In the quiet cadence of distant market bells, a personal realization emerged that forever shifted how I understand price moves. A long-ago stint reporting agricultural prices in brief radio segments taught me a brutal, humbling lesson: embellishment—superlatives, buzzwords, and supposed insights—could mask a simple truth about what actually drives markets. My broadcasts, dressed up with terms like “heavy volume” or “weather concerns,” often redirected attention away from what mattered most: the real forces behind price action. The moment I confronted that gap in understanding changed everything. It forced a profound self-reflection about the media’s role in shaping market narratives and, more importantly, about my own role as a trader trying to interpret complex dynamics with insufficient clarity. Admitting ignorance, while painful, became the pivotal breakthrough of my trading career, a turning point that compelled me to separate what truly matters in trading from what merely sounds insightful.

That admission set in motion a lengthy, rigorous journey through the labyrinth of trading. The world of price charts and market indicators, with its parade of jargon and credentialed gurus, often promises a golden key to success if you master the right tool or system. I explored a wide array of methods, hoping to unlock the underlying causes of market trends and the mechanics of price action. Yet most tools, even those celebrated for their sophistication, fell short of delivering true illumination. They explained nothing about the deeper interplays that drive sustained moves, and they risked obscuring the forest for the trees. This realization did not come quickly; it came through years of trial and error, with several steps forward followed by persistent setbacks. Still, the stubborn, painstaking process yielded a decisive breakthrough: a moment of clarity that reshaped my understanding of financial markets and the way I approach them.

Socrates’ philosophy provided a philosophical compass for this transformation. Wisdom, he argued, does not spring from knowing all the answers but from asking meaningful questions that expose ignorance and refine understanding. Questions, properly posed, challenge preconceived notions, foster critical thinking, and yield deeper insights. From this process, intellectual curiosity grows and the discipline of reasoning becomes more valuable than reliance on assumptions. The ability to generate intelligent questions—those that reveal underlying truths or inconsistencies—often grows from genuine curiosity and a longing for clarity. This relentless inquiry becomes a crucial habit, enabling navigation through complexity, guiding the search for truth, and supporting well-founded decisions in uncertain markets.

My epiphany did not arise from mastering a new gadget, a deeper credential, or a flashy tool. Instead, it emerged from a quiet interior process: an acknowledgment of the limits of conventional wisdom in trading and a commitment to embrace the market’s inherent complexity. By resisting the lure of certainty offered by many trading systems and focusing on evidence-based analysis, I learned to operate with a nuanced perspective that values clarity and verifiable data above all. The emphasis shifted from chasing the latest signal to cultivating a disciplined, question-driven approach that can adapt to changing conditions. This reframing laid the groundwork for what would become a practical, repeatable way to think about markets—one grounded in observable performance, real-time evaluation, and rigorous reasoning.

Instrumentally, this new mindset began to take shape as I deepened my understanding of how markets perform when viewed through the lens of strength and weakness. I began to imagine market performance as a sequence of distinct buckets, a mental model designed to illuminate where money is actually flowing and which areas are outpacing others. In this visualization, one bucket might capture a robust +25% gain, another a more modest +5%, a third a small -3% decline, and a fourth a substantial -15% drop. The immediate question becomes: what is the first bucket doing right to produce such gains? This line of inquiry, while a useful starting point, would soon reveal its own limitations. It’s easy to mistake isolated outperformance for a durable signal; the trick is to understand whether that strength is sustainable or merely a temporary aberration.

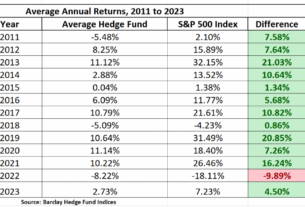

In trading, benchmarks matter, but they can also mislead if misapplied. Traditional benchmarks like broad stock market indexes—the S&P 500, the Nasdaq, the Dow Jones Industrial Average, and the Russell 2000—offer clear metrics, and investors can approximate exposure to these benchmarks through closely tracking ETFs. However, a more salient realization is that real outperformance often requires identifying what is currently outperforming in real time, rather than simply predicting who will outperform based on historical models or theoretical constructs. This insight reframed my approach: instead of chasing potential winners, I prioritized those showing real-time leadership in performance. Under this framework, the question shifts from “What will outperform?” to “What is outperforming now, and why?” The shift is fundamental because it reframes analysis from speculative forecasting to empirical observation.

From this pivot emerges a practical practice: maintaining a real-time performance grid that tracks top assets across multiple time horizons. A grid that continuously displays leaders across short, medium, and longer-term windows makes the phenomenon of “winners keep winning” visible, not as a promise of guaranteed future gains but as a prompt for deeper investigation. By focusing on the strongest performers and studying their behavior, it becomes possible to identify the defining factors behind these persistent moves. This is not a call to blindly chase yesterday’s winners but a disciplined effort to understand what makes certain assets resilient and scalable in the current environment. When the grid highlights a clear cadre of leaders, questions arise naturally: what are the underlying catalysts behind their moves? Which factors—macro forces, company-specific developments, or shifts in sentiment—are propelling the surge? How sustainable are these dynamics, and what risks threaten them?

