TheNasdaq Composite(NASDAQINDEX: ^IXIC)has been a great performing index, as it beat the broaderS&P 500(SNPINDEX: ^GSPC)in 2024 by rising 28.6% versus the S&P 500’s 23.3%. It wouldn’t surprise me to see those results again in 2025, but I think a few companies within the Nasdaq Composite can outperform the broader index in 2025.

These stocks areMeta Platforms(NASDAQ: META),Alphabet(NASDAQ: GOOG)(NASDAQ: GOOGL),ASML(NASDAQ: ASML),PayPal(NASDAQ: PYPL), andMercadoLibre(NASDAQ: MELI). I think all five of these stocks are solid buys for 2025, and investors would be smart to take a position in them now.

AI Plays: Meta, Alphabet, and ASML

Artificial intelligence (AI) was a huge investment theme in 2023 and 2024, and I expect it to be no different in 2025. Meta, Alphabet, and ASML are a few of my favorite AI investments, but for different reasons.

- Meta and Alphabet are probably better known by their flagship properties, Facebook and Google. These two giants make most of their money on advertising and have significant AI investments. Knowing what ads to put in front of a consumer is key, and developing leading AI models is one way to achieve that goal.

- Google Gemini and Meta’s Llama are their two generative AI platforms, and each is near the top of the list of best-performing models.

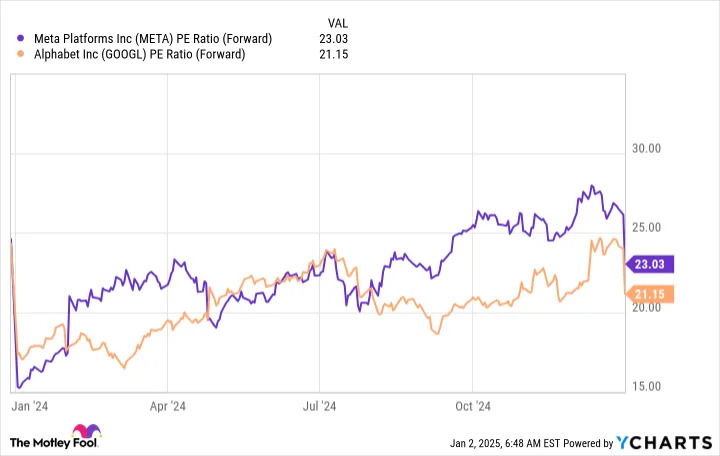

Despite their dominant market position in advertising and solid progress in the AI arms race, these two trade for attractive price tags. META PE Ratio (Forward) data by YCharts shows that Meta and Alphabet are significantly cheaper than the Nasdaq 100 index, which has a forward price-to-earnings (P/E) ratio of 27.1.

This makes these two stocks steals at their current price tags, and investors should take advantage of them in 2025.

- ASML is an entirely different AI investment, as it makes machines vital in microchip production. Its extreme ultraviolet (EUV) lithography machines trace the microscopic etches on chips. ASML is the only company in the world with this technology, giving it a monopoly in the space.

- However, Western governments have stepped in and prevented ASML from selling certain machines to China and its allies, which has caused ASML to reduce its 2025 guidance.

This announcement caused the stock to plummet, but ASML’s management was confident that the long-term investment growth picture was still intact. In fact, management didn’t even change its 2030 revenue guidance from the previous ranges given in 2022.

With its monopoly and strong growth projection for 2030, ASML is a solid buy for 2025.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

- The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them.

- The 10 stocks that made the cut could produce monster returns in the coming years.

- Consider when NVIDIA made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $915,786!*

The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002.

Here are my top 5 Nasdaq stocks to buy in 2025:

- Meta Platforms (NASDAQ: META): A leader in AI and advertising, with a strong track record of growth.

- Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL): Another leader in AI and advertising, with a strong portfolio of brands and products.

- ASML (NASDAQ: ASML): The only company in the world with EUV lithography machines, giving it a monopoly in microchip production.

- PayPal (NASDAQ: PYPL): A leading provider of digital payment services, with a strong track record of growth.

- MercadoLibre (NASDAQ: MELI): A leader in e-commerce and payments in Latin America, with a strong track record of growth.

Investors would be smart to take a position in these stocks in 2025.