Investing in a week of rapid shifts in trade policy, labor-market signals, and central-bank rhetoric, four pivotal themes dominated the discourse: how the EU-US trade accord reshapes tariffs for European imports, what the latest US jobs data implies for the Federal Reserve’s next steps, how inflation dynamics could influence policy under both the Fed and the European Central Bank, and the evolving expectations for rate movements in Europe amid a still uncertain global backdrop. As markets digest these developments, the coming days are poised to bring fresh data and new interpretations that could recalibrate investment and policy outlooks across major economies.

Tariff Talks and the EU Accord: What Changed, What Remains Uncertain

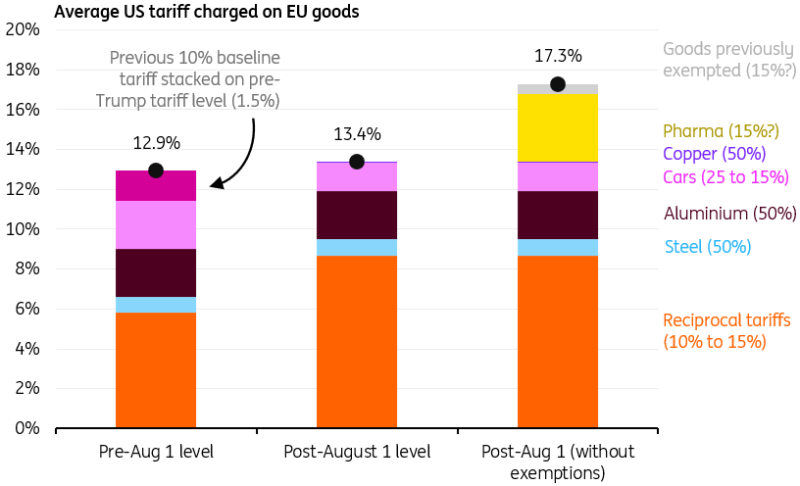

Last week’s trade horizon was anchored by a delicate signal: a quantitative easing of tariff pressures with the European Union, paired with a mix of commitments and ambiguities that will keep policymakers and market watchers closely attentive in the days ahead. The most consequential element of the week’s developments was the adjustment in automobile tariffs, which were lowered from 25% to 15% in the EU context. At the same time, the base tariff, historically set at 10%, rose to 15%. Crucially, this newer framework no longer compounded on the pre-existing average tariff burden—roughly around 1.5%—that European exporters faced prior to the Trump administration’s tenure as President. Taken together, the net effect on the overall tariff burden from the United States to the EU appears, on initial calculations, to be a modest uptick: the average tariff on all goods imported from the EU rose from about 12.9% to roughly 13.4 following this week’s agreement. The observable movement seems largely to be a rounding artifact rather than a dramatic shift in trade costs, but it nonetheless represents a normalization of tariff calculations under the new framework.

A more nuanced dimension lies in the potential inclusion of pharmaceutical products within the EU tariff schedule. The agreement, as currently understood, also contemplates a 15% levy on the pharmaceutical sector, alongside the chip sector and perhaps a broader range of goods that are presently exempt from the global tariff regime. If these sectors were fully integrated into the tariff structure, the average tariff applied to EU-origin goods could rise meaningfully. Yet the precise timing and scope of when these pharmaceutical tariffs would come into force remain unclear. It is not certain whether the administration would implement these measures immediately or phase them in through a quarterly review mechanism that could alter the pacing and magnitude of tariff exposure. The Treasury and trade authorities have signaled that the process might involve periodic reassessment rather than an immediate, all-at-once application, but the exact contours are not yet settled.

From a broader macro perspective, the primary value proposition for Europe in signing off on the deal lies in reducing business and consumer uncertainty. The immediate tariff adjustments may appear technically modest, but the certainty they provide could have meaningful indirect effects on investment decisions, supply chain planning, and consumer sentiment. However, several open questions persist. For example, how will the arrangement handle ongoing negotiations around energy procurement commitments and investment incentives, especially as Europe and the United States map out coordinated or divergent energy policies in the coming quarters? How strictly will the United States enforce any future procurement and investment pledges by European partners, and what quarterly reviews would entail in practice? And importantly, what are the potential spillovers if additional sectors, such as biopharmaceuticals, come under a tariff regime that alters relative price competitiveness?

