Wall Street analysts stand at the intersection of data, markets, and capital, guiding investors through a maze of numbers, trends, and risks. They synthesize company fundamentals, industry dynamics, and macroeconomic signals to estimate fair value and articulate how securities should be priced given what’s happening in the world. Their work shapes investment decisions across institutions and individual portfolios alike, serving as a navigational compass in a complex and ever-evolving financial landscape.

The Role and Methodologies of Wall Street Analysts

Wall Street analysts occupy a pivotal role in financial markets, functioning as both investigators and interpreters of corporate health and prospects. Their primary mission is to determine a stock’s fair value by weighing a broad spectrum of inputs—financial statements, market conditions, competitive dynamics, and broader economic forces. This process rests on a foundation of rigorous financial analysis, quantitative modeling, and careful judgment about future events and their potential impact on earnings and cash flow.

Analysts begin with a meticulous examination of a company’s financial statements. They scrutinize earnings, revenue, and cash flow, recognizing how these measures reflect not only current performance but the quality and sustainability of profits. They also assess the balance sheet, looking at assets, liabilities, and shareholders’ equity to gauge financial stability, liquidity, and the capacity to weather downturns. In doing so, they pay particular attention to key metrics such as total assets, debt levels, and book value, as these indicators illuminate leverage, capital structure, and the potential for value creation through asset utilization or deleveraging.

Beyond the raw numbers, analysts place substantial emphasis on the company’s growth trajectory and profitability profile. They track revenue growth trends, gross margins, operating margins, and earnings per share (EPS) trends over multiple periods to discern consistency, cyclicality, and margin resilience. Evaluating margins helps analysts understand how efficiently a company converts sales into profits and how competitive positioning translates into earnings power. This line of inquiry naturally leads to a broader competitive assessment, where the company’s position within its industry is weighed against peers, market share dynamics, pricing power, and barriers to entry that might sustain above-market returns.

A core component of the analysis is the use of financial ratios, which condense complex financial statements into comparable metrics. Analysts compute and interpret a range of ratios, including the Price-to-Earnings (P/E) ratio, which reveals how the market values the company’s earnings and how valuation compares to peers and historical norms. The Price-to-Sales (P/S) ratio measures the stock price relative to revenue, offering insight when profits are volatile or transitional. The Price-to-Book (P/B) ratio compares the stock price to the company’s book value per share, providing a view into how the market prices net asset backing. The Debt-to-Equity ratio assesses leverage and how aggressively a company finances its growth; the Return on Equity (ROE) indicates how effectively shareholder funds are transformed into profits. The Dividend Yield evaluates the income return relative to the stock price, which is particularly relevant for investors seeking income alongside growth.

Interpreting these ratios requires nuance. High P/E or P/S ratios can signal growth expectations or overvaluation, but they may also reflect robust future potential or quality of earnings. Conversely, low multiples could indicate undervaluation or fundamental challenges. The meaningful use of these ratios emerges in context: comparisons to industry peers, historical norms, and the prevailing business cycle. Analysts also examine the consistency of these metrics over time, watching for turning points that might foreshadow shifts in profitability or risk.

Valuation extends beyond multiples to more sophisticated models, with discounted cash flow (DCF) analysis occupying a central place in many analysts’ toolkits. DCF involves projecting a company’s future cash flows and discounting them back to present value using a rate that reflects the risk of those cash flows. This method hinges on credible assumptions about revenue growth, operating margins, capital expenditure, changes in working capital, and the discount rate itself. The process requires a careful balancing of optimistic scenarios with risk management, often accompanied by sensitivity analyses that show how changes in growth rates or discount rates alter the estimated intrinsic value. DCF remains a robust framework because it ties value to the fundamental ability of a business to generate cash, even as it acknowledges uncertainty about the timing and magnitude of future results.

Analysts extend their analysis by evaluating the company’s industry positioning. They assess market share, competitive advantages, and barriers to entry that shape a firm’s ability to sustain above-average returns. Industry dynamics—trends in demand, technology adoption, regulation, and convergence with adjacent markets—inform projections of revenue growth and profitability. Analysts consider macroeconomic conditions and cyclical factors that influence demand, supply chains, and investment cycles. Their assessment of a company’s growth engines combines quantitative data with qualitative judgments about management strategy, product pipelines, and the potential for disruptive innovations to reconfigure competitive landscapes.

In practice, analysts also examine a company’s governance and management quality, executive incentives, and capital allocation priorities. They listen to management discussions during earnings calls and investor conferences for signals about strategic intent, cost-control initiatives, and plans for shareholder value creation. Reading research reports and other company-produced materials helps build a holistic view of the business, while direct engagement with management during meetings and conferences can uncover additional layers of insight—though access, timing, and selective disclosures require careful interpretation.