The framing then broadens into a broader, asset-wide inquiry. The essential wisdom is captured in a two-part discipline: identify what is strong and what is weak, and then test the persistence of the observed strength. This is not merely a heuristic; it becomes a methodological approach to filter noise, prioritize opportunities, and structure risk management around credible, evidence-based signals. In practice, this means constructing and maintaining a performance grid that shows how top assets perform across different time frames, enabling a clear view of which assets are driving leadership and which are lagging. The method relies on continuous observation and disciplined inquiry, rather than reliance on any single signal or opinion. It requires a willingness to revise hypotheses as evidence evolves and to recognize that the market’s structure can shift under new conditions.

With this framework established, I turn to concrete demonstrations of how real-time leadership translates into actionable insight. The narrative of market leadership becomes especially revealing when viewed through a year-to-date lens. As I analyzed performance from January 1, 2024, a handful of assets stood out as the strongest performers, with several others showing notable strength or weakness depending on the window of observation. The top performers in that period included a mix of corporate equities, technology-driven equities, and digital assets, illustrating the multifaceted nature of modern markets. In examining these leaders, certain questions emerge that guide deeper understanding: What is going on with MicroStrategy? What is happening with Bitcoin? What is the trajectory for Nvidia? Why do gold and silver outperform the broader equity indexes? These questions are not mere curiosity; they are an invitation to dissect the conditions that drive durable outperformance.

The emergence of a robust narrative around leadership in the market is not a matter of coincidence. Instead, it reflects how a disciplined approach to performance monitoring can reveal the structural dynamics that sustain momentum. The process begins by acknowledging the dominance of certain assets within the market ecosystem and then asking why those assets are able to maintain strength across multiple horizons. In this context, the S&P 500 becomes a useful reference point, but not the exclusive yardstick. I learned to treat the S&P 500 as a baseline—the equator, if you will, against which more significant stories can be identified. By keeping one eye on the broader market while directing attention to assets that are north of the equator, the path to identifying genuine opportunity becomes clearer. This approach helps avoid the trap of merely chasing broad market exposure when the leverage lies in specific, stronger-than-market trends.

A notable influence in shaping this approach comes from a line of thought that connects artificial intelligence with intermarket analysis. Louis B. Mendelsohn, a pioneer in applying AI to financial markets, explored how deep machine learning networks can illuminate relationships across asset classes. In reflecting on his work, I found that the biggest market-wide shifts often become evident when measured against the rest of the market. The perception that megatrends are obvious only surfaces after such a comparative analysis. Nvidia, for example, has demonstrated a long history of outperformance when measured against the broader field, reinforcing the concept that dominant megatrends tend to illuminate themselves once the market context is properly understood. This observation serves as a practical reminder that AI tools can be employed to sift through enormous data, detect patterns, and reveal the structure underlying persistent trends.

With a clear grasp of who is leading the pack and why, I extend the inquiry into the technological edge that enables deeper analysis. The same performance framework can be leveraged with AI assistance to go beyond surface-level observations. Artificial intelligence helps analyze trends, identify patterns, and refine decision-making by filtering out noise and assessing the sustainability of moves. The goal is not to replace human judgment but to augment it with data-driven clarity. In this sense, AI becomes a powerful complement to intermarket analysis, enabling traders to verify whether a prevailing trend is likely to persist in the weeks and months ahead. The concept is simple in description but powerful in execution: by focusing on the strongest performers and applying AI-driven analytics to those trends, one can improve the odds of aligning with opportunities that exhibit real potential for continued growth.

To illustrate the potential of this approach, several real-time indicators and forecasts are often cited in practice. The narrative emphasizes the dynamic relationship between the market leaders—Bitcoin, MicroStrategy, Nvidia, and Tesla—across multiple time frames. The idea is to observe how each asset behaves on a short-term horizon and how that behavior compares with medium- and long-term trends. This comparative view helps to differentiate transitory spikes from more durable shifts in momentum. The recurring pattern is that certain assets repeatedly rank among the top performers in various windows, signaling a robust, testable set of conditions that could underpin sustainable leadership.

In this light, the practical implication is straightforward: to outperform the market, start by identifying what is already outperforming. The approach is not a guarantee of future success, but it is a disciplined framework for investigating real signals rather than chasing speculative predictions. When the strongest performers reveal a consistency of leadership across multiple time frames, it is both reasonable and prudent to investigate the underlying drivers more thoroughly. Tools like AI become instrumental at this stage, enabling deeper analysis of trends, detection of subtle shifts in momentum, and better management of risk and volatility. AI-supported insights can help confirm whether a trend’s strength is likely to persist or whether a material change in the market structure could erode that momentum.

As the narrative unfolds, it becomes clear that a systematic emphasis on what is strong—supported by rigorous inquiry into the forces behind that strength—provides a practical, repeatable strategy for navigating the markets. The process emphasizes curiosity and disciplined evaluation over reliance on any single model or theory. It invites traders to build a feedback loop: observe real-time performance, generate questions, test hypotheses against evidence, and refine the analysis iteratively. This cycle, grounded in the essential distinction between strong and weak performers, becomes a compelling framework for approaching intermarket analysis with clarity and confidence.

