It’s not just the headlines that don’t seem to match the receipts. Across households, margins tighten as prices rise for essentials—food, rent, utilities—while the official inflation narrative lately reads as if everything is under control. For traders and investors, the friction between the government’s economic reports and lived experience isn’t a theoretical dispute: it’s a source of risk, and potentially an opportunity, depending on where you stand when the data gate opens. The central tension is straightforward in appearance but complicated in practice: the most watched measures of the economy—CPI, PPI, and jobs data—are not neutral bystanders. They rely on methodologies that shift with political winds, undergo revisions that can wipe away hundreds of thousands of jobs from the record, and typically arrive after the market has already moved on. When the signal finally lands, it can feel like a picture that’s incomplete at best and misleading at worst. In fast-moving markets where timing, accuracy, and context define outcomes, traders can’t rely on government data as the sole compass. The disconnect between “official” inflation and the inflation people actually experience isn’t simply a policy debate; it’s a real-world risk—plus a potential trading edge—for those who position themselves with eyes wide open.

The disconnect between official data and lived experience

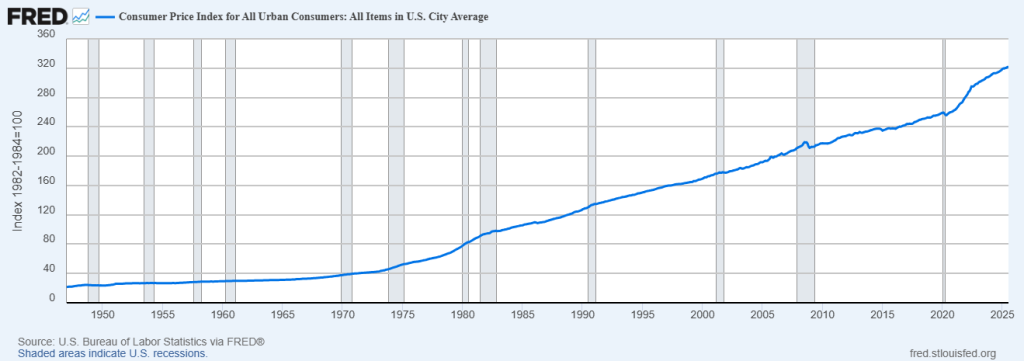

The Consumer Price Index is designed to track the cost of living, yet its underlying methodology can mute the pain consumers feel in real time. Substitution is deployed to allow cheaper goods to replace more expensive ones within the consumer basket, smoothing the perceived impact of price hikes. Weighing acts to dilute the influence of certain high-cost categories, often skewing the headline in ways that underemphasize the burden of particular expenditures. Hedonic adjustments—accounting for alleged “quality improvements” in goods and services—can reduce the reported price of an item even when the sticker price is climbing. The net effect, from a consumer perspective, is that inflation can feel persistently higher than the official number suggests, even as the CPI itself moves. This is not merely a theoretical quibble; it reflects everyday experiences with groceries, housing, energy, and transportation costs that often outpace the numbers published by official statisticians.

Employment figures carry their own caveats. This year, quiet revisions by the National Bureau of Economic Research removed hundreds of thousands of jobs from earlier reports, a recalibration that ripples through related data sets—income, spending, and productivity—altering the narrative of economic health. The process of revising jobs data is not a minor footnote; it reshapes perceptions of labor market strength and, by extension, policy expectations and market sentiment. Similarly, gross domestic product and productivity metrics depend on inputs like trade flows, inventory levels, and corporate investment data—each with its own margin for error and potential misinterpretation. The risks grow when timing enters the equation: by the time CPI, jobs, or GDP are released, markets have already priced in leaked expectations or private forecasts, meaning the official data arrives as a retraced step rather than a fresh signal. For traders, this lag can transform what should be a clarifying datapoint into a retrospective footnote while the market moves on to the next development.

