outstanding Treasuries during the most acute phase of the crisis, translating into significant capital losses for holders, including banks that navigated leveraged exposure. The core risk questions revolve around why investors would continue to fund the government at acceptable yields when the historical safety premium had been eroded by inflation, fiscal certificates, and unprecedented supply pressures. The situation is not merely a matter of short-term volatility; it challenges the traditional framework that positions Treasuries as the anchor of the global debt market, the yardstick for risk-free rates, and the benchmark funding source for a wide array of borrowers, from multinational corporations to foreign governments.

Two interlinked dynamics drive the current concerns. First, the scale of refinancing risk for U.S. debt is immense. A vast proportion of outstanding Treasury debt requires rolling over in the near term, creating a cycle in which the government must continuously issue new securities to pay off maturing ones. This refinancing requirement is compounded by the fact that an overwhelming share of newly issued debt matures within a short horizon—an arrangement that necessitates frequent auction activity and exposes the debt management framework to shifting funding conditions and investor sentiment. Second, the global demand for dollar-denominated debt remains substantial, but the willingness of investors to purchase longer‑dated Treasuries at modest yields appears to be waning. This shift has broad implications for the cost of financing, the trajectory of the Federal Reserve’s balance sheet, and the broader health of financial markets.

In practical terms, the market has witnessed a pattern of sluggish appetite for longer maturities. Investors have shown a preference for shorter-duration Treasuries, cash equivalents, and instruments with quicker refinancing cycles. The reluctance to commit to longer horizons reflects concerns about rising inflation, the potential for higher policy rates, and the prospect of future debt service burdens expanding as the debt stock grows. The numbers behind these concerns paint a sobering picture: the U.S. government faces a daunting refinancing schedule as it seeks to manage a mounting debt stock. Projections indicate that a sizable portion of the national debt will need to be rolled over within a five-year window, forcing policymakers to balance the need for funding with the risks of higher borrowing costs and potential crowding-out effects on private investment.

This environment places the U.S. Treasury market at the center of global finance. The yield on ten‑year notes, a critical benchmark, continues to influence borrowing costs across a broad spectrum of financial instruments—corporate bonds, municipal issues, and even foreign government debt denominated in dollars. As yields move, they ripple through the pricing of risk across markets, affecting the cost of capital for companies and governments alike. The magnified sensitivity to rates under a high‑debt regime brings into focus the delicate trade‑offs that policy makers confront: how to maintain financial stability, guarantee liquidity, and support economic activity while ensuring the government can service its obligations sustainably.

A deeper layer of concern is the potential for a policy misalignment between debt dynamics and the real economy. If interest costs begin to dominate the federal budget attention—perhaps at the expense of defense spending, infrastructure, or essential social programs—the risk of fiscal imbalances grows. The debt trajectory, if left unchecked, can feed into a cycle of higher taxes, reduced policy flexibility, and greater vulnerability to external shocks. The question for investors and policymakers alike is whether the current framework can adapt to a regime where debt service becomes a larger share of the federal budget and where refinancing risk intensifies due to shifting demand conditions for Treasuries.

In this context, investors and traders must reassess assumptions about the “risk-free” status of Treasuries. The traditional view posits that Treasuries offer safety and liquidity at predictable costs, but the evolving debt landscape and market liquidity constraints demand a more nuanced assessment of risk. If the government’s need to refinance continues to outpace the market’s willingness to absorb new debt at acceptable yields, the path of least resistance may involve higher yields, greater issuance costs, and a reevaluation of the global role of the dollar as the primary reserve currency. Conversely, policy responses that restore confidence in the debt management framework—through disciplined spending controls, credible long‑term fiscal plans, and transparent refinancing strategies—could steady the market, reduce funding stress, and reanchor Treasuries as a reliable anchor for global finance.