With the foundations in place, it is useful to ground the discussion in concrete examples drawn from recent market performance. In the period starting January 1, 2024, the top performing markets displayed a mix of tech-driven momentum, digital assets, and select equities that benefited from macro and micro catalysts. As readers examine a year-to-date snapshot, several recurring themes emerge: the role of leadership among specific assets, the persistence of momentum in certain sectors, and the ways in which external factors—corporate earnings, policy shifts, and technological breakthroughs—interact with asset-specific narratives. The questions that arise from this examination—such as the approach to MicroStrategy, Bitcoin, Nvidia, and precious metals—serve as catalysts for deeper analysis rather than mere curiosities. They encourage a structured, evidence-based interrogation of what makes an asset maintain strength over time and under evolving conditions.

A deeper understanding of market leadership also reveals how the broader market context shapes decision-making. The narrative around top performers becomes a lens through which to view the dynamics of capital allocation, risk tolerance, and the allocation of resources to high-conviction trends. The emphasis on identifying what is strong and what is weak supports a more resilient approach to trading and investing, reducing exposure to assets that fail to demonstrate durable momentum. This perspective sits at the intersection of traditional market analysis and cutting-edge AI-driven techniques, blending empirical observations with advanced analytics to yield a more robust framework for interpreting markets.

In this evolving landscape, a practical takeaway is clear: to outperform, focus on what is currently outperforming, and use AI to analyze those trends for deeper insight. This approach does not merely rely on historical performance or speculative forecasts; it emphasizes real-time leadership and the ongoing evaluation of momentum across multiple horizons. The combination of real-time observation, rigorous questioning, and AI-supported analysis provides a compelling path forward for traders seeking to navigate complexity with greater confidence. It invites ongoing curiosity, disciplined execution, and a respect for the uncertain nature of markets, while offering a structured method to identify, study, and capitalize on enduring trends.

Conclusion of Section 1 through Section 3. The next sections will continue to build on this framework, elaborating on how to operationalize these ideas with a focus on AI-enabled trend analysis, intermarket relationships, and practical trading implications that align with a disciplined, evidence-based approach to market leadership.

The Four-Bucket Vision: Benchmarking and the Pursuit of Real-Time Outperformance

A central component of the approach to understanding price movements rests on a mental model that segments market performance into four distinct buckets. This visualization—illustrated by a sustained gain of +25% in the first bucket, a moderate +5% in the second, a small -3% dip in the third, and a sharp -15% decline in the fourth—offers a structured framework for evaluating how different assets are moving relative to one another. It is not merely a descriptive exercise; it is a diagnostic tool designed to reveal which parts of the market are delivering leadership and which are lagging.

The initial impulse when confronted with such a four-bucket schema is to ask what the leading bucket is doing right. This question, while intuitive, invites a deeper inquiry. It pushes us toward understanding the conditions, catalysts, and structural forces that enable a particular asset class or individual instrument to deliver outsized gains. Yet, as with any heuristic, this starting point has its limitations. The mere existence of a high-performing bucket does not guarantee that the spark will endure. Transience and mean reversion can erode seemingly robust trends, and the risk of overconfidence looms if one merely extrapolates from short-term strength. Therefore, the method requires careful, ongoing assessment to separate durable momentum from temporary outperformance.

In practice, the four-bucket concept dovetails with a broader benchmarking framework rooted in widely observed market metrics. While broad equity indices such as the S&P 500, the Nasdaq, the Dow, and the Russell 2000 provide convenient yardsticks, there is a crucial distinction to be made. Benchmarks help orient the analysis, but the real opportunity often lies in identifying what is currently outperforming in real time. This perspective shifts the focus from trying to predict tomorrow’s winners to recognizing the leaders who are already delivering outperformance in the present moment. It is a subtle but powerful shift: the emphasis moves toward real-time performance evaluation, enabling a trader to align with leaders while questioning the durability of their strength.

To operationalize this approach, a real-time performance grid is maintained. This grid tracks top assets across multiple time frames, offering a dynamic view of which instruments are ahead and by how much. The grid serves as a navigational tool for understanding the market’s current leadership structure, revealing patterns that might not be visible when looking at a single time frame. By observing the winners and examining their trajectories across short-, medium-, and long-term windows, traders can discern the underpinnings of momentum and the consistency of leadership. The grid thus becomes a crucible for turning surface-level outperformance into deeper inquiry about the sustainability of a trend and the forces driving it.

Crucially, the emphasis is not on a single number or a single snapshot of performance. The real strength of this method lies in its multi-time-frame approach. By comparing how assets rank across different horizons, one can gauge whether leadership is broad-based or narrowly confined to a particular period. This information informs risk management decisions and allocation strategies, helping traders decide where to focus attention, how to diversify exposure, and when to adjust positions as the pattern evolves. The four-bucket framework, combined with the multi-frame grid, provides a practical approach to translating qualitative observations into quantitative monitoring.

In applying the four-bucket model, several additional considerations come into play. First, there is the need to separate structural momentum from episodic spikes. A dramatic move in a single week may reflect a temporary shock or a one-off event rather than a durable shift in trend. Second, cross-asset interactions matter. When one asset’s performance surges, it often has knock-on effects for related instruments or sectors. Understanding these linkages helps explain why some assets maintain leadership even as broader market conditions change. Third, risk management remains essential. Sustained outperformance invites attention, but it also requires thoughtful controls to avoid being overexposed to a single trend or asset that might reverse. The four-bucket model does not replace risk management; it complements it by providing a structured lens through which to observe and interpret market dynamics.