The broader issue isn’t only about mathematics. It’s about trust and the incentives that float around a political economy that shapes what gets measured, how it’s measured, and when it’s measured. In a political landscape where information can be wielded as a tool of influence, the risk isn’t only measurement error; it’s accountability and independence. The more a measurement framework is tied to the political apparatus, the more concerns arise about whether the numbers reflect reality or political objectives. When people hear that a nation’s statistical agency might be steered toward a narrative rather than a precise, transparent accounting, the confidence of investors, policymakers, and the public erodes. The essential question for many observers isn’t simply whether the math adds up; it’s whether the system that produces those numbers is designed to illuminate truth or to shape perception for political ends.

In this context, a growing chorus discusses potential reforms to reduce reliance on a single government scoreboard. The argument is not to discard data or to embrace chaos, but to diversify measurement by incorporating independent, transparent sources that can cross-check and illuminate observed costs and trends. Proponents point to the value of external audits, open datasets, and private-sector benchmarks as a way to reduce the vulnerability of the system to political incentives. They argue for a framework where the economy’s “weights and measures” are not the sole purview of a single public institution, but rather a monitored ecosystem where multiple, credible sources can corroborate or challenge the official picture. The core premise remains: when data is the backbone of policy and the lifeblood of markets, credibility matters just as much as accuracy.

Under this frame, the discussion shifts from “which number is right today?” to “how do we know we’re seeing the full picture?” One practical implication is the recognition that the gap between official inflation and real experiences may be the primary driver of risk in a market environment that prizes speed and precision. Traders who assume a universal, uniformly accurate inflation signal may misprice risk or miss structural shifts in consumer behavior and corporate investment. The market’s best defense against this misalignment is to demand triangulation—cross-checks from multiple data streams, high-frequency indicators, and qualitative context that explains how structural changes might influence measured outcomes. The result is not a rejection of government data but a disciplined, plural approach to interpreting the economy’s health—especially when the stakes are high for portfolios, hedges, and risk management.

Why revisions, timing, and lag matter for traders

A central complaint about official statistics is the revision cycle and the timing of releases. The numbers that end up being reported often reflect conditions from a prior period, not the present moment. For traders, that lag matters because markets tend to move on expectations—the forecasts, the whispers, and the glimpses of what the future holds. If a CPI reading comes out after the market has already priced in the consensus, the reaction can be muted or even discordant with what the data actually implies for subsequent policy moves. If, on the other hand, revisions to earlier data reveal a previously hidden weakness or strength, markets can swing in unexpected directions as investors reprice risk across equities, bonds, currencies, and commodities.

Beyond lag, revisions complicate the narrative that “the trajectory is known.” When revisions erase significant portions of past job gains or reclassify productivity, the historical baseline for trend analysis shifts. Models that rely on stable datasets encounter discontinuities that require recalibration. For active traders and risk managers, this means that historical relationships—such as the link between inflation surprises and equity drawdowns, or the sensitivity of rates to labor market strength—may weaken or reassert themselves in surprising ways after revisions. The practical takeaway is that reliance on a single snapshot or a single dataset is an exercise in fragility. A robust approach embraces the probability that a line drawn across time could bend as new information arrives, and that the market’s memory is imperfect.

The timing problem is compounded by the phenomenon of leaked forecasts and private expectations. In a market environment where investors increasingly trade on information that’s not publicly released, the official numbers arrive as a kind of postscript to a much more widely anticipated narrative. In such conditions, the published figure can become less informative about where the economy is headed and more about how the market will interpret the data once the absence of surprise becomes a given. This creates a dynamic in which traders must weigh both the content of the data and the context of its release—an exercise that requires careful sequencing, anticipation of revisions, and an appreciation for the structure of information flow in modern markets.