The broader implication of the Treasury conundrum is clear: the health of the domestic economy, the stability of financial markets, and the tone of monetary policy are intricately linked to the willingness and ability of the U.S. Treasury to finance deficits without triggering a destabilizing feedback loop. The coming years will test the resilience of debt management practices, the credibility of fiscal discipline, and the market’s appetite for risk in the face of ongoing fiscal pressures. For investors, the essential takeaway is that Treasuries remain a central pillar of global finance, but their role is evolving. The associated risks demand vigilant risk management, diversification, and a sober appraisal of how debt dynamics intersect with inflation, growth, and monetary policy to shape asset prices and the affordability of capital across the economy.

Inflation, CPI, Real Rates, and the Policy Dilemma

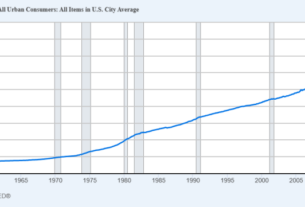

Inflation data continue to command attention as a key input into both monetary policy expectations and the investment calculus. The latest figures from the Bureau of Labor Statistics show a modest monthly uptick in consumer prices, with a December advance reflecting ongoing cost‑of‑living pressures. While the monthly increase matched consensus forecasts, it reinforces the sense that inflation dynamics remain stubbornly persistent rather than decisively fading. These readings have important implications for the trajectory of interest rates, market expectations, and the real returns that investors can reasonably anticipate on a risk‑adjusted basis.

To gauge the real return from holding government debt, investors often compare the nominal yield on long‑dated notes with the rate of inflation. As of the most recent data, the yield on ten-year Treasuries sits near 4.0 percent, while the inflation rate implied by the CPI (on a year‑over‑year basis) sits around 3.6 percent. The resulting real rate is a slim positive figure—about 0.04 percentage points—meaning the actual purchasing power of those interest payments, after inflation, grows only marginally over the holding period. In practice, this near‑zero real return has meaningful consequences for savers, retirees, and institutions that rely on bond income to meet obligations. It also raises questions about whether the risk premium embedded in fixed income is adequate to compensate for the opportunity costs and inflation risk borne by investors.

The inflation picture is further complicated by the persistent gap between headline inflation measures and the dynamics seen in wages, services prices, and shelter costs. The CPI’s current path suggests that the broader inflation regime remains capable of re‑accelerating if supply constraints tighten, energy prices shift, or labor markets tighten in ways that push up costs for businesses. In such an environment, financial markets could experience renewed volatility as expectations for policy rate adjustments shift in response to incoming data. The policy response—whether the Federal Reserve maintains a higher‑for‑longer stance, signals flexibility to adapt to evolving inflation signals, or pivots toward a more accommodative posture—will be crucial in shaping both the inflation trajectory and the valuation of risk assets.

An important dimension of this debate is the comparative measure of inflation against the real yield environment. When inflation outpaces or remains close to nominal yields, the real return risks become more pronounced for investors who depend on fixed income for income generation. This has important implications for retirement planning, pension funding, and endowment strategies, where the need to preserve purchasing power is a central objective. In such circumstances, investors may seek inflation-protected securities, higher‑quality credit with limited duration risk, or diversified exposures that provide a hedge against inflationary shocks. The challenge lies in balancing the desire for higher yields against the risk of price volatility, credit risk, and duration sensitivity in a world of shifting policy expectations.

The inflation‑growth conundrum also interacts with the broader debt dynamics discussed earlier. If inflation remains embedded at a higher level for a prolonged period, real debt burdens can be sustained even if nominal growth accelerates. This interplay between inflation, growth, and debt service costs shapes the fiscal landscape and the risk premium attached to various asset classes. The policy implication is clear: central banks must carefully calibrate their stance to avoid a disproportionate burden on borrowers while sustaining credible anti‑inflation measures. Market participants—whether pension funds, insurance companies, or individual investors—must incorporate a disciplined framework that accounts for both current inflation readings and the probability distribution of future inflation outcomes.