Not every asset or issuer receives equal attention from analysts. A disciplined curation process governs which stocks and sectors attract coverage. In traditional market dynamics, large-cap, highly liquid, and widely followed names receive the most attention because they offer depth of data, higher liquidity, and broader investor interest. These characteristics facilitate more precise modeling and more robust consensus estimates, while also enabling quicker reaction to new information. By contrast, penny stocks and many small-cap firms often receive limited coverage, due in part to liquidity constraints, higher risk, and less readily available information. The result is a concentration of research effort on assets with the most transparent pricing and the greatest potential for widespread investor impact.

Coverage decisions are not made in a vacuum. Analysts weigh client demand, market relevance, and the potential for the analytics to influence investment decisions by institutional and retail clients. They also consider the broader market environment and potential catalysts, including earnings surprises, regulatory changes, M&A activity, product launches, and shifts in consumer behavior. In parallel, firms carefully manage conflicts of interest, compliance considerations, and regulatory expectations to ensure that their research remains credible, objective, and useful for investors seeking to understand value and risk.

To supplement quantitative models, analysts frequently rely on qualitative inputs from multiple sources. They talk to company management to gain firsthand insight into strategy, product development, and capital allocation decisions. They attend conferences and investor days to observe strategic messaging and to hear questions from the investment community. They read third-party research and industry reports to confirm or challenge their own views. In aggregate, these sources contribute to a more nuanced, well-rounded view of a company’s fair value and potential catalysts that could drive valuation changes.

An essential aspect of the analysis is the development of a consensus view. Analysts often align with the street through consensus estimates, which reflect the aggregated expectations of multiple research teams. While individual opinions matter, triangulating different viewpoints helps investors gauge the range of potential outcomes and the probability of various scenarios. The consensus can be a powerful benchmarking tool, enabling traders and investors to assess where the market might be leaning and where risks may lie.

Analysts’ work extends beyond single-stock coverage to encompass broader market contexts. They evaluate not only the microeconomics of individual firms but also sectoral dynamics and macro trends. This macro-to-micro linkage helps investors understand how a technology shift, regulatory reform, or global economic cycle might affect entire industries—from technology and healthcare to finance and consumer staples. The insights generated by analysts, while not infallible, contribute to a collective understanding of fair value and risk and help investors calibrate their own strategies in relation to market expectations.

In sum, the role of Wall Street analysts is to convert a torrent of financial data and market signals into an informed, defensible assessment of what a stock should be worth given current conditions and expected future developments. Their methodologies combine rigorous accounting and financial modeling with qualitative judgment about strategy, competition, and macro context. While no forecast is guaranteed, analysts provide a structured framework for evaluating value, testing assumptions, and guiding investment choices in an ever-changing financial world.

Coverage Scope, Market Influence, and Asset Diversity

Analysts traditionally concentrate coverage on publicly traded equities, but their remit often spans a broader array of assets, including sectors and Exchange-Traded Funds (ETFs). This broader lens allows analysts to identify macro trends and cross-asset relationships that can inform stock-specific narratives as well as sector-wide opportunities and risks. By analyzing sectors rather than a single company, analysts can detect structural shifts—such as technology adoption cycles, regulatory changes, or healthcare innovations—that reshape growth trajectories and risk profiles across multiple issuers.

Within equities, coverage tends to privilege larger, more liquid companies. The market’s attention and capital allocation tend to cluster around high-cap, well-known entities with accessible data and clearer business models. Liquidity is a critical factor because it facilitates the execution of trades, the incorporation of new information into prices, and the ability of analysts to test and refine valuation assumptions with real-time price signals. Publicly traded assets on major exchanges—those with transparent pricing and robust trading volumes—are more likely to attract sustained research coverage because the information environment is more conducive to accurate valuation, and the potential impact on client portfolios is greater.

That said, coverage does not ignore dynamic or transformative sectors. Sectors characterized by rapid change, such as technology, healthcare, and energy, frequently attract intense analyst attention when there are compelling catalysts like breakthrough products, regulatory shifts, or meaningful capital allocation decisions. Analysts assess sector-specific drivers—rising demand, margin expansion, regulatory reforms, supply chain realignments, and competitive dynamics—to forecast how the earnings power of companies within these sectors may evolve. The goal is to understand how macro- and sector-level fundamentals propagate through individual company results, affecting fair value and investment appeal.

Analysts also consider the broader market environment and the influence of macroeconomic conditions. They examine interest rates, inflation, currency movements, and global growth trends to determine how these variables shape discount rates, capital costs, and investment appetites. The interplay between macro signals and company-specific fundamentals often helps explain divergences between price movements and earnings trajectories, guiding investors to consider both idiosyncratic and systemic risks when valuing securities.