Another key question is how the deal shapes the growth outlook for Europe and the United States. While the tariff adjustments reduce some level of uncertainty, the data and commentary coming out of euro-area economies suggest that the growth trajectory for the remainder of the year remains challenging. Analysts frequently note that the main monetary and fiscal levers, business investment confidence, and consumer demand will determine the true economic impact of the tariff framework. If the pharmaceutical component does come into play at 15% and is subsequently subject to quarterly reviews or other conditional protections, the net impact on trade volumes and pricing dynamics could be more meaningful for specific industries and for the overall inflation calculus.

In sum, the tariff accord with the EU marks a careful, incremental step toward stabilizing transatlantic trade relations, but it leaves a mosaic of important details unsettled. The most consequential aspects—whether pharmaceutical tariffs will be activated, how and when quarterly reviews will be implemented, and what the exact long-run tariff path looks like—remain to be clarified. For investors and policymakers, the implication is clear: a period of reduced uncertainty is welcome, but the actual economic and inflationary effects will depend on the precise application of these terms and the persistence of any associated policy adjustments on both sides of the Atlantic.

Labor Market Signals and the Fed’s Next Move: Jobs Data, Inflation, and Policy Risks

The labor market was the fulcrum of market expectations this week, tilting sentiments toward a possible shift in Federal Reserve policy. Financial markets priced in a material probability—approximately a 93% likelihood—that the Fed would cut interest rates in September, a jump from roughly 44% just hours earlier, following weaker-than-expected employment data. The surge in expectations underscores how sensitive policy projections are to the latest payrolls and the evolving interpretation of labor-market slack.

A core lens into this dynamic comes from the detailed analysis of payroll data revisions. The May and June employment figures were revised downward, with nonfarm payrolls showing little to no net gain across both months. Such adjustments are often a powerful signal: when data are revised lower, it can imply that the economy was somewhat weaker than initially believed, raising the case for monetary stimulus to support job creation and demand. If these revisions are representative of a broader pattern, the evidence would align with a more accommodative stance by the central bank. Yet the interpretation is not straightforward, as deeper structural factors could be at play—most notably, the rate at which the labor force is growing.

Fed Chair Jerome Powell highlighted an important nuance: payroll data, though informative, is not perpetually the most useful signal for the policy path. He argued that the unemployment rate could be a more stable barometer in the current environment, where labor-force growth has slowed—partly reflecting immigration dynamics and policy decisions shaping the pace at which people enter or re-enter the workforce. In practice, this means that even if job creation slows, the unemployment rate might not rise as rapidly if labor supply is expanding more slowly, thereby perpetuating a higher level of unemployment resilience than the headline payroll numbers might imply.

This interpretation challenges the conventional view that a weakening labor market automatically presages weaker inflation pressures. Powell’s stance suggests that inflation dynamics could diverge from the immediate tone of payrolls, especially if labor supply and wage dynamics respond differently to policy and demographic factors. The broader implication is that the Fed could still deliver a measured, data-dependent path toward easing, should inflation trajectories cooperate or at least not accelerate beyond expectations.

Two critical questions loom on the horizon. First, will the forthcoming inflation reports—most notably the CPI and the core PCE readings—validate or undermine the case for a September rate cut? Inflation metrics remain central to policy, and even as employment data show mixed signals, a hotter-than-expected inflation profile could force the Fed to pause or delay any easing. Second, how do external forces, such as energy prices, supply-chain disruptions, and fiscal policy developments, influence the inflation path in the near term? The answer to these questions will not only determine the timing of a potential rate cut but also shape expectations for the path of the federal funds rate through year-end.

From a policy-reaction perspective, the Fed’s behavior will also hinge on the perceived durability of labor-market weakness versus a longer-run trend of modest job gains. If job growth remains tepid while unemployment trends stabilize, the Fed could adopt a wait-and-see posture while monitoring inflation indicators more closely. Conversely, if inflation accelerates or remains stubbornly elevated as the labor market softens, the Fed might opt for a more cautious approach, balancing the dual goals of supporting employment and containing inflation.

In addition to domestic considerations, external macro developments—such as tariffs and their impact on inflation, as discussed in the tariff section, or international demand conditions—will bleed into the Fed’s assessment of the environment. The interplay between tariff-induced price pressures and wage dynamics is a key variable in the inflation calculus. The central bank’s sensitivity to these cross-border channels means that global trade developments will not be a peripheral concern; rather, they could shape the strength and timing of monetary policy adjustments.