Within this nuanced context, headlines about shifts in policy expectations, conversations about inflation persistence, and the interplay between labor market tightness and wage growth continue to define the investment climate. While some indicators suggest cooling in certain inflation components, others imply that price pressures remain resilient in areas such as housing, medical care, and services. The consequence is a nuanced scenario in which the true test is not simply whether inflation will fall in the short term, but whether it can remain anchored at a manageable level as structural factors—ranging from demographics to productivity trends—shape the medium‑term inflation path. As such, policymakers and investors alike must remain vigilant about the risk that inflation may reassert itself should supply‑side constraints ease unexpectedly or demand conditions strengthen more quickly than anticipated.

Debt Trajectories, Deficits, and the Policy Crossroads

The fiscal arithmetic facing the United States exhibits a magnitude and velocity that challenge conventional budgeting assumptions. In a span spanning a few months, the federal debt has expanded rapidly, with projections indicating sizable additions to the debt stock in the near term. This trajectory has intensified concerns about the sustainability of deficits, the capacity of the government to finance obligations, and the potential macroeconomic consequences of sustained debt growth. The sheer scale of refinancing needs—when previously issued notes and bonds must be rolled over under market conditions that may be less favorable than in the past—highlights a structural constraint on policy flexibility. As the debt load rises, so does the sensitivity of debt service costs to shifts in interest rates, a reality that can crowd out other essential public investments if left unchecked.

One salient feature of the current financing environment is the high share of Treasury debt that matures within a narrow window. In recent years, a substantial portion of new debt has a short time horizon, amplifying the refinancing risk. The more frequently the government must refinance, the more exposed it becomes to abrupt changes in market demand and to the possibility of higher borrowing costs if investors demand a larger risk premium for longer maturities. In practical terms, this means continued auction activity, dynamic debt management strategies, and ongoing attention to market depth and liquidity. The government’s ability to meet its obligations without compromising macro stability rests on a combination of prudent spending, credible long‑term fiscal reform, and an efficient debt issuance program that supports liquidity and keeps financing costs manageable.

Against this backdrop, several policy scenarios become salient. One path would emphasize deficit reduction through tax reforms, spending re‑alignment, and targeted entitlement adjustments. Such measures could improve debt dynamics and reduce the trajectory of interest costs, thereby reinforcing market confidence and reducing refinancing risk. Another path emphasizes growth-oriented policies that raise productivity and expand the tax base, potentially offsetting higher debt service through stronger nominal growth. A third path contemplates inflation management aimed at preserving purchasing power and moderating the real burden of debt. Each scenario carries trade‑offs: higher taxes can dampen demand and investment if implemented abruptly, while aggressive spending cuts can constrain growth and social stability if not carefully managed. The balancing act thus hinges on credible, transparent, and long‑term policy commitments that reassure markets while protecting essential public services and investment.

A critical dimension of the debt discussion is the question of what happens if the government cannot sustain debt issuance at acceptable financing costs. The calculus extends beyond merely funding current deficits to considering the long‑term implications for the dollar’s reserve status, the risk of inflationary financing, and the potential for political pressures to favor inflationary monetization as a last resort. History offers stark illustrations of gradual inflation eroding purchasing power and undermining trust in public debt. In the present context, the risk is not a sudden default in the near term, but a slower, more insidious process of de‑facto default through persistent money creation, creeping inflation, and a steady erosion of debt affordability. Investors, policymakers, and households all bear the consequences of a debt strategy that fails to balance short‑term needs with long‑term sustainability.

Within this framework, several practical considerations emerge for market participants. First, diversify across cash, income‑producing assets, and inflation hedges to protect against a range of possible debt outcomes. Second, monitor the term structure of debt issuance and the shape of the yield curve, which can provide signals about market expectations for growth, inflation, and policy stance. Third, assess the sensitivity of portfolios to rising interest rates and to the cost of rollovers, particularly for institutions with large-duration liabilities. Fourth, consider the role of international capital flows, currency dynamics, and the potential for spillovers that could arise if domestic debt conditions deteriorate or if policy responses fail to reassure global investors. In an era of elevated debt levels and complex risk factors, a disciplined, multifaceted approach to risk management becomes not merely prudent but essential for preserving capital and sustaining growth.

