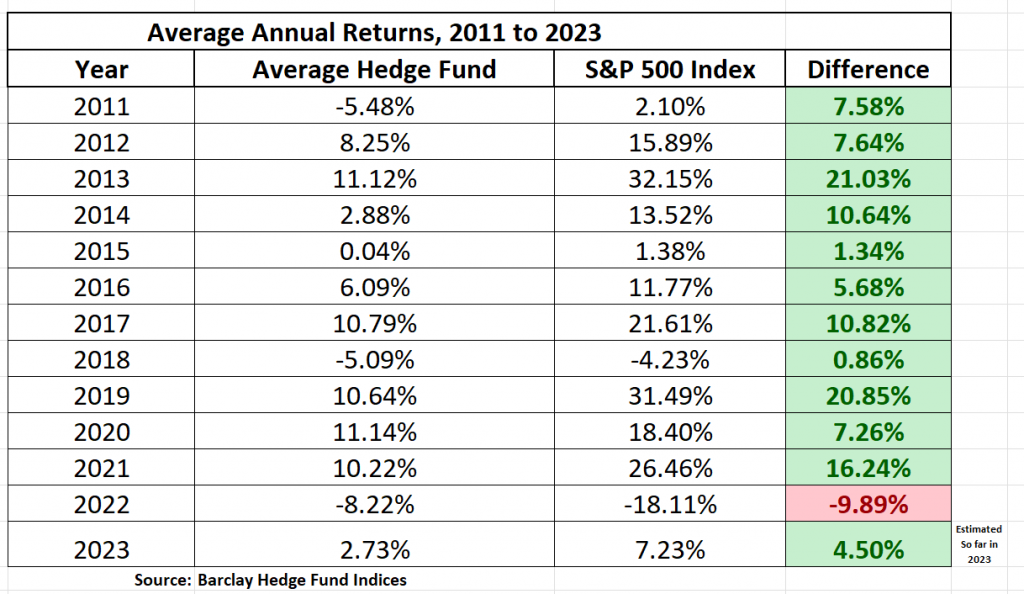

A common stereotype paints hedge fund managers as financial winess and relentless pursuers of alpha, working tirelessly to squeeze out every basis point. Yet, when you compare their net results to a simple S&P 500 index investment, the broader market frequently outperforms more than 90% of hedge funds over time. In plain terms, a straightforward index ETF—one often used as a teaching tool for newcomers—has repeatedly beaten the majority of actively managed hedge funds and investment managers. The fundamental reason behind this reality lies in what the industry refers to as the 2/20 barrier. This 2/20 structure denotes a 2% management fee on assets under management, plus a 20% performance fee on all returns that surpass a predefined hurdle. When the market advances by 8.2%, for instance, the average hedge fund must post gains in the vicinity of 10% or more after fees just to match the broader market. With hedge funds overseeing money on behalf of hundreds or even thousands of investors, the question arises: are their strategies truly worth the high cost? While the movement of assets and the complexity of strategies make for an intricate landscape, there is substantial value in examining data to understand what has consistently delivered results and why. Exploring the question of what constitutes “winning” helps investors understand the data deeply and the tools that top funds rely on to achieve consistent outcomes. The statistical picture for hedge funds and investment managers is sobering. Over the last 13 years, only one year saw the average hedge fund beat the broader market—a mere 7.6% success rate. In other words, hedge funds trailed the performance of the S&P 500 Index by an average of 8.04% per year across that period. The numbers become even more striking when focusing on 2022, widely viewed as a year of relative strength for some hedge funds: the average hedge fund still registered a loss of 8.22%, while the S&P 500 declined by 18.11%. These figures illustrate the difficult environment for active management and underscore the appeal of simpler, lower-cost index strategies that have consistently demonstrated resilience and reliability.

The Performance Gap: Hedge Funds, Fees, and Simple Indexing

The stark contrast between hedge fund results and broad-market performance invites a deeper look at how fee structures and strategy choices shape outcomes. The 2/20 model incentivizes strong performance, rewarding managers who can deliver returns significantly above the base level while simultaneously recouping fees even in less favorable years. In theory, the added skill of active management could justify the extra cost, but in practice the penalty for underperformance is steep due to the combined drag of management and performance fees. This dynamic places pressure on hedge funds to generate substantial alpha to justify their expense, particularly for funds handling capital from a broad investor base with fewer opportunities to optimize tax efficiency and liquidity.