Looking ahead, the central bank has two notable data-collection milestones before the September meeting: inflation metrics and the consumer-spending pulse. If inflation remains stubbornly high or accelerates, the case for a rate cut could weaken, despite soft labor-market signals. If inflation cools or demonstrates resilience at a lower level, the Fed could proceed with a measured easing, backed by a more rhythmic assessment of labor-market slack and wage dynamics. The balance of probabilities remains finely poised, and markets will likely respond decisively to any surprises in inflation data or further revisions to employment figures.

Inflation Dynamics and the Inflation Outlook: The PCE, CPI, and the Policy Path

Inflation remains the central narrative that could either accelerate or dampen expectations for policy normalization. The deflator measures—notably the PCE (personal consumption expenditures) core index—have shown signs that price pressures may persist, albeit in a nuanced manner. Recent readings suggest a pattern where the core goods price trajectory sits near a roughly 4% annualized pace when viewed through a particular lens that focuses on three-month annualized changes. While this signal does not uniformly translate into a single, simple forecast for the coming months, it raises the possibility that inflation could reaccelerate as tariffs, supply-chain frictions, and demand pull on prices at the consumer level.

This dynamic aligns with a broader view that tariff effects may manifest with a lag in the inflation data. The argument is that tariff-driven price pressures might not immediately show up in the earliest CPI prints but could become more pronounced in subsequent readings. If the PCE core remains elevated or climbs further, the risk to the policy outlook is that market expectations for rate cuts could be delayed or scaled back, and financial conditions could tighten accordingly.

The upcoming CPI reports—two readings before the September policy review—are pivotal in shaping expectations. If inflation cools as expected, and if the labor market softening continues to reflect structural factors rather than a demand-driven deceleration, investors could lift rate-cut prospects modestly. Conversely, a hotter-than-anticipated inflation trajectory could solidify the case for delaying any easing, and possibly prompting the Fed to maintain a higher policy rate for longer. This delicate balance underscores the central bank’s reliance on a suite of indicators, including wage growth, consumer spending, and the broader inflation basket that includes domestically produced and imported goods affected by tariff regimes.

From a more structural perspective, the inflation debate must reckon with how policy interacts with energy markets, housing costs, and global supply chains. A robust energy sector can support overall inflation in the short term if energy inputs rise or disruptions occur, while easing supply-chain bottlenecks could dampen price pressures in the medium term. The housing component—especially rents and shelter costs—remains a stubborn element that tends to lag other price series but has outsized influence on headline inflation and the consumer’s purchasing power.

Moreover, the inflation outlook has a meaningful geopolitical and trade dimension. Tariff policies, trade agreements, and global price dynamics for critical inputs like pharmaceuticals and semiconductors influence both the price level and the volatility of inflation. The potential application of targeted tariffs to certain sectors could introduce additional volatility to inflation expectations, complicating the central bank’s calibration of policy. As a result, policymakers will need to weigh not only domestic demand and labor-market slack but also the risk that external policy moves alter the inflation trajectory in uncertain ways.

In this context, the market’s gaze is likely to remain trained on the dual signals of inflation data and the rate-path narrative for both the Federal Reserve and other major central banks. The delicate choreography involves acknowledging that tariffs, wage growth, consumer spending, and energy dynamics do not proceed in isolation. Each can amplify or offset the others, creating feedback loops that influence inflation’s persistence or decline. The coming CPI prints, therefore, will be scrutinized not just for their standalone numbers but for their implications for the broader policy stance, including whether a September cut remains on track or whether market expectations must be recalibrated to accommodate a more measured or prolonged easing cycle.

ECB Prospects: Rate-Cut Probability Diminishes and the Euro’s Trajectory

The European Central Bank’s path in the face of shifting global dynamics continues to be guided by a blend of domestic conditions and international developments. Market participants have grown less confident about a sharp, near-term cut in policy rates for September, with indicators moving toward a more cautious stance. The week’s trade developments and the broader macro environment did not generate a decisive shift in Frankfurt’s logic; if anything, the tariff agreement’s modest impact on amplification of price pressures left the ECB comparatively steady—though not exactly hawkish.