In practice, the decision of what to cover is a strategic one. Firms weigh research bandwidth, senior analysts’ expertise, and the relevance of coverage to client bases. The goal is to provide in-depth, credible, and timely insights that support informed decision-making while aligning with the firm’s research ethics and regulatory obligations. This approach ensures that analysts illuminate the most material drivers of value and risk for the assets most likely to influence client portfolios, rather than chasing marginal opportunities that may dilute analytical rigor.

Analysts also strategically weigh which assets receive the most attention based on liquidity and investor demand. Liquidity is essential for market activity and for the price discovery process, ensuring that prices reflect new information quickly and accurately. Where liquidity is thin, analysts must exercise greater caution in their projections, as smaller trades can disproportionately affect pricing and the ability to realize expected returns. This is why large-cap stocks often receive more extensive coverage: their high trading volumes and broad market interest provide a stable information environment, enabling more reliable estimates of fair value and more robust risk assessments.

The role of the analyst extends beyond merely calculating valuation to offering a narrative that ties the numbers to real-world implications. This narrative helps investors understand how a company’s strategy could translate into future cash flows, how competitive dynamics may shift over time, and what catalysts could push fair value higher or lower. The narrative is complemented by quantitative rigor—the numbers, the models, and the probabilistic thinking that underpins forecasting in a probabilistic market. Together, they furnish a coherent view of the investment landscape, guiding capital allocation decisions across risk appetites and time horizons.

In addition to the traditional stock-centric focus, analysts increasingly consider the environment in which companies operate. Global supply chains, geopolitical developments, and technological change all feed into earnings potential and risk. The interconnections between markets, industries, and regions mean that insights from one area can illuminate others. A mature, holistic approach recognizes that a company’s fair value is not an isolated figure but a function of a dynamic ecosystem in which inputs are continually evolving.

The analyst’s influence in the market is not purely academic or theoretical. Their conclusions and recommendations inform a wide range of market participants, from institutional endowments and pension funds to individual traders who rely on research-driven insights for decision-making. While analysts’ forecasts may differ from actual outcomes, their frameworks offer investors a disciplined method to interrogate assumptions, test scenarios, and calibrate risk. The result is a more informed, more resilient investment community that can adapt to changing conditions and seize opportunities when credible value emerges.

The Analytics Toolkit: Ratios, Valuation, and Cash Flow Modeling

A crucial part of an analyst’s workflow is the systematic use of quantitative tools to measure value, risk, and growth potential. The core toolkit includes widely used valuation ratios, cash flow analyses, and sensitivity testing that reveal how different assumptions impact outcomes. Each tool serves a distinct purpose, and together they provide a multi-faceted view of a company’s intrinsic value relative to its market price.

Key valuation ratios are a staple of the analyst’s analysis. The Price-to-Earnings (P/E) ratio captures how the market prices current and expected earnings, offering a snapshot of valuation relative to profits. The Price-to-Sales (P/S) ratio steps back from profitability to focus on top-line scale, which can be particularly informative in sectors where earnings are volatile or temporarily suppressed by investments for growth. The Price-to-Book (P/B) ratio connects the stock price to the company’s net asset backing, a metric that is especially relevant for asset-heavy businesses or firms with significant intangible assets. The Debt-to-Equity ratio provides insight into leverage and capital structure—an essential consideration for firms with substantial debt or aggressive growth strategies. Return on Equity (ROE) measures how efficiently equity is turning into profits, a proxy for managerial effectiveness and capital allocation prowess. Dividend Yield evaluates the income component of a stock, which matters for investors seeking steady cash flows and can influence valuation through expectations of future dividend growth or cutbacks.

Interpreting these ratios requires careful context. A high P/E, for instance, may reflect robust growth expectations or a premium due to brand strength and market leadership, while a low P/E could signal a misunderstanding by the market or fundamental weakness. The P/B ratio can be misleading for firms with intangible assets or growth assets that aren’t captured on the balance sheet. Debt levels must be weighed against cash flow adequacy and interest resilience, particularly in environments of rising rates. ROE should be considered in light of capital structure and the sustainability of returns. Dividend yields must be evaluated in relation to payout ratios, growth prospects, and the company’s reinvestment opportunities.

Beyond multiples, discounted cash flow analysis anchors valuation in a forward-looking cash-generation framework. The DCF approach requires a careful set of assumptions: projected revenue growth, operating margins, taxes, capital expenditures, changes in working capital, and the terminal value that captures long-term growth beyond explicit forecasts. The discount rate, typically derived from the cost of capital, reflects the risk profile of the business and the volatility of its cash flows. Sensitivity analysis is a standard practice to illustrate how shifts in growth rates, margins, or discount rates affect valuations. This helps investors understand the degree of uncertainty embedded in any single intrinsic value figure and where the primary risk levers lie.