The AI Advantage: Artificial Intelligence in Trading and Market Navigation

A distinctive feature of today’s market discourse is the rising prominence of artificial intelligence, machine learning, and neural networks as tools to interpret data, identify trends, and manage risk. In a climate characterized by high valuations, volatile geopolitics, and debt‑driven dynamics, AI can serve as a supplemental compass for traders seeking to navigate uncertainty and complexity. The premise is straightforward: by leveraging large data sets, historical patterns, and adaptive learning algorithms, AI systems can detect subtle inflection points, quantify trend strength, and adjust risk budgets in real time. This capability has the potential to augment human judgment, allowing investors to respond more quickly and more precisely to evolving conditions.

Supporters of AI‑driven strategies argue that these technologies provide a hedge against model risk, delays in information processing, and cognitive bias. They point to the ability of AI to incorporate a vast array of inputs—from macroeconomic indicators and policy signals to sentiment data and cross‑asset relationships—and to update implications as new data arrive. Critics, however, caution that AI models are not immune to overfitting, data biases, or regime shifts in which previously predictive relationships deteriorate. They emphasize the importance of transparency, robust validation, and disciplined risk controls to prevent systemic mispricing or excessive leverage driven by machine predictions.

Against this backdrop, the narrative around trading with AI emphasizes several practical themes:

-

Trend following at scale: AI systems can be configured to identify and follow persistent market trends while maintaining explicit risk controls, which may help traders avoid late‑stage risk exposures and abrupt reversals.

-

Dynamic hedging and position sizing: By continuously evaluating volatility regimes and correlation structures, AI can inform adaptive hedging strategies and scalable position sizing, reducing tail risk during stress periods.

-

Contingent risk management: AI can monitor a broad spectrum of risk factors, enabling timely alerts and automated responses if market conditions deteriorate beyond predefined thresholds.

-

Complement to human judgment: Rather than replacing traders, AI is presented as a tool that enhances decision speed and data processing, allowing professionals to focus on strategic analysis and risk governance.

-

Transparency and governance: Effective use of AI requires clear disclosure about model assumptions, backtesting results, and ongoing performance evaluation to ensure accountability and alignment with investment objectives.

In practice, the most successful use of AI in trading blends human oversight with algorithmic insight. Humans provide context, ethical guardrails, and a nuanced understanding of political and policy shifts, while AI systems filter noise, quantify relationships, and execute disciplined trade management at speeds far beyond human capability. This partnership can help investors navigate the current environment—where equity valuations are lofty, debt dynamics are delicate, and macro signals can shift abruptly—without surrendering the essential safeguards that protect capital and ensure sustainable returns.

The Global Debt Web, Central Bank Policy, and the Road Ahead

Beyond the United States, the global debt landscape is vast and increasingly interconnected. The stock of outstanding debt worldwide—across sovereigns, corporations, and households—has surpassed staggering thresholds, creating a web of debt dynamics that reverberate through currency markets, trade, and financial stability. In many economies, the combination of rising deficits, aging demographics, and productivity constraints contributes to a long‑haul challenge: how to sustain growth and social programs while managing debt service costs in an environment characterized by uncertain growth and fluctuating inflation.

Central banks play a pivotal role in shaping the path ahead. Their policy choices about interest rates, asset purchases, and macroprudential measures influence the cost of capital, the pace of credit creation, and the resilience of financial systems. The risk is not merely inflation or growth but the delicate balance between supporting demand and maintaining price stability. If policy becomes too accommodative for too long, inflationary pressures can reassert themselves, forcing a tightening regime later on that could shock financial markets. If policy remains too tight for too long, growth could stall and debt burdens could become more burdensome relative to income and output. The resulting policy trade‑offs require clear communication, credible frameworks, and a willingness to adjust as new data arrive.