Two crucial factors shape the ECB’s current posture. First, the broader environment of trade policy and growth expectations in the eurozone remains mixed. While some components of growth data and confidence have shown incremental improvements, the overall trajectory still faces headwinds from a gently decelerating global economy, energy price volatility, and external demand shocks. Second, the currency dynamic provides a subtle tailwind. The euro’s weakness in response to the tariff news, especially against a stronger dollar, has the potential to ease price pressures imported from abroad and support export competitiveness. In turn, this dynamic can influence the ECB’s judgments about the necessity and timing of additional stimulus.

The euro’s relative weakness also has bearing on central-bank communications and policy stance. With a weaker currency, imported inflation may ease as competitive pricing and energy costs play a different role in the euro-area’s inflation picture. Conversely, if the stronger dollar and global risk aversion drive market expectations, the ECB could lean toward a more conservative approach, preferring to maintain favorable financing conditions rather than risk reigniting inflation through aggressive easing. The balance is delicate, as policymakers must reconcile signs of improving some domestic indicators—such as low unemployment and supportive but imperfectly mapped growth—with persistent below-target inflation in parts of the region.

Analysts continue to stress that, even if a September rate cut does not materialize in full, the ECB’s stance will be highly data-dependent. The combination of stable or improving growth signals and inflation risks that remain complicated by external factors could push the ECB to a gradual path rather than a swift, large-scale easing. In this framework, the argument for holding rates steady in September gains traction, with the door left open for later action if the economy’s catalysts align more convincingly in favor of monetary accommodation.

A subtext to the European outlook is the risk-reward calculus around any potential shift in policy after a period of relative stability. If the US tariff environment were to relax further, or if the euro-area’s own internal dynamics—such as a rebound in manufacturing activity or stronger services growth—start to lift inflation toward the target, the ECB could reorient toward stimulus or, in a more optimistic scenario, begin contemplating rate normalization again in a future cycle. The calculus remains highly conditional on a constellation of domestic and international signals, with the tariff pathway and global growth momentum acting as significant variables in the week-to-week evolution of policy expectations.

Think Ahead: Regional Market Outlooks Across Emerging and Developed Markets

The week’s turbulence extended beyond the big-ticket policy signals to shape a spectrum of regional outlooks across the developed and emerging markets universe. The following sections summarize the evolving expectations for the United States, Canada, the United Kingdom, Hungary, the Czech Republic, Turkey, and Armenia, reflecting how policymakers and investors are reading data, responding to trade developments, and positioning for potential shifts in monetary policy.

United States (James Knightley): The immediate question centers on whether individual policymakers, including Michelle Bowman and Christopher Waller, could grow more comfortable with rate cuts if labor-market data continues to soften. The ISM services index remains a critical barometer of business activity in the U.S. and is expected to reveal modest improvements, supported by regional surveys. At the same time, the narrowing trade deficit gap could contribute to a more favorable trade balance, enhancing the outlook for macro stability. The interpretation hinges on a nuanced balance between service-sector momentum and the overall demand environment. The employment picture will continue to drive sentiment, but the broader macro narrative will hinge on inflation trends and the policy response to those signals. In short, the coming weeks will be decisive for the timing and extent of any policy shifts, with investors keenly watching how the Fed reconciles labor-market slack with inflation dynamics.

Canada (James Knightley): Canada’s data calendar places the focus on the employment report due on Friday as investors gauge the potential impact of tariff-related shifts on trade with the United States, which accounts for a large share of Canadian exports. The key question is whether the domestic economy can sustain the positive momentum seen in prior payroll data or if it is on the cusp of a slowdown. The risks include domestic demand softness and external demand weakness, which could complicate investment and hiring plans. While a surprisingly resilient labor market might reassure policymakers, a sharper-than-expected slowdown could prompt a more cautious stance in policy communication and forward guidance.

United Kingdom (James Smith): The Bank of England’s policy path remains a subject of debate, with a potential 25 basis point cut in the upcoming meeting on the horizon. The broader inflation picture in the UK continues to display persistence, which tempers expectations for rapid easing. The UK’s labor market data and inflation trajectory interact in a nuanced way; policymakers may find themselves in a position where a split vote reflects a cautious approach. The regional growth dynamics, housing costs, and consumer confidence are essential factors in shaping the BoE’s decisions, as is the evolving global risk environment.