The consequences extend beyond trading desks. When policymakers rely on data that is increasingly contested, the design of macroeconomic policy can become more reactive rather than forward-looking. If the public and market participants distrust the measurement framework, the legitimacy of policy actions can be questioned, even when those actions are well founded in economic theory. The result can be a feedback loop where data uncertainty reinforces policy hesitancy, which in turn fuels further market volatility and investor skepticism. In the end, the goal of a statistical system should be to minimize such disconnects by offering a transparent, well-documented methodology that can endure public scrutiny and withstand political pressures.

The real-world inflation puzzle: from stamps to groceries

One of the most illustrative episodes in the inflation debate is the long-run price evolution of a government-controlled staple: the postage stamp. The chart of U.S. stamp prices since 1958 tells a stark story. From 4 cents in 1958 to 78 cents today, the price has risen by 1,850 percent over roughly 67 years. That outcome translates into a compound annual growth rate of about 4.9 percent per year, a rate that, in raw history, dwarfs the officially reported 2.7 percent inflation over the same horizon. This comparison isn’t merely a curiosity; it’s a provocative signal about the gap between what most people feel in daily life and what the CPI suggests as a long-run inflation trend. If a fundamental, widely used, government-controlled product has priced in inflation at nearly twice the rate claimed by official measures in the long run, questions arise about how other broad baskets of consumer goods are behaving in the real world.

The stamp example is not an anomaly; it is emblematic of a broader pattern. When inflation is perceived as running hotter than the headline number, households adjust their budgets, savings behavior, and expectations for future price movements. If the public trusts the official gauge, they may be lulled into complacency; if they distrust it, they may seek alternative signals, diversify their portfolios, or adjust spending and saving strategies in ways that can increase volatility or alter demand patterns. The contrast between real cost-of-living increases and the “official” inflation narrative matters not only for households but for the entire macroeconomic ecosystem, including pricing strategies across sectors, wage negotiations, and the design of monetary policy.

Another common illustration is the experience of everyday retailers and consumers at the store shelf. A shopping trip that once cost a certain amount now requires more dollars for roughly the same bundle of goods. The divergence between these micro-level experiences and macro-level inflation metrics raises questions about what the CPI actually captures. For example, if the price of staples—housing, food, energy—outpaces the reported inflation rate, households may experience deteriorating real purchasing power even when overall inflation appears contained. The gap has tangible consequences for savings, debt servicing, and long-term planning, which in turn feed back into consumption, investment, and growth.

In parallel, discussions about price evolution under government control raise concerns about substitution and the composition of the CPI basket. If more expensive items are replaced by cheaper alternatives, or if higher-quality goods are deemed to have improved enough to offset price increases, the index can look milder than the lived reality. These dynamics have a direct impact on how households plan for retirement, education, healthcare, and housing—the domains where costs often rise fastest and bite hardest. For investors and policymakers, understanding this distinction is crucial for interpreting the signals coming from inflation data and for evaluating whether the policy response is aligned with the actual pressures families face.

The broader takeaway is that the inflation narrative presented by official statistics is a carefully curated story about the cost of living that may not fully reflect the lived experience of most households. The stamp example is a vivid reminder that the long-run, real-world price trajectory can outpace the headline number by a wide margin. If such gaps persist, credibility costs accumulate and demand for alternative metrics grows. In a market environment that prizes transparency and timely information, these tensions can become central to how investors position their portfolios and how policymakers justify actions.

The debt spiral, deficits, and the macro risk landscape

Beyond inflation, the fiscal side of the economy poses a structural challenge that compounds the uncertainty around official data. The United States has moved from a historical baseline where the gross national debt was under a few trillion dollars to a point where it now stands in the trillions, with projections that would have seemed unimaginable a generation ago. A stark narrative emerges when we compare past and present debt levels: about $6 trillion of gross national debt at the turn of the millennium versus more than $37 trillion by mid-2025, which marks a 520 percent increase in two and a half decades. This escalation, combined with a debt-to-revenue ratio around 740 percent, signals a fragile fiscal trajectory that policymakers cannot ignore if they are to maintain fiscal sustainability and preserve the currency’s credibility.