From a practical standpoint, the four-bucket framework invites traders to move beyond static recommendations and toward a living, adaptive approach. It encourages regular revisiting of leadership signals, re-evaluating the factors that drive outperformance, and recalibrating risk positions in light of evolving information. The method is inherently iterative: identify leadership, analyze its drivers, test durability, and adjust exposure accordingly. The result is a more resilient, evidence-based approach to market participation, one that aligns with a disciplined, question-driven mindset.

As we continue to explore this approach, the emphasis remains on the central insight: leadership is observable in real time, and recognizing it is a prerequisite to meaningful performance. The four-bucket model helps transform raw price movements into actionable understanding, guiding traders toward assets that display genuine momentum while inviting scrutiny of the forces sustaining that momentum. This disciplined framework, when combined with robust data analytics and thoughtful risk controls, can help distinguish lasting trends from transient noise, supporting better decision-making under conditions of uncertainty.

In the sections that follow, we will delve into concrete examples and empirical observations drawn from real market data, illustrating how this framework operates in practice and how it can be applied to a wide range of asset classes, including equities, currencies, commodities, and digital assets. We will examine how the performance grid highlighted leaders such as MicroStrategy, Bitcoin, Nvidia, and Tesla, and how the appearance of leaders over different time horizons informs our understanding of market dynamics. The goal is to provide a thorough, evidence-based exploration of how to harness real-time outperformance as a cornerstone of a robust trading approach.

Real-Time Leadership: Who Is Driving the Market—and Why

The market narrative I developed hinges on identifying who is currently outperforming and then asking focused questions about why that leadership exists and whether it is likely to persist. This approach is neither purely empirical nor purely speculative; it seeks to ground decision-making in observable performance while probing underlying causes through deliberate inquiry. When you examine the top performers year-to-date—since January 1, 2024—you begin to notice a recurring and revealing pattern: certain assets dominate across multiple time horizons, suggesting a coherent set of drivers behind their strength.

Among the assets that lead in this period, MicroStrategy, Bitcoin, Nvidia, and the broader sector of AI-related equities consistently surface at or near the top of the performance charts. The questions that naturally arise in studying these leaders are telling: What is going on with MicroStrategy? What is happening with Bitcoin? Why is Nvidia at the forefront? How do gold and silver behave relative to the broader stock market indexes? The cadence of these inquiries reveals a narrative of leadership built not on a single factor but on a confluence of dynamics, including macro liquidity, technology adoption, and evolving risk appetites among market participants.

A compelling metaphor emerges when comparing the performance of the S&P 500 with broader market leadership. I consider the S&P 500 to be the equator in this landscape—a baseline against which the more dynamic stories of leadership can be measured. Focusing attention on assets and trends that lie north of the equator—the leaders—helps avoid passive exposure to broad market indices that may deliver steady but modest returns. This mental model encourages a proactive stance: by charting where the money is actually flowing in real time, one can align with the engines of growth rather than merely tracking a broad market proxy. In this sense, the equator metaphor is a useful heuristic to sharpen focus on genuine alpha sources.

The discussion of leadership becomes more nuanced when we look at time horizons and the persistence of outperformance. Across a six-month window, for example, the same trio of assets—MicroStrategy, Bitcoin, and Nvidia—often appears at the top of the performance stack, with other assets such as Tesla occasionally joining the leaderboard. The fact that these assets resurface in different periods signals the presence of durable, underlying forces rather than ephemeral pushes. The emergence of Tesla in a mid-cycle fashion underscores the iterative nature of leadership: a high-growth tech name may reappear as market conditions shift, liquidity flows evolve, or investor sentiment adapts to new information.

To understand why these leaders persist, one must look beyond surface price movements and examine the catalysts that sustain momentum. For Bitcoin and MicroStrategy, macro trends in institutional interest, the evolution of digital asset ecosystems, and shifts in the perception of risk and store-of-value properties contribute to sustained demand. Nvidia, as a core beneficiary of the AI revolution, captures gains from heightened corporate spending on compute, expanded chip demand across data centers, and a broader narrative about AI-enabled productivity gains. The energy of these narratives often translates into continued demand, helping to propel price action over extended periods.

Gold and silver present an interesting counterpoint to the leadership cluster dominated by tech-centric assets. While they may underperform during periods of risk appetite, they often outperform when real yields are pressured or during episodes of market stress disguised by other narrative drivers. Their relative performance across different time frames adds depth to the analysis, reminding us that safe-haven assets can still play a meaningful role in a diversified approach, even as tech and AI-driven themes capture the spotlight. The comparative performance of precious metals against stock market indexes becomes a study in risk-off versus risk-on dynamics, with the magnitude of the moves offering insight into macro sentiment and liquidity conditions.

A practical takeaway from this leadership-focused analysis is straightforward: if you want to outperform, you must know what is outperforming. The real-time grid and the four-bucket framework converge here to provide a narrative that is both descriptive and diagnostic. By identifying the strongest performers in real time, you create a foundation for deeper analysis—one that examines the drivers behind sustained momentum and scrutinizes the conditions under which those drivers might shift. In doing so, you move away from reactive trading toward a proactive, evidence-based approach that emphasizes discovery, validation, and disciplined execution.