A critical dimension of this global debt conversation is the impact on international capital flows and currency dynamics. When major economies experience debt stress or policy shifts, the domino effect can influence exchange rates, balance‑of‑payments positions, and the cost of capital for emerging markets. The pricing of risk across global debt markets thus depends not only on domestic fundamentals but also on the relative credibility of central banks, the strength of fiscal frameworks, and the resilience of supply chains in a globalized economy. Investors tracking these developments must consider structural vulnerabilities—such as high leverage in certain sectors, dependence on external financing, and exposure to commodity price cycles—that can amplify the transmission of shocks across countries and asset classes.

As the year unfolds, several themes will shape the trajectory of markets and policy:

-

Debt sustainability: Countries will face ongoing questions about how to manage deficits and refinancing needs without triggering a loss of confidence, capital outflows, or currency depreciation.

-

Inflation resilience: The persistence or attenuation of inflation will determine whether central banks maintain restrictive stances or gradually ease policy, with consequential effects on asset prices and borrowing costs.

-

Growth momentum: Global growth trajectories, influenced by trade tensions, technological innovation, and productivity gains, will shape corporate earnings, investment decisions, and debt issuance strategies.

-

Financial stability: The interconnections among banks, nonbank lenders, and shadow financial markets mean that systemic risk can emerge through liquidity stress, funding gaps, or credit cycles even when headline indicators look stable.

In this broader context, the investment community should remain attentive to developments that can shift the risk–reward landscape across multiple horizons. A disciplined approach to risk management, diversification across geographies and sectors, and ongoing evaluation of debt metrics and policy trajectories will help investors navigate a period of heightened uncertainty while seeking to capitalize on the opportunities that arise from policy clarity, global demand, and technological progress.

The North Star for Traders: AI, Trends, and Risk Management

As markets grapple with elevated valuations, debt dynamics, and geopolitical uncertainty, a recurring theme emerges: the transformative role of artificial intelligence in guiding trading decisions. The contemporary toolkit for traders increasingly relies on algorithmic insights that complement traditional fundamental and technical analysis. The idea is not to abandon judgment but to augment it with data-driven pattern recognition, probabilistic forecasting, and adaptive risk controls. In a landscape where information arrives in torrents and market regimes shift with little warning, AI can offer a structured framework for decision making that reduces emotional bias and accelerates the execution of disciplined strategies.

The practical implications for traders who incorporate AI into their workflow include:

-

Systematic trend identification: AI systems can sift through vast datasets to identify persistent patterns across equities, fixed income, commodities, and currencies, enabling traders to participate in durable moves rather than chase fleeting fluctuations.

-

Risk budgeting and drawdown control: By continuously evaluating volatility, correlation, and liquidity, AI can guide position sizing and hedging to maintain resilience during adverse periods.

-

Adaptive strategy testing: Machine learning models enable backtesting across multiple regimes, providing a more robust understanding of strategy performance under diverse scenarios and reducing the risk of overfitting to historical data.

-

Scenario analysis and stress testing: AI can simulate a range of plausible macro shocks, helping traders prepare for tail events and adjust risk limits accordingly.

-

Governance and transparency: The deployment of AI in trading should be accompanied by clear governance, auditability, and performance evaluation to ensure that models behave as intended and align with risk appetite and regulatory requirements.

It is important to emphasize that AI is not a silver bullet. Markets remain driven by human behavior, policy signals, and macro forces that can exceed the patterns learned by machines. The most resilient investment approaches combine AI‑enhanced insight with disciplined risk controls, robust governance, and continuous human oversight. In a world where the macro environment has grown increasingly complex, the integration of machine learning and neural networks into trading strategies represents a meaningful evolution in the quest to identify, confirm, and protect against the most persistent trends.

The overarching message for investors is clear: embrace innovative technologies as tools that expand your analytical capabilities, but maintain a rigorous framework for risk management, scenario planning, and portfolio construction. The aim is not to chase every signal, but to align with robust, persistent trends while preserving the flexibility to adapt as conditions evolve. By integrating AI insights with a disciplined, diversified approach, market participants can navigate a difficult landscape—from geopolitical shocks to debt dynamics and inflation surprises—without surrendering the core objective of preserving capital and achieving sustainable growth.