Deficits are not merely a line item; they are a policy signal that reshapes investor expectations and the cost of capital. With deficits running in the vicinity of $1.36 trillion for the current year and signaling a climb toward 9 percent of GDP (roughly $2.7 trillion) by the mid-2030s, the trajectory points to a government that must refinance large volumes of maturing debt in an environment of higher prevailing interest rates. The near-term refinancing needs are substantial: around $9.2 trillion in debt maturing next year—almost a third of GDP by some measures—highlighting how fragile the balance of operation and debt service has become. Even if spending froze, the refinancing requirement could still pressure yields and crowd out essential public investments. In other words, the debt landscape itself becomes a driver of macro risk, independent of the current pace of growth or inflation.

Interest payments have already overtaken traditional defense spending in some years, with annual servicing costs surpassing the defense budget. If interest costs continue to rise, the burden will squeeze discretionary spending, cap the government’s flexibility, and potentially demand policy responses that reshape macroeconomic conditions. Some observers warn that without dramatic changes in either revenue or spending restraint, the United States could reach a point where ongoing financing—rather than productive investment—becomes the primary fiscal anchor. The prospect of the Federal Reserve stepping in as a perpetual buyer of Treasuries to stabilize markets remains a topic of serious debate, with implications for the integrity of the currency, the smooth functioning of the bond market, and the overall financial architecture that supports both public and private sector activity.

The macro argument doesn’t end with debt totals and deficits. The belief that “we can grow our way out of it” has traveled across administrations with varying degrees of conviction. If inflation were truly about 2.7 percent, then the calculus of debt service and growth suggests a manageable, even optimistic scenario. But when the costs of living appear to outpace official inflation by substantial margins, the real return on investments, household savings, and public fiscal health come under pressure. The disconnect between the official inflation narrative and the lived experience adds a layer of uncertainty to debt management strategies, currency dynamics, and international confidence in the U.S. dollar as the global benchmark. It also invites scrutiny of the assumptions baked into revenue projections, entitlement outlays, and the long-run feasibility of current political commitments in a high-rate environment.

As the clock ticks toward multi-trillion-dollar refinancing calendars, the risk of a harsher adjustment—whether through higher rates, slower growth, or painful fiscal reform—intensifies. The macro system’s resilience hinges on credible, transparent, and sustainable policy choices that can be communicated and defended to markets and the public alike. Without this credibility, the combination of rising debt, persistent deficits, and a reliance on policy tools that may lose traction in the face of shifting inflation dynamics could unleash a feedback loop in which market volatility, political pressure, and economic performance feed on one another.

The market narrative: gold, crypto, and the resilience of “non-dollar” signals

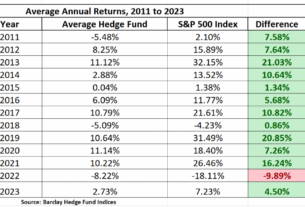

Against the backdrop of a debt-ridden macro framework, markets have begun to express a bifurcated narrative. On one hand, traditional equity indices have shown resilience at times, supported by a small subset of leading tech firms. On the other hand, bullion and cryptocurrency markets have registered remarkable strength in recent months, with gold and Bitcoin both advancing sharply while broad stock indices trace more modest gains. On a year-to-date basis, gold and Bitcoin have each appreciated by roughly 27 percent, signaling a flight to perceived hard assets and a concern about the durability of fiat-based systems. In contrast, the broad market measure, the S&P 500, has advanced at a more restrained pace—about 10 percent in the same period—reflecting a concentration of upside among a narrow group of high-flyers rather than a broad-based rally.

This divergence raises questions about what the market is actually signaling about risk, credibility, and the long-term value of traditional currencies. If gold and Bitcoin are rising together, it suggests that some investors are seeking protection against perceived systemic vulnerabilities, whether driven by inflation expectations, fiscal pressures, or doubts about the strength of the financial framework that underpins fiat currency. The simultaneous strength of these “anti-system” assets indicates a broad reallocation of capital toward assets viewed as storehouses of value in uncertain times. When the stock market’s gains are driven by a handful of technology giants, critics argue that the market reflects a skewed distribution of risk and a skewed confidence in the equity outlook, rather than a broad-based improvement in fundamentals.