Long-term performance analyses reveal a persistent pattern: many active funds struggle to outperform a low-cost market-cap-weighted benchmark, especially after fees are accounted for. The S&P 500 Index, as a broad representation of U.S. large-cap equity performance, often embodies efficient market behavior over the long run. For passive investors, the simple purchase of a diversified index ETF can deliver broad exposure, transparency, and lower costs—characteristics that have proven advantageous when measured across multiple market cycles. Consequently, the data has generated a conversation about the value proposition of hedge funds, particularly as investor appetite for cost-conscious diversification grows.

The phenomenon is not merely about cost. It also reflects the robustness of index strategies in capturing overall market risk premia while avoiding the higher transaction costs, management complexity, and opaque incentive structures that can accompany active management. The evidence from the last decade plus includes years where even seasoned hedge funds have struggled to beat simple passive allocations after fees. Yet, not all is bleak for active management. The exploration of selective skill, innovative vehicles, and risk-managed strategies provides a pathway for investors who seek to balance potential upside with downside protection. For some market environments, sophisticated strategies—when executed with discipline and transparent risk controls—can offer attractive risk-adjusted returns. The critical takeaway is that the cost and structure of active management shape the net outcomes and must be weighed carefully against straightforward indexing.

The Value of Data-Driven Inquiry

Despite the heavy headwinds for general hedge fund performance, there is measurable value in studying the data and understanding which strategies have shown resilience and consistency. An important takeaway for investors and traders is to ask what qualifies as winning in different contexts, and to examine the tools and datasets top funds use to achieve sustained outcomes. The broader market’s long-run outperformance of many active strategies emphasizes the importance of robust risk management, disciplined position sizing, and a clear understanding of when to participate or step back. The data also invites a closer look at alternative strategies and product designs that can potentially deliver favorable outcomes with a transparent risk profile.

Notable Observations: DIVO and Covered Call ETFs in 2022

Among the standout cases in 2022 was a particular exchange-traded fund known for its distinctive approach: a covered call ETF that produced noteworthy results in a challenging market year. This ETF, identified by its ticker symbol DIVO, managed to limit losses more effectively than the broader market, posting a decline of only 1.48% in a year when the S&P 500 suffered a much steeper drop of approximately 18.85%. The contrast highlights the potential for income-focused strategies to cushion downside risk during periods of heightened market volatility, while still providing exposure to equities. Understanding how DIVO achieves these outcomes requires a closer look at the mechanics of the covered call strategy and its implications for risk and return.

What Is a Covered Call ETF?

A covered call ETF is a specialized type of exchange-traded fund that generates ongoing income by selling call options on the stocks in its portfolio. The ETF purchases a diversified basket of stocks and then sells call options to other investors, granting the option buyers the right to purchase the underlying stocks at a predetermined price. The sale of call options collects option premiums, which serve as income for the fund. This structure creates a trade-off: it limits potential gains in exchange for a steady income stream and generally reduces overall portfolio volatility relative to a pure equity exposure. Investors seeking regular income and a smoother ride in fluctuating markets often gravitate toward these funds because they offer an elevated yield with a more conservative risk profile than traditional equity funds.

DIVO is designed to apply this covered call approach consistently across its portfolio, maintaining a persistent implementation of the strategy across market environments. This is a key feature that distinguishes it from other funds that might apply the approach more selectively or inconsistently. The result is an income-oriented exposure that is still grounded in equity ownership, which can appeal to investors seeking a combination of yield and price stability. While this approach can deliver attractive results in certain cycles, investors should acknowledge that upside potential is often capped by the mechanics of selling call options, and the strategy can experience reduced participation in strong bull markets. The overall performance in 2022 illustrates how income-focused strategies can outperform broad market declines when market dynamics favor option-premium generation and defensive positioning.

Why Such ETFs Appealed in 2022

The year 2022 highlighted the appeal of strategies that emphasize income generation and downside protection. In an environment characterized by heightened volatility and drawdowns, a covered call approach can produce relatively steadier income streams that offset some capital depreciation. The DIVO example demonstrates that an innovative ETF design can deliver outsized relative resilience when compared with the broader market’s performance. This outcome underscores an important insight for investors: sometimes non-traditional strategies can offer meaningful diversification benefits and risk-adjusted advantages, especially in uncertain or turbulent market regimes.