Analysts also integrate a qualitative facet into their valuation. They examine competitive advantages or “economic moats” that protect profitability, such as brand strength, network effects, proprietary technology, and regulatory barriers. They assess management quality, strategic clarity, and the quality of capital allocation decisions. All of these factors shape the persistence of earnings and free cash flow, which in turn influence long-run valuation estimates.

The process of valuation is iterative and comparative. Analysts build models, test assumptions, and then cross-check results against a stock’s market price, relative valuations, and the consensus outlook. They compare the target company to direct peers and to broader benchmarks, evaluating how the firm’s growth, profitability, risk, and capital efficiency stack up against the competitive set. The aim is not to produce a single “correct” number but to provide a reasoned range of valuations, highlight the main drivers of value, and present scenarios that help clients assess whether the current price offers attractive upside or risks downside.

An important practical dimension of the toolkit is scenario analysis. Analysts develop bull, base, and bear case scenarios to reflect different macro conditions, competitive dynamics, and internal execution outcomes. Each scenario yields a different valuation and different price target, which helps investors attach probability-weighted outcomes to potential investments. Scenario planning is particularly critical when markets are volatile, when there is limited visibility into earnings trajectories, or when catalysts (such as product launches, regulatory decisions, or M&A activity) could materially alter the risk-reward equation.

Experience and disciplined judgment are essential complements to mechanical calculations. Analysts bring careful consideration of accounting anomalies, one-off items, and non-recurring events that can distort straightforward metrics. They ask whether earnings are driven by sustainable operations or temporary factors, such as aggressive cost-cutting, one-time gains, or unusual revenue recognition practices. This critical scrutiny helps ensure that valuations reflect the business’s ongoing economics rather than a snapshot of distorted results.

In addition to the core valuation work, analysts synthesize evolving market signals—pricing trends, volatility, liquidity, and investor sentiment—to contextualize their estimates. They monitor how price action interacts with earnings expectations and macro developments, using this information to refine assumptions and horizons. The final output is typically a well-argued investment thesis that includes a fair value range, a rationale for price targets, and explicit risks that could derail the forecast. This narrative is designed to help clients understand not only whether a stock is buyable or sellable, but also why and under what conditions.

The analytical framework described here is designed to be robust, transparent, and repeatable. While no forecast can capture every shift in a dynamic market, a disciplined approach that integrates quantitative models with qualitative assessment provides a credible basis for decisions. The goal is to translate complex financial data into clear implications for price movement, risk exposure, and potential reward, ensuring that investors can act with confidence even in the face of uncertainty.

Consensus, Data, and the Investor Toolkit

A distinctive feature of modern equity research is the emphasis on consensus estimates. Analysts aggregate forecasts to form a market-wide view of a company’s near-term earnings trajectory, which anchors price targets and guides investment decisions. The consensus process involves collecting earnings forecasts, revenue projections, and other key metrics from multiple analysts across research firms. The result is a range of estimates that captures diverse perspectives, methodologies, and information sets. The consensus estimate often serves as a practical benchmark for comparing actual results, guiding expectations about what the market would price into the stock upon earnings announcements.

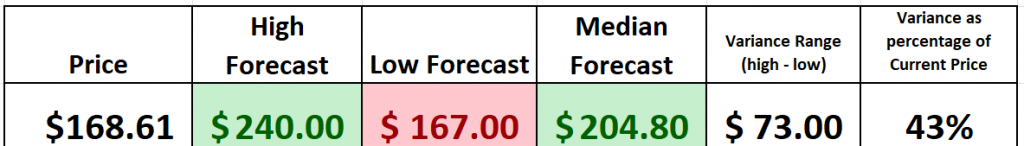

When analysts publish 12-month price targets, they typically present three reference anchors: the most bullish forecast, the most bearish forecast, and the median forecast. This trio provides a panoramic view of the distribution of expectations and highlights the degree of disagreement among analysts. The spread between the high and low targets—often referred to as the target range—offers insight into forecast dispersion and the level of uncertainty surrounding a stock’s future valuation. A wide range indicates greater disagreement about growth prospects, risk factors, or the durability of competitive advantages, whereas a narrow range suggests a more consensual view about the company’s trajectory.

Analysts also compare current prices to these forecasts to gauge the sensitivity of the stock to future expectations. By observing how the live price relates to the high, low, and median targets, investors can infer whether the market is pricing in optimism or pessimism about the company’s prospects. The variance between bullish and bearish targets is a quantitative reflection of forecast uncertainty and market-implied risk. If the current price sits near the bearish target, the stock may be viewed as relatively vulnerable to downside catalysts unless new information improves the outlook. Conversely, proximity to the bullish target could indicate upside potential if catalysts materialize and execution aligns with expectations.