The story is not simply about asset class performance. It also illuminates a wider theme: the market’s assessment of the durability of the U.S. dollar and of traditional monetary policy. If investors see distress in the financial architecture—whether from the government’s debt position, the inflation data gap, or the potential misalignment between policy actions and real-world prices—they may reallocate toward assets that preserve value over time, or toward instruments that resist currency devaluation. The upshot is that the macro narrative can be read through market behavior that emphasizes hedging against risk and safeguarding purchasing power, even when official statistics portray a different trend. This is not a triumphant endorsement of one asset over another, but a signal that investors are actively evaluating the credibility and resilience of the monetary framework.

Meanwhile, the performance of equities remains interesting to observe in the context of this broader risk landscape. The gains in the S&P 500 have been buoyed largely by a few behemoths that dominate the index’s leadership. The broader market, which includes thousands of smaller companies and sectors, has not participated in a uniform upward drift to the same degree. This nuance matters, because it underscores the fragility of the assumption that a single market-wide push will translate into durable growth when the broader macro conditions—deficits, debt, inflation credibility, and policy effectiveness—are unsettled. The market’s response to macro truth versus macro hope becomes a focal point for investors seeking to align portfolios with the evolving risk environment. As the narrative evolves, market participants must determine whether the signals from gold, Bitcoin, and selective equities indicate caution about the macro framework or merely a temporary reallocation within a comfortable, yet potentially misleading, risk landscape.

AI and the evolving toolkit for traders: promise, skepticism, and governance

Against this backdrop of credibility concerns, some traders are turning to advanced analytic tools that promise to extract signals from vast arrays of data far more quickly and systematically than human traders can manage. The argument in favor of AI-driven analytics is straightforward: in a world where data flows are enormous, the speed and consistency of machine-based pattern recognition can provide an edge. These tools can scan hundreds of global indicators, process millions of data points, and produce a clearer, more timely read on where the market is headed next. The appeal is not just speed; it’s the potential for a disciplined, unemotional approach to entry and exit, which critics often argue is precisely what human traders lack when emotions run high.

But the reality of AI in trading is more nuanced. Machines can identify patterns and reversals that human eyes might miss, and they can help maintain a consistent stance through periods of volatility or sentiment-driven noise. Yet they are not magic. They operate within the constraints of data quality, model design, and the assumptions embedded in their training. The risks are real: overfitting to historical regimes that do not repeat, misinterpreting a statistical blip as a persistent trend, or relying on outputs that can misalign with risk tolerance and capital constraints. The responsible use of such tools requires rigorous testing, ongoing validation, and a clear governance framework that defines how signals are interpreted, when to trade, how to size positions, and how to handle risk limits when performance diverges from expectations.

Within the broader conversation about trading technology, a key question remains: to what extent can artificial intelligence augment human judgment without eroding accountability? A sophisticated AI system can illuminate possibilities, but it does not obviate the need for risk controls, scenario planning, and human oversight. The most resilient approach treats AI as a decision-support tool rather than a replacement for judgment. It integrates machine-derived signals with fundamental assessment, macro context, and personal risk preferences. Such integration can help traders avoid being swept along by headlines or by the cognitive biases that afflict even the most experienced investors. In markets characterized by high complexity and rapid shifts, a disciplined blend of data-driven insight and prudent governance may offer a more robust path forward than reliance on intuition or hope alone.

The broader takeaway is that the market is demanding more rigorous, transparent, and data-driven approaches to forecasting and risk management. AI-based tools can be an important piece of the toolkit, particularly for integrating a wide range of indicators and testing trading hypotheses in a disciplined, repeatable manner. Yet they should be deployed with a clear understanding of their limitations, the quality of input data, and the risk-management framework that governs their use. The central challenge remains: how to balance the speed and precision of machine analysis with the human capacity for judgment, ethics, and accountability in financial decision-making.