An important dimension of this exploration is the role of intermarket relationships and the application of advanced analytics to interpret them. The same assets that lead in one context may interact with broader market themes in complex ways. AI tools, including predictive forecasting and machine learning-based pattern recognition, can assist in deciphering these interconnections, revealing how the momentum of a leading asset might influence other markets or how related sectors respond to shifts in sentiment. The objective is not to create a predictive crystal ball but to build a robust framework for understanding market structure, validating hypotheses with data, and adjusting expectations as the evidence evolves. In that sense, the analysis of leadership is as much about tempering conviction as it is about identifying opportunities.

As this narrative unfolds, a consistent theme reemerges: to understand where the money is being made, one must observe where leadership is concentrated and how it evolves over time. The four-bucket approach helps to structure this observation, while AI-driven tools provide a deeper, data-driven lens for interpretation. The fusion of these methods enables traders to formulate more informed decisions about entry points, risk controls, and portfolio composition. It also supports a more nuanced appreciation of how market leadership migrates across asset classes as conditions change, offering a dynamic picture of where opportunities are most likely to emerge. The result is a more resilient framework for navigating the markets, one that respects uncertainty while leveraging observable patterns to guide action.

The broader implication is clear: outperformance begins with knowing what is strong and maintaining a disciplined process to understand why. By focusing on current leadership and applying AI-enhanced analysis to these signals, investors can improve their understanding of market dynamics and increase the probability of capturing meaningful returns. This approach does not guarantee success in a world of unpredictable events, but it provides a structured, evidence-based method for identifying leading assets, testing assumptions, and adjusting strategies in response to real-time information. As markets continue to evolve, the combination of leadership-focused observation and AI-powered analysis will remain a powerful toolkit for anyone seeking to navigate complexity with confidence.

Interpreting the Leaders: AI, Intermarket Analysis, and the Case for Nvidia, Bitcoin, MicroStrategy, and More

The convergence of real-time leadership signals and artificial intelligence marks a turning point in how we think about market analysis. Rather than treating AI as a futuristic add-on, the approach integrates AI into the core process of observing, questioning, and validating market signals. In practice, AI serves as a complementary instrument that enhances our ability to parse complex intermarket relationships, recognize patterns, and test the robustness of observed trends. This integrated framework aligns with a broader tradition of intermarket analysis, which emphasizes the interconnectedness of asset classes and the ways in which liquidity, macro sentiment, and sector-specific catalysts interact to shape price action.

Nvidia stands out within this paradigm as a central case study in analytical clarity. Over an extended horizon, Nvidia has repeatedly demonstrated leadership that is detectable when measured against a broad spectrum of assets. The stock’s performance is not merely a function of consumer enthusiasm for AI but also a reflection of structural demand for computing power, data center expansion, and software-enabled productivity gains across industries. The AI narrative in which Nvidia is a flagbearer helps illuminate why certain leadership emerges and endures, reinforcing the idea that understanding the catalysts behind momentum is essential for robust decision-making.

Bitcoin and MicroStrategy likewise provide important lessons in market dynamics and the role of narrative in asset pricing. Bitcoin’s behavior often reflects shifts in macro risk appetite, liquidity flows, and the evolving perception of digital assets as stores of value or speculative vehicles. MicroStrategy, as a corporate vehicle with a focus on bitcoin holdings, offers a case study in how corporate strategies and exposure to digital assets can influence price action and cross-asset correlations. The questions raised about these assets—what is driving their strength, how sustainable is their momentum, and what indicators suggest a coming shift—are not merely academic. They are practical prompts for traders to examine the interplay between technology-driven narratives, macroeconomic conditions, and the evolving regulatory environment that shapes investor sentiment.

Tesla adds another layer of complexity to the leadership story. Its performance, which can appear intermittently on leadership lists, underscores how market attention to technology, consumer demand, and scalable energy solutions can synchronize with broader AI and semiconductor cycles. The six-month view that sometimes includes Tesla among the leaders illustrates the importance of recognizing that leadership can be cyclical rather than constant. The ability to anticipate such shifts depends on a careful synthesis of price action, momentum signals, and the underlying drivers that sustain moves over time. The emphasis remains on disciplined observation and rigorous testing of assumptions in light of new information.

Gold and silver, while often considered hedges or diversifiers, offer critical perspective on risk-off dynamics and macro sentiment. Their relative strength or weakness relative to mainstream stock indices helps provide a more complete picture of risk tolerance in the market. The contrasting performance of precious metals during various phases of risk appetite serves as a reminder that leadership is not monopolized by technology or digital assets. The broader market environment—including inflation expectations, real yields, and policy signals—also influences precious metals, sometimes creating counter-currents to the AI-led momentum seen in equities and digital assets. This interplay underscores the value of a diversified approach and the importance of situational awareness in portfolio construction.