The Path Forward: Strategic Implications for Investors

In the face of geopolitical tension, elevated valuations, and a debt environment that tests the limits of conventional policy tools, investors are compelled to recalibrate their expectations and strategies. The following considerations are central to constructing a resilient approach:

-

Focus on discipline, not bravado: In a market environment where valuations are high and uncertainty is elevated, a disciplined investment process—grounded in risk controls, diversification, and regular reassessment of assumptions—becomes a critical asset.

-

Diversify across risk profiles: A balanced mix of equities, fixed income, real assets, and inflation hedges can help absorb shocks and preserve purchasing power over time, reducing reliance on any single asset class.

-

Embrace dynamic tactical adjustments: Markets can remain overvalued for extended periods, yet opportunities arise as regimes shift. A framework for tactical adjustments, supported by AI‑assisted analysis, can help identify when to tilt toward defensives, offload crowded trades, or deploy capital to symptoms of structural change.

-

Monitor debt and policy signals closely: The trajectory of deficits, debt service costs, and central bank policy will shape risk premia and capital costs for years to come. Keeping a close eye on fiscal reforms, refinancing dynamics, and monetary policy expectations is essential.

-

Prioritize liquidity and capital preservation: In uncertain times, preserving capital and ensuring liquidity is a prudent priority. Strategies that balance yield with safety, and that maintain access to capital when markets tighten, are valuable in reducing vulnerability to abrupt dislocations.

-

Prepare for regime shifts: The possibility of a sustained shift in growth dynamics, inflation persistence, or policy stance underscores the need for scenario planning. Investors should test portfolios against multiple plausible futures and adjust exposure accordingly.

The current environment is complex, with multiple moving parts that interact in unpredictable ways. Yet within this complexity lies an opportunity to implement a structured, forward‑looking approach that emphasizes risk awareness, strategic diversification, and the intelligent use of technology. By combining rigorous fundamental analysis with adaptive, data-driven insights, investors can position themselves to weather a challenging period while remaining poised to benefit from the structural drivers that endure beyond today’s headlines.

Conclusion

The year’s intersection of geopolitical tensions, acute debt dynamics, and inflationary pressures has produced a market backdrop that demands both caution and calculated risk-taking. The equity market’s elevated valuations, paired with a seemingly fragile real‑rate environment, challenge conventional wisdom about “risk‑free” assets and the premium investors require for bearing risk. The U.S. Treasury market sits at the center of this constellation, with liquidity concerns, rapid refinancing needs, and a debt profile that continues to evolve under political and macroeconomic pressures. Inflation and CPI readings reinforce the need for vigilant monitoring of price pressures and policy responses as the economy negotiates a delicate balance between growth, stability, and purchasing power.

Amidst these real‑world tensions, there is also a countervailing narrative: the capacity to adapt, innovate, and utilize advanced tools to navigate uncertainty. Artificial intelligence, machine learning, and neural network technologies offer new avenues for discerning persistent trends, managing risk, and supporting disciplined decision making. While AI is not a substitute for sound judgment or prudent risk governance, it can serve as a valuable complement to traditional analysis, enabling investors to process vast data streams, test scenarios, and adjust exposures in near real time.

Ultimately, the path ahead will hinge on how policy designs translate into credible, sustainable outcomes—how fiscal discipline is maintained without compromising growth; how debt management restores confidence in long‑term funding; and how inflation expectations respond to a mix of monetary restraint and supply‑side improvements. The global economy’s interconnectedness means that developments in one region can reverberate across markets and influence outcomes in unexpected ways. Against this backdrop, a resilient investment approach combines a clear understanding of macro fundamentals with adaptive risk management and a readiness to reallocate as conditions evolve.

In closing, the prudent course for investors is to stay informed, stay diversified, and stay disciplined. The coming months will test the durability of earnings, the soundness of public finances, and the credibility of policy signals. By adhering to a structured framework that incorporates both traditional analysis and advanced data-driven insights, market participants can navigate the volatility with greater confidence and position themselves to capture opportunities that arise from structural, rather than episodic, shifts in the global economy.