The integration of consensus estimates with real-time price action is a practical approach for investors seeking to align their strategies with the prevailing market thinking. The consensus view also serves as a benchmark for assessing the credibility of individual analyst opinions. Rather than elevating any single forecast to a pedestal, investors can use the consensus as a baseline while paying careful attention to the underlying assumptions and the degree of divergence among analysts. This approach helps traders identify where their own views diverge from the crowd and where risks or opportunities may lie.

In the modern research ecosystem, the compilation and interpretation of consensus estimates are supported by a wide array of data sources and analytical tools. Analysts collect earnings estimates, revenue projections, and other metrics from a variety of sources and integrate them into quantitative models. They then compare these consensus inputs to current market prices and evolving macro signals to form a nuanced forecast. This integrated approach enables investors to better understand the relationship between expected performance and valuation, including how much of the price is already reflecting optimistic assumptions and how much remains as potential upside.

A practical use case of consensus data involves evaluating an anchor stock like Apple Inc. (AAPL). Analysts may assemble a consensus of 12-month price targets drawn from multiple firms and then examine the distribution of these targets relative to Apple’s current trading price. By identifying the gap between the current price and the consensus targets, investors can gauge how much upside the street expects and how sensitive the stock might be to changes in earnings outlook, product cycles, and market conditions. This kind of synthesis helps investors make better-informed decisions about entry points, risk management, and the probability-weighted returns of potential positions.

The value of consensus estimates also lies in their ability to standardize the information environment. By providing a common framework for comparing forecasts across different analysts and firms, consensus estimates reduce the noise that can arise from disparate methodologies. Investors gain a clearer sense of the market’s expectations and where discrepancies exist, enabling more precise risk assessment and scenario planning. While consensus should not be seen as a guarantee of future performance, it remains a useful reference point for evaluating valuation, price momentum, and the probability of achieving forecasted outcomes.

Beyond consensus, analysts build portfolios of information sources to support their judgment. They triangulate primary company filings, earnings calls, investor presentations, and industry reports with economic indicators, commodity prices, currency movements, and geopolitical developments. This holistic approach improves the odds that the forecast reflects a comprehensive understanding of the firm’s operating environment and the structural forces shaping its prospects. Investors can apply a similar approach by incorporating a mix of financial statements, earnings projections, and macro indicators into their own decision-making processes, thereby building a more resilient investment framework.

In the end, consensus estimates are a tool for understanding market sentiment and the distribution of expectations, not a final verdict on a stock’s fate. The practical utility lies in how investors use these estimates to frame questions, stress-test assumptions, and identify potential catalysts that could drive deviations between forecasted results and actual outcomes. For active traders and long-term investors alike, consensus data—when combined with rigorous analysis and prudent risk management—can enhance decision-making and support more informed investment choices.

The Human-Plus-AI Axis: Artificial Intelligence, Machine Learning, and Trading Insights

The intersection of finance and artificial intelligence has evolved from a nascent curiosity into a central engine for processing, analyzing, and acting on vast datasets. Wall Street analysts, traders, and researchers increasingly rely on machine learning, neural networks, and other AI-enabled tools to parse complex market signals, identify patterns, and forecast price movements with expanding sophistication. AI offers the ability to synthesize disparate data streams—corporate fundamentals, macro indicators, alternative data, sentiment signals, and real-time price action—into coherent analytical outputs that can guide decision-making.

Artificial intelligence functions as a powerful complement to human expertise. Machine learning models can process massive historical datasets to reveal patterns that may elude manual analysis. Neural networks, capable of capturing nonlinear relationships, can adapt to evolving market regimes and generate predictive indicators that help traders anticipate shifts in momentum, volatility, and trend. In practical use, AI tools may produce indicators or signals that align with established analytical frameworks, such as trend-following signals, price targets, or probability-weighted risk assessments. When integrated thoughtfully, AI can help traders remain disciplined, reduce cognitive biases, and maintain focus on the prevailing trend.

However, AI is not a guaranteed path to profits. The reliability of AI-derived insights hinges on data quality, model design, and the calibration of risk controls. Markets can exhibit regime changes, data anomalies, or structural breaks that degrade model performance. Black-box models, while powerful, can obscure the logic behind predictions, making it difficult to interpret why a signal is generated or how robust it is under stress scenarios. This is why a practical trading framework typically blends AI-generated outputs with human oversight, scenario planning, and conservative risk management.

A notable application of AI in trading is the use of predictive indicators that synthesize multiple data streams to identify the prevailing trend and potential reversal points. For instance, AI-enhanced analysis can produce a consensus-oriented view of price targets and confidence intervals, updating them as new information becomes available. Such tools can help traders test how the market is framing a stock’s fair value in light of the most recent earnings data, macro developments, and company-specific news. The ongoing objective is to align investment decisions with the most current information while maintaining a disciplined stance toward risk.