The intermarket analysis framework emphasizes the need to view price movements as products of interacting forces rather than isolated events. The AI-enhanced toolkit supports this view by enabling the examination of relationships that might be too intricate to detect with naked eye or manual analysis alone. Machine learning models can highlight subtle correlations, lagged effects, and nonlinear interactions that contribute to sustained leadership. They can also assist in stress-testing scenarios, revealing how changes in one market may reverberate across others under different macro conditions. In doing so, AI aids in building a more nuanced understanding of the market’s architecture and the risk factors that can alter the trajectory of leading assets.

One practical implication for traders is the use of AI to refine entry and exit decisions without abandoning the core principle of leadership awareness. The approach encourages a process that starts with identifying current outperformance, then uses AI to deepen the analysis of those signals. This includes validating whether the observed momentum is likely to persist, examining potential catalysts, and assessing risk-reward dynamics across multiple horizons. The objective is not to forecast every turn in the market but to build a robust framework that aligns with leading signals while incorporating a disciplined risk management plan. Through this fusion of real-time leadership assessment and AI-enabled analysis, traders can reduce reliance on guesswork and increase the probability of making well-founded decisions.

As part of the ongoing evaluation, it is worth noting how the performance grid evolves over time. In periods where Nvidia and Bitcoin demonstrate sustained momentum, AI-driven analytics often reveal reinforcing patterns across correlated assets, sectors, and even macro indicators. Conversely, when leadership rotates toward new beneficiaries, AI tools help identify the evolving drivers and re-anchor risk strategies accordingly. The continuous cycle—observe leadership, ask critical questions, apply AI for deeper validation, and adjust strategies—constitutes a robust approach to market analysis that respects complexity and uncertainty while seeking to harness persistent momentum.

The broader takeaway is that robust market analysis today integrates human judgment with data-driven insights. The emphasis on identifying currently outperforming assets, understanding the underlying factors that sustain that performance, and employing AI to validate and quantify the strength of that leadership creates a more resilient basis for trading decisions. This synthesis of leadership-focused observation and machine-assisted analysis is central to modern intermarket analysis and to a practical strategy for navigating stocks, futures, options, currencies, and digital assets in a cohesive, risk-managed framework.

Practical Implications: How to Apply a Leadership-Driven, AI-Enhanced Approach to Trading

The core idea—prioritize what is outperforming and use AI to analyze those trends—has tangible implications for how we approach trading and risk management in the real world. It involves a disciplined routine of monitoring real-time performance across multiple time frames, asking targeted questions about leadership, and employing AI-driven analytics to assess the durability of momentum. The practical steps below outline a coherent workflow that traders can adapt to their own styles and time horizons, whether they focus on equities, commodities, currencies, or digital assets.

First, establish a dynamic performance grid that tracks the top assets across short-, medium-, and long-term horizons. This grid should be refreshed regularly to reflect new data and should highlight shifts in leadership as they occur. A well-maintained grid enables rapid recognition of changes in momentum, allowing for timely reassessment of positions and risk exposure. The grid also provides a structured basis for comparing assets against benchmarks and against one another, helping to identify where capital is actually flowing in the present environment. The practical value lies in turning abstract observations into concrete monitoring, enabling more informed decisions about entry points, position sizing, and exit strategies.

Second, develop a questioning framework that guides deeper inquiry into leadership signals. Begin with a few sharp questions: What is driving the current outperformance? Is the momentum supported by fundamentals, policy dynamics, or liquidity conditions? How long has this leadership persisted, and what are the indicators of potential reversal? What are the risk factors that could undermine the strength of this leader? By organizing inquiry around these questions, traders create a structured path from observation to understanding, reducing the likelihood of reacting to noise or short-lived spikes. This approach also helps maintain a balanced perspective, ensuring that the pursuit of winners does not blind us to warning signals or signs of fatigue in the prevailing trend.

Third, integrate AI-assisted analysis to deepen the understanding of leadership signals. AI can process vast datasets, identify patterns that humans may miss, and generate forecasts or scenario analyses that inform risk management. The aim is to use AI as a collaborator that clarifies the dynamics behind momentum rather than as a substitute for sound judgment. For instance, AI-based pattern recognition can help confirm whether a leader’s strength is due to genuine scalability, sector-wide demand, or external catalysts, while scenario modeling can illuminate how the leader might perform under different macro conditions. The result is a more nuanced view of momentum that supports disciplined decision-making.

Fourth, align risk controls with the emphasis on leadership. If a leader demonstrates persistent, multi-time-frame momentum, a trader might consider maintaining exposure but with proportional risk controls that reflect the trend’s strength and volatility. Conversely, if the leader shows signs of waning across one or more horizons, the risk management framework should trigger review and possible adjustment. Position sizing, stop rules, and hedging strategies should be integrated into the workflow to address the possibility of a leadership rotation or abrupt shifts in market sentiment. The objective is to maintain a resilient portfolio that can withstand shifting leadership while preserving upside potential.

Fifth, apply intermarket analysis to understand the broader context in which leadership operates. Look for cross-asset relationships that reinforce momentum or signal potential deterioration. This includes monitoring correlations among equities, commodities, currencies, and digital assets, as well as tracking macro indicators such as interest rates, inflation metrics, and policy statements. An AI-enabled toolkit can help identify intricate relationships and lagged effects that might escape intuitive analysis, offering a deeper, data-backed understanding of how leadership signals propagate through the market. The integration of intermarket analysis with AI-driven insights yields a richer, more comprehensive perspective on where the money is moving and why.