The political economy of data credibility: a governance question

The reliability of national statistics is not just a technical issue; it is a governance issue. When the independence of the statistical agencies is questioned, the integrity of the data itself is put into doubt. The hypothetical scenario where a political leader can remove a top statistician or otherwise influence the measurement apparatus is more than a theoretical risk; it represents a direct threat to the confidence that markets and citizens place in the data that inform policy, investment, and daily decisions. While it’s rare to find a single moment that proves such concerns, the possibility underscores why many observers call for structural safeguards that limit political interference and promote transparency. An independent, credible statistical system—apolitical and rigorous—serves not only a healthy economy but a healthy democracy as well.

The August 1, 2025 incident, in which a high-level political decision was announced in connection with the monthly jobs report, punctuates a broader concern about data governance. The firing of a BLS commissioner, alleged political motivations, and the immediate response from staff and analysts underscored how fragile trust can be when the line between data and politics blurs. Such episodes provoke a reckoning about how futures are priced, how policy is justified, and how the public understands what the numbers mean for their lives. They also intensify calls for independent data producers, transparent methodologies, and public accountability for the assumptions that shape the economy’s scorecards.

A careful reading of these dynamics suggests a few practical implications for investors and policymakers. First, there is value in triangulating signals from multiple sources to gauge the true state of the economy rather than leaning on a single metric. Second, there is a case for adopting complementary indicators, including private-sector measurements and alternative data, to cross-check official statistics and illuminate anomalies. Third, there is a need for clear governance protocols that preserve independence, ensure methodological stability, and maintain rigorous documentation for revisions and updates. In short, credibility is the currency that underpins the usefulness of data in guiding policy and investment decisions, and preserving it requires ongoing vigilance, open dialogue, and structural reforms that reduce political leverage over the numbers.

Conclusion

The tension between official economic statistics and lived experience is not a trivial disagreement; it is a defining characteristic of modern macroeconomics and market behavior. The CPI, PPI, and jobs data offer a framework for understanding the economy, but they are not perfect instruments. Their methodologies—substitution, weighting, and hedonic adjustments—can obscure real-world pressures, while revisions, timing, and leaks complicate the ability to act on fresh information. The result is a market environment in which the data lag, are sometimes contested, and are sometimes used to advance political narratives as much as to reveal objective truths. This reality creates both risk and opportunity for traders, policymakers, and households alike.

The long-run arithmetic of debt, deficits, and rising interest costs further compounds the challenge. The nation’s fiscal trajectory—an expanding debt stock, a growing portion of the budget devoted to interest payments, and mounting refinancing needs—adds a persistent layer of macro uncertainty. In such a world, market signals that diverge from traditional inflation measures—such as the concurrent strength of gold and cryptocurrency alongside a more modest stock rally—offer a window into how investors assess risk, value, and the durability of the monetary system. The emergence of AI-driven trading tools adds another dimension, promising to sharpen decision-making through data-driven pattern recognition while demanding careful governance to avoid overreliance and misinterpretation.

Ultimately, the path forward requires a balance between trust in credible measurement and skepticism of simplistic narratives. It calls for governance reforms that preserve independence and transparency, diversified data sources to reduce reliance on a single scoreboard, and investment in tools that enhance, rather than replace, prudent judgment. For traders, the lesson is clear: plan for uncertainty, diversify your informational inputs, and use technology to augment discipline rather than to chase noise. For policymakers, the lesson is equally clear: maintain the credibility of the data, explain methodologies openly, and recognize that the numbers matter most when they reflect the lived experience of households and businesses. In a world where the cost of uncertainty is measured in lost dollars and eroded confidence, the goal is not to eliminate all risk but to understand it more fully—and to respond with clarity, accountability, and resilience.