The synergy between human analysts and AI-driven analytics can yield more nuanced insights than either could achieve alone. Analysts bring domain expertise, qualitative judgments, and an intuitive understanding of business strategy, competitive dynamics, and governance. AI brings computational speed, pattern recognition, and the ability to simulate numerous scenarios rapidly. When combined, they create an analytical framework that is both rigorous and adaptive, capable of addressing a wide array of market conditions and investment horizons.

The practical implications for investors are meaningful. By leveraging AI-enabled tools alongside traditional analysis, investors can better test hypotheses, quantify risk, and explore a broader set of scenarios. This approach supports more informed decision-making and can improve the consistency of trading outcomes in the face of volatility and uncertainty. Yet it is important to exercise critical judgment: AI should supplement, not replace, fundamental analysis, human experience, and prudent risk controls. The best outcomes arise when technology augments insight while remaining anchored in sound investment discipline.

Investors seeking to understand AI-enhanced analytics should consider the following: ensure data quality and transparency, maintain clear governance over modeling and outputs, apply robust risk controls, and continuously validate models against out-of-sample data. They should also be mindful of potential biases in training data, model overfitting, and the risk of data-snooping. By addressing these considerations, traders can harness AI to complement their analysis and support better, more informed decisions in dynamic markets.

The broader implication for the investment community is a shift toward more data-driven, evidence-based approaches that preserve human judgment. As AI continues to mature, it will likely become integral to the workflow of analysts and traders, enabling faster synthesis of information, more systematic scenario testing, and more disciplined risk management. The evolving toolkit will combine traditional valuation frameworks with AI-powered signals, expanding the set of tools available to investors who seek to navigate increasingly complex markets with confidence and foresight.

Practical Case Study: Apple’s (AAPL) Forecasts in Action

To illustrate how these concepts play out in real markets, consider Apple Inc. (AAPL), a foundational example often used to discuss consensus estimates, price targets, and the interaction between current price action and forward-looking forecasts. As a reference point in market discussions, Apple’s share price movements provide a lens through which to analyze how consensus targets translate into trading behavior and how AI-driven signals may influence decision-making.

At a given snapshot in time, Apple’s stock traded around a level such as 168.61, a value that can prompt analysts and traders to compare the live price to published consensus estimates and targets. In this context, a search for Wall Street analysts’ estimates on Apple often yields a range of 12-month price targets derived from various institutions. The consensus target typically aggregates multiple forecasts into a median figure, while also highlighting the high and low extremes to illustrate the dispersion of expectations. The average of the price targets, the median target, and the disparate high and low estimates provide a structured view of the market’s forward-looking sentiment.

The practical value of these consensus figures lies in their ability to anchor discussions about upside potential and risk. For example, a consensus target in the vicinity of 204.80 would imply a substantial upside from a price of 168.61, representing a notable premium based on anticipated earnings growth, product cycles, and corporate actions. Conversely, a low target near 167.00 would suggest that a significant share of analysts foresee limited upside or potential downside if certain catalysts fail to materialize or if execution deviates from expectations. Examining the range between the most bullish and most bearish forecasts helps investors gauge forecast dispersion and the degree of uncertainty surrounding Apple’s trajectory.

A practical analytical approach involves placing these forecasts into a structured framework, such as a spreadsheet, to analyze variance and relationship to current prices. By comparing the most bullish and bearish projections to the current price, investors can quantify the absolute and percentage differences, identify where the price stands relative to the forecast distribution, and assess how price movements align with evolving expectations. This exercise reveals the degree to which the market has priced in optimism or pessimism about Apple’s future earnings.

Traders can further examine how far the current price is from the most optimistic forecast or from the median forecast to understand how prices are representing future potential. This analysis helps identify whether the market is overestimating or underestimating Apple’s fair value, given the current information and the expected path of earnings. The dynamic is not static; consensus estimates are periodically updated as new data arrives, and price action continually evolves in response to quarterly results, product announcements, and macro developments.

The integration of AI with consensus data can enhance this case study by providing real-time trend analysis and probability-weighted risk assessments. A predictive AI indicator can visualize the current consensus level alongside price action, helping traders understand whether the current trend supports or contradicts the prevailing forward-looking view. For example, if AI-derived signals indicate a downtrend aligned with the most bearish forecast, traders might adopt a more cautious posture or use risk controls to manage exposure. Conversely, if AI signals indicate a strengthening trend consistent with bullish targets, traders might position for upside opportunities while monitoring catalysts that could validate or challenge the forecast.