Sixth, maintain a long-term perspective that complements short-term bets. While the leadership-driven approach emphasizes real-time signals, it should not come at the expense of a patient, strategic view of market structure. Leaders today may become laggards tomorrow as macro conditions evolve, policy shifts occur, and technological breakthroughs reshape expectations. A well-rounded strategy combines timely action on current leaders with prudent consideration of longer-run trends and structural shifts. The goal is to reconcile agility with discipline, ensuring that tactical opportunities do not undermine strategic objectives.

Seventh, continuously refine the process based on results and new information. The market environment is dynamic, and the effectiveness of any framework depends on ongoing evaluation and iteration. Track the outcomes of trades driven by leadership signals, analyze the accuracy of AI forecasts, and adjust models and heuristics as needed. The practice of continuous improvement—driven by data, feedback, and critical questioning—ensures that the approach remains robust under changing conditions and resilient in the face of uncertainty.

In implementing these practical steps, it is crucial to remain mindful of the risks associated with trading in any environment, particularly one characterized by high momentum or AI-driven strategies. The emphasis on leadership signals and AI analysis should be complemented by rigorous risk management, diversification, and a disciplined approach to capital allocation. Traders must be aware that outsized gains can be accompanied by substantial drawdowns, and that leverage, liquidity conditions, and sudden regime changes can alter the trajectory of even the strongest leaders. A careful, measured approach helps mitigate these risks while preserving the opportunity to participate in meaningful market moves.

To illustrate how this approach translates into real-world decisions, consider the assets that have led in recent periods: MicroStrategy, Bitcoin, Nvidia, and Tesla, among others. The real-time leadership demonstrated by these assets, when examined across short-, medium-, and long-term horizons, provides a concrete basis for evaluating whether their momentum is likely to continue. AI-enhanced analysis can help confirm whether the driving factors behind their leadership remain intact and whether the risk-reward balance supports continued exposure. This combination of leadership observation and AI-supported validation offers a practical framework for making informed trading decisions rather than relying on intuition or untested theories.

In summary, the practical implications of a leadership-driven, AI-enhanced trading approach are substantial. By focusing on what is currently outperforming, using a multi-horizon performance grid to monitor momentum, and applying AI tools to analyze the durability and drivers of that momentum, traders can develop a more robust, evidence-based practice. This approach enhances clarity, reduces reliance on guesswork, and equips practitioners with a structured workflow that can adapt to evolving market conditions. It is a comprehensive framework that integrates observations of leadership with data-driven insights, supporting more informed decisions in a complex, interconnected financial landscape.

The Future of Trading: A Critical Look at AI-Driven Insights, Warnings, and Practicalities

As the market landscape evolves, the integration of artificial intelligence into trading and market analysis raises important questions about accuracy, reliability, and risk. Embedding AI into a leadership-centric framework—one that emphasizes real-time outperformance and intermarket relationships—offers promising avenues for enhancing decision-making. The key is to balance the power of AI with disciplined judgment, ensuring that sophisticated analytics reinforce human understanding rather than supplant it. This balance is essential to navigating the complexities of modern markets, where momentum can shift rapidly and new drivers can emerge without warning.

A core premise of this exploration is that AI has the potential to transform how we conduct intermarket analysis. By processing vast quantities of data—from price movements and volumes to macro indicators and sentiment signals—AI can uncover patterns and relationships that may be imperceptible to the unaided eye. The ability to synthesize information across multiple markets and time frames enables a more precise assessment of momentum and the factors sustaining it. Yet, as with any tool, AI must be used judiciously. The reliability of AI-driven insights depends on the quality of data, the appropriateness of models, and the careful interpretation of outputs. Traders should not rely on AI outputs in isolation but should weave them into a broader framework built on observation, hypothesis testing, and risk management.

A practical advantage of AI in this context is its capacity to test hypothetical scenarios and generate synthetic futures under varying conditions. For example, AI can help simulate how a leading asset might respond to shifts in liquidity, changes in policy, or evolving technological trends. Such scenario analysis can inform risk controls and help traders prepare for potential regime changes. However, it is essential to recognize that AI forecasts are not guarantees; they are probabilistic tools that can improve the quality of decision-making when combined with human judgment and sound risk management. The strength of an AI-assisted framework lies in its ability to expand the range of what is considered and analyzed, thereby reducing blind spots and increasing the robustness of trading strategies.

Another critical consideration is the importance of context when interpreting AI-generated insights. AI outputs should be interpreted within the broader narrative of market leadership and intermarket dynamics. Observing which assets are leaders across multiple horizons remains a core practice, even as AI adds new layers of analysis. The objective is to ensure that AI reinforces the questions that matter, such as the sustainability of momentum, the credibility of catalysts, and the implications for risk exposure. The best results come from a synergy of human curiosity, structured inquiry, and AI-powered analysis that together create a more comprehensive view of market behavior.

The practical implications for traders and investors extend beyond individual trades. A leadership-focused, AI-enhanced approach encourages a continuous learning mindset: constantly asking questions, testing hypotheses, and refining models in light of new data. It also calls for a disciplined framework for information processing, ensuring that signals are not misinterpreted or overvalued in the heat of momentary momentum. In other words, the approach seeks to combine flexibility with rigor, enabling adaptive responses while maintaining a steadfast commitment to evidence-based decision-making.