Hungary (Peter Virovacz): In Hungary, the retail and industrial sectors are likely to reflect the economy’s gradual, cautious improvement after a weak earlier cycle. Industrial production and retail sales are expected to show month-on-month gains, albeit tempered by consumer confidence and domestic demand constraints. Inflation trends in Hungary are complicated by imported price pressures and household income dynamics, but the forint’s relative strength and commodity price movements may influence the inflation outlook. The central bank faces a delicate balancing act between supporting growth and containing price pressures, and market participants will scrutinize any policy statements for signals about the operational mix of rate stabilization or gradual easing.

Czech Republic (David Havrlant): Inflation in the Czech Republic is expected to have eased year-on-year in July, with core inflation also trending lower. Food inflation challenges could intensify in the near term due to volatile prices for agricultural products and related supply-chain dynamics. Retail and industrial output for June could maintain healthy growth, reflecting resilient consumer demand and a favorable wage environment. The Czech central bank’s decision on interest rates is likely to reflect improving growth conditions and lower inflation pressures, but policymakers will need to balance the potential for price acceleration driven by labor-market dynamics or housing market activity.

Turkey (Muhammet Mercan): Turkey’s inflation outlook faces upward pressure from a 25% rise in natural gas prices, automatic tax adjustments on goods like alcohol and tobacco, and a depreciation of the lira against the euro, affecting consumer prices. The monthly inflation figure for July is anticipated around 2.5%, while the annual rate is expected to edge down from 35% to around 34.1%, helped by base effects. Market participants will monitor how the central bank responds to these dynamics, including the pace of policy normalization or accommodation given the inflation backdrop and the currency trajectory.

Armenia (Dmitry Dolgin): Armenia’s central bank is set to decide on policy rates, with a likely move between a cut to 6.50% and holding at 6.75%. The case for a cut strengthens given easing inflation and weaker growth dynamics, but policymakers will weigh the risks posed by lingering inflationary pressures and a balanced financial system. The decision will reflect a careful assessment of currency stability, capital flows, and the domestic demand environment, with potential implications for financing conditions and broader macro stability.

Think Ahead in Emerging Markets and Developed Economies: The broader backdrop is one of nuanced, country-specific dynamics. The tariff developments with the EU intersect with regional growth prospects, and the global inflation mosaic—driven by energy prices, supply chains, and policy expectations—continues to shape how central banks calibrate their stance. As markets navigate the interplay of domestic data and international policy, investors will be watching for any shifts in guidance, forward guidance, or changes in near-term rate expectations that could influence asset prices, currency moves, and capital flows.

Conclusion

The week’s events underscore a central theme: macro policy is increasingly driven by the interaction of trade policy, labor-market signals, and inflation dynamics, all within a volatile global environment. The EU-US tariff accord, though seemingly modest in immediate impact, introduces a framework that reduces uncertainty for businesses while leaving open important questions about sector-specific tariffs and review mechanisms. The US labor market narrative remains nuanced—payrolls show weakness, yet unemployment and labor-force dynamics complicate a straightforward read on inflation and the Fed’s trajectory. Inflation readings, particularly those tied to the PCE core and CPI, will be pivotal in shaping expectations for the timing and size of future rate moves by the Federal Reserve, even as arguments for a September cut face a constellation of opposing factors.

Across Europe, the ECB’s policy path appears to be leaning toward caution, with the euro’s movement and energy-price dynamics playing meaningful roles in shaping its decisions. The combination of a softer growth backdrop and the potential for imported price relief through a weaker euro offers a complex, data-driven recipe for policy makers—one that prioritizes data-dependent action over policy bravado. As Think Ahead analyses highlight, regional economies face distinct challenges and opportunities, with labor markets, inflation, and consumer confidence guiding central-bank communicate and policy choices in ways that may diverge from the United States.

In the days ahead, investors and policymakers will watch for fresh data releases, updates on tariff enforcement, and any explicit guidance on how and when quarterly reviews or sector-specific adjustments might be implemented. The convergence or divergence of these threads will shape the global macro narrative, influence risk sentiment, and determine the speed and direction of capital flows across currencies, bonds, equities, and commodities. The overarching message is clear: while one week can bring clarity on certain near-term questions, it also raises new, deeper questions about how policy will adapt to a world where trade frictions, labor-market shifts, and inflation pressures remain interwoven in a complex, evolving tapestry. As the story unfolds, readers and market participants should stay attuned to the forthcoming data, policy signals, and the subtle shifts in expectations that could redefine the trajectory of major economies in the months ahead.