Historical performance plays an important role in assessing the reliability of consensus targets. The results of prior forecasts can illuminate how often targets are exceeded or missed and by what magnitude. While past performance does not guarantee future results, understanding historical accuracy helps investors calibrate expectations and manage risk. In a hybrid approach, analysts and traders combine consensus data with AI-driven analysis, backtesting, and scenario planning to form a more robust view of potential outcomes.

The Apple case demonstrates how the interplay between price action, consensus estimates, and AI-driven insights can inform decision-making. It highlights the significance of monitoring the price’s relationship to key forecast levels and how the evolving market context affects the credibility of those forecasts. While a single stock case cannot capture the entire market, it provides a concrete example of how valuations, market expectations, and predictive analytics can intersect in practical trading decisions.

In a broader sense, Apple’s case underscores the value of structured, evidence-based analysis that integrates multiple data sources. The consensus targets offer a transparent framework for thinking about upside potential and risk, while AI-powered tools add another layer of quantitative insight that complements human judgment. This combination—fundamental analysis, consensus benchmarking, and AI-assisted interpretation—can help traders and investors navigate the complexity of modern markets, supporting more informed and disciplined investment choices.

It is important to acknowledge that even with rigorous analysis, markets are influenced by a multitude of unpredictable factors. Macroeconomic shifts, geopolitical events, product failures or boons, regulatory changes, and shifts in consumer sentiment can all alter the trajectory of a stock’s value. The Apple example serves as a reminder that while consensus targets and AI indicators can guide decisions, prudent risk management, diversification, and ongoing monitoring remain essential components of a robust investment strategy.

In practice, traders who use Apple’s case as a learning tool often follow a disciplined workflow. They start by outlining the current price against the consensus targets to understand where the market currently stands relative to expectations. Then they incorporate AI-driven trend signals to gauge whether the prevailing momentum supports or contradicts the forecast. Next, they consider valuation overlays—such as DCF-based intrinsic value ranges and relative valuation against peers—to determine whether price action aligns with fundamental and market-implied value. Finally, they apply risk controls, including position sizing and stop-loss orders, to manage downside risk and preserve capital in the face of volatility or unexpected catalysts.

The Apple example also illustrates the broader principle that a stock’s fair value is not a fixed target but a moving target shaped by new information and shifting expectations. Analysts and AI tools together help investors stay attuned to these shifts, offering a framework for updating views as data evolves. By maintaining a dynamic, evidence-based approach, traders can adapt to changing conditions and position themselves for opportunities that arise as the market recalibrates fair value in response to new developments.

Risk Management, Ethics, and Market Realities

Trading and investing in financial markets involve substantial risk, and the relationship between analysts’ forecasts and actual outcomes is not deterministic. The reality of investing is underscored by the potential for loss, volatility, and unpredictability. Investors should recognize that even the most disciplined valuation process cannot guarantee positive results, and market prices can deviate from fundamentals for extended periods due to sentiment, liquidity constraints, or structural shifts in industries.

A robust approach to risk emphasizes diversification, position sizing, and disciplined execution. Investors should consider a range of scenarios—bullish, base, and bearish—and monitor how evolving information could shift valuations and risk exposure. It is prudent to maintain awareness of liquidity conditions, as sudden changes in liquidity can amplify price movements and impact the ability to exit positions at desired prices. Risk controls should be integrated into the decision-making process from the outset, rather than added after entering trades.

Ethical considerations are also central to research and trading practices. Analysts and investment professionals must adhere to regulatory requirements, maintain transparency about methodologies, and disclose potential conflicts of interest. The integrity of the research process depends on rigorous standards for objectivity and the clear communication of uncertainty. Investors benefit from a research environment in which analyses are thorough, well-documented, and free from undisclosed incentives that could skew conclusions.

It is essential for market participants to understand the limits of models and predictions. Even sophisticated AI-driven analyses operate within the constraints of data quality, model assumptions, and the probabilistic nature of markets. The most reliable investment approaches combine discipline, critical thinking, and humility—acknowledging that forecasts can be wrong and adjusting strategies accordingly. This prudent mindset supports resilient performance across a wide range of market conditions.

Investors should also be mindful of cognitive biases that can color judgment. Overconfidence, anchoring to familiar targets, and confirmation bias can lead to under- or overreaction to new information. A disciplined framework that includes diversified data sources, independent checks, and stress testing can help counteract these biases. The integration of AI tools should be accompanied by human oversight to ensure that data quality issues, model limitations, and unanticipated events are not overlooked.

Liquidity, market structure, and systemic risk are additional realities that shape investment outcomes. Even a well-founded valuation can be challenged by sudden shifts in liquidity, unexpected policy developments, or macro shocks that reverberate through markets. Investors must account for these structural factors when formulating strategies and assessing risk/reward tradeoffs. The aim is to build portfolios that balance potential upside with prudent risk controls and robust diversification, recognizing that no single approach can fully eliminate risk.