In the broader context of market education and professional development, adopting an AI-enabled leadership framework has the potential to democratize access to sophisticated analysis. As AI tools become more accessible, a wider community of traders can engage in real-time evaluation of leadership signals, apply intermarket analysis with greater precision, and experiment with scenario-based risk management. This democratization does not guarantee universal success but it does raise the probability that more participants can navigate the markets with greater clarity and resilience. It also underscores the importance of continuous learning, as market participants must stay current with evolving technologies, data sources, and analytical techniques.

While the potential benefits are substantial, it is essential to acknowledge the inherent risks and limits of any trading approach, including AI-enabled ones. The guidance is to proceed with caution, always using capital that can be afforded to lose and maintaining clear risk-management practices. The financial markets will remain an arena of probability, not certainty, and even the most robust models can encounter regimes that defy expectations. The presence of AI does not eliminate risk; it reframes it by enhancing our ability to anticipate, evaluate, and respond to potential outcomes.

A thoughtful, structured approach to AI-assisted leadership analysis combines several pillars: real-time performance monitoring, Socratic questioning, intermarket analysis, and disciplined risk management. It calls for a hardy skepticism toward overly confident predictions and a preference for evidence-based conclusions grounded in observable, verifiable signals. This approach aspires not to promise outsized returns in every situation but to improve the odds of identifying meaningful opportunities and managing risk in a way that aligns with the realities of a dynamic market environment.

The practical takeaways for practitioners are manifold:

-

Maintain a living performance grid that tracks leaders across multiple time frames.

-

Use a targeted set of questions to probe the drivers of leadership and its durability.

-

Leverage AI to deepen understanding of momentum, identify patterns, and test scenarios, while preserving human judgment as the ultimate arbiter of decision-making.

-

Recognize the limits of AI and the importance of risk controls, diversification, and prudent capital allocation.

-

Embrace intermarket analysis to understand how leadership signals propagate across asset classes and macro conditions.

-

Stay adaptable by continuously refining models, assumptions, and strategies in light of new evidence.

The path forward in trading is not simply about adopting the latest technology or chasing the loudest headlines. It is about building a disciplined, evidence-based framework that combines human curiosity with machine-powered insights. This fusion creates a more robust, nuanced, and resilient approach to navigating markets, especially in an era of rapid change and expanding data availability. The future of trading lies in the thoughtful integration of AI with timeless principles of market analysis—identifying leadership, understanding drivers, and managing risk with clarity and prudence.

Conclusion

The journey from a broadcast voice that relied on flashy terms to a trader who seeks enduring, evidence-based understanding of market dynamics is a testament to the power of humility, inquiry, and disciplined method. By acknowledging that the loudest narratives do not always reflect the true drivers of price action, I embraced a process centered on what is actually outperforming in real time. This leadership-focused perspective reframed how I think about market analysis, shifting the emphasis from predicting the next big winner to understanding the forces that sustain momentum and the conditions that threaten it.

A core takeaway from this evolution is the central role of questions. Socratic thinking—asking purposeful, revealing questions—drives the refinement of knowledge and reduces the risk of cognitive blind spots. The practice of questioning became a reliable compass, guiding me through the noise and toward deeper insight. The four-bucket visualization and the real-time performance grid provided practical tools to translate observations into actionable understanding. They enabled me to identify current leaders, assess whether leadership is likely to endure, and align risk accordingly. These tools are not mere abstractions; they are part of a comprehensive, repeatable workflow grounded in real-time data, disciplined analysis, and informed judgment.

Artificial intelligence emerged as a powerful ally in this framework. Rather than replacing human insight, AI enhances the capacity to process vast datasets, analyze intermarket relationships, and validate the persistence of momentum across multiple horizons. AI’s role is to illuminate patterns, quantify strength, and test hypotheses against a rigorous set of criteria. Yet AI’s outputs must always be interpreted in the context of market structure, macro conditions, and prudent risk management. The true value of AI lies in augmenting, not supplanting, the human capacity to reason under uncertainty.

The practical implications for traders and investors are straightforward: integrate leadership-focused assessment with AI-assisted analysis, while maintaining a disciplined risk framework. Monitor real-time performance, ask penetrating questions about the drivers of momentum, and use AI to deepen your understanding of the forces at play. This combination helps identify enduring opportunities, while expectations are tempered by a sober recognition of risk and the possibility of regime changes. The path forward is not a guarantee of easy profits but a structured, resilient approach to navigating complex markets with greater confidence.

In closing, the journey described here is about clarity, curiosity, and continuous improvement. By focusing on what is strong, interrogating why it is strong, and applying advanced analytics to validate and extend that strength, traders can better align with the market’s most persistent opportunities. The future of trading is unfolding as AI-enabled analysis becomes an integral part of the decision-making process, offering a richer understanding of momentum and intermarket dynamics. The essential questions remain timeless: What is outperforming now? Why is it outperforming? Will the pattern endure? And how should risk be managed in light of evolving evidence? Answering these questions with rigor and discipline is what differentiates durable success from fleeting spectacular moves in the ever-changing landscape of financial markets.