The broader investment landscape is increasingly data-driven, with analysts and traders leveraging a spectrum of data-driven insights to inform their decisions. This trend reflects a preference for evidence-based, repeatable reasoning that can withstand scrutiny and adapt to changing conditions. Nonetheless, it remains crucial to preserve a human-centered approach that weighs qualitative factors—such as management quality, competitive dynamics, and strategic execution—that numbers alone cannot capture. The most effective decision-makers combine data-driven insights with careful judgment and risk management, ensuring that insights translate into actionable, sustainable investment choices.

The Path Forward: Synthesis, Strategy, and Practical Guidance

In the evolving world of finance, the synergy between Wall Street analysts and AI-driven analytics represents a frontier of opportunity for investors who aim to navigate complexity with discipline and clarity. The key to realizing this opportunity lies in understanding how to translate consensus estimates, fundamental analysis, and AI insights into a coherent investment plan that aligns with risk tolerance and time horizon. A practical approach involves integrating multiple elements: robust valuation work, a clear assessment of catalysts and risks, careful monitoring of consensus targets, and the prudent use of AI signals as a complementary input rather than an autonomous decision-maker.

Investors can benefit from building a structured decision framework that includes explicit questions and decision rules. For example, one could ask: Where are we relative to the most bullish and bearish forecasts, and how does the current price interact with these targets? How wide is the forecast dispersion, and what does that imply about the level of risk? How does AI-driven trend information align with fundamental valuation and consensus expectations? What are the key catalysts that could drive a revaluation, and what is the probability of their occurrence within the investment horizon? By answering these questions within a disciplined framework, investors can reduce noise, identify meaningful opportunities, and manage risk more effectively.

A balanced approach also emphasizes ongoing education and adaptation. Markets evolve, and so do the tools we use to analyze them. Professionals should stay abreast of advances in financial modeling, data analytics, and machine learning techniques while maintaining a healthy skepticism about the limitations and assumptions embedded in any model. Continuous learning—through case studies, backtesting, and scenario analysis—helps refine strategies and improve resilience during drawdowns.

For individual investors, the wealth of research and analytical methodologies available can be transformative when applied thoughtfully. The combination of traditional fundamental analysis, consensus benchmarks, and AI-enhanced insights offers a comprehensive framework for evaluating fair value and guiding investment decisions. The emphasis should be on building a robust investment process that emphasizes risk control, diversification, and informed judgment, rather than chasing short-term price movements or relying solely on automated signals.

As the trading landscape shifts toward more data-driven approaches, the collaboration between human expertise and AI will likely become more pronounced. Firms will invest in more sophisticated analytical ecosystems that integrate company fundamentals, market analytics, and AI-driven indicators. This evolution will shape how portfolios are built, how trades are executed, and how risk is managed in all market environments. Traders and investors who adapt to this integration—while preserving core principles of sound valuation, risk management, and disciplined execution—are positioned to navigate the next era of trading with greater precision and confidence.

Conclusion

Wall Street analysts, armed with a blend of financial acumen, disciplined valuation techniques, and strategic insight, play a central role in shaping market expectations and investor decisions. Their work—spanning the careful analysis of income statements, balance sheets, and cash flows; the application of valuation ratios and discounted cash flow modeling; and the synthesis of qualitative factors such as management quality and competitive dynamics—helps illuminate what a stock should be worth given current conditions and anticipated developments.

The integration of AI, machine learning, and neural networks adds a powerful new dimension to this analytical framework. When used responsibly, AI can augment human judgment by processing vast data sets, identifying patterns, and testing a wider array of scenarios. The most effective practitioners combine the strengths of human analysis with AI-driven insights to form more robust investment theses, test their assumptions, and manage risk in a disciplined manner. This synergy enhances decision-making, enabling investors to align strategies with evolving market conditions and forward-looking expectations.

Yet the market remains an arena of uncertainty, where forecasts can miss the mark and prices can move for reasons beyond fundamental valuation. Investors should approach consensus estimates, price targets, and AI signals as inputs within a broader decision-making framework that emphasizes risk management, diversification, and ongoing evaluation of evolving information. By maintaining a rigorous approach that integrates quantitative analysis with qualitative judgment, investors can navigate the complexities of financial markets and pursue informed opportunities across asset classes and time horizons.

In the end, the future of trading is shaped by the ongoing collaboration between human expertise and technological innovation. Neural networks, machine learning, and AI-driven analytics promise to enhance our ability to decipher market signals and refine strategies, while the timeless importance of sound fundamentals, prudent risk controls, and disciplined execution remains the bedrock of successful investing. The goal is not to chase the perfect forecast but to develop a resilient, adaptable process that consistently seeks to understand value, manage risk, and seize opportunities as they arise in a dynamic, interconnected global market.