Broader Implications for Investors

The experience of DIVO in 2022 points to a broader lesson for investors: diversification is not only about spreading capital across different sectors or asset classes, but also about incorporating strategies with distinct risk-return profiles. Covered call ETFs add a layer of income generation and defensive capability that can complement traditional equity allocations. However, they also come with trade-offs, notably capped upside and sensitivity to volatility and interest rate movements. For investors weighing these instruments, a careful assessment of risk tolerance, income needs, and time horizon is essential, along with an understanding of how such a strategy interacts with other portfolio components. The DIVO case exemplifies how innovative product design can yield resilience in adverse markets, while reminding investors that every strategy comes with inherent limitations that should be acknowledged and managed.

Risk and Portfolio Fit

From a risk-management perspective, covered call ETFs can function as a hedge against downside risk while still exposing investors to equity-market participation. They often appeal to those who prioritize higher current income and a smoother ride rather than chasing aggressive growth. It is critical to acknowledge that performance is not guaranteed and that market conditions can change the effectiveness of the strategy. The 2022 results for DIVO offer a concrete example of what this approach can achieve under certain circumstances while also illustrating the constraints of capped upside in bull markets. For investors building a diversified approach, such strategies can be valuable components when integrated with other assets, but they should be sized and monitored prudently to ensure alignment with overall risk tolerance and investment objectives.

Risk Quantification and Market Context

Understanding drawdowns and risk exposure remains central to evaluating any strategy, including covered call ETFs. The core concept is to quantify the potential downside over historical periods and anticipate the likelihood of similar losses in the future. In addition to income generation, risk-conscious investors examine how a covered call ETF behaves during drawdowns, how it responds to volatility, and how it interacts with other elements of a diversified portfolio. When combined with traditional equity exposure, covered call ETFs can contribute to a more resilient overall risk-return profile, though investors should remain aware of the trade-offs involved. The DIVO example helps illuminate how such a strategy can deliver performance advantages in the right context, while also serving as a reminder of the importance of strategic allocation, ongoing risk assessment, and alignment with long-term investment goals.

Risk Management, Drawdowns, and the Value of Trend-Detection Tools

A central theme that emerges from analyzing hedge fund performance, index comparisons, and innovative ETF designs is the essential role of risk management in modern markets. The downside risk evident in 2022, when broad markets experienced significant declines, emphasizes the need for strategies that can generate income or mitigate losses during downtrends. One intuitive way to quantify risk is to examine the worst consecutive drawdowns of an asset over a given period. For example, during 2022, SPY experienced drawdowns that varied across a spectrum—from relatively shallow declines around 8% to substantial declines approaching 19%. Such a wide range illustrates how a buy-and-hold approach can suffer severely in adverse conditions, underscoring why many investors seek hedges or alternative strategies that reduce exposure to dramatic losses.

Downside Mitigation and the Role of AI

The integration of artificial intelligence (AI), machine learning, and neural networks presents a compelling area for enhancing downside protection while preserving upside potential. A hypothetical framework could involve using AI-driven signals to time the sale of call options or other protective measures during down forecasts, providing a partial hedge against price deterioration. In a complementary fashion, AI and machine learning could be employed to optimize covered call strategies in real time, attempting to preserve gains during uptrends while managing downside exposure. The overarching idea is to deploy sophisticated trend analysis and predictive analytics to navigate market cycles more effectively than traditional rule-based approaches alone.

Trend Analysis as a Core Tool

One prominent trend-analysis approach described in the material involves a tool that combines predictive moving averages with AI-driven insights to identify potential trend changes. The concept emphasizes the importance of early recognition of shifts in market direction, using a combination of short-, medium-, and long-term indicators to generate buy or sell signals. The goal is to align trades with the prevailing trend, ideally on timely entries and exits that enhance risk-adjusted returns. In practice, traders monitor signals for bullish or bearish conditions and seek confirmations from multiple timeframes and indicators. The emphasis remains on staying on the right side of the prevailing trend while avoiding late-stage movements that could erode capital.

The Role of Predictive Indicators in Trading

Predictive indicators rooted in neural networks and other AI methodologies aim to translate complex market data into actionable forecasts. The idea is to move beyond purely backward-looking metrics and incorporate forward-looking expectations based on patterns learned from historical data. When such indicators generate credible forecasts, traders may adjust positions to capitalize on anticipated momentum or to protect capital against anticipated downturns. While predictive indicators are not foolproof, their potential to improve timing decisions and risk management is a focal point of contemporary quantitative and algorithmic trading discussions.

The Broader Implication for Market Participants

For investors and traders willing to engage with AI-enabled tools, the potential is to enhance decision-making through data-driven insights that complement traditional analysis. The integration of AI, machine learning, and neural networks into trading workflows speaks to a broader trend in financial markets: the fusion of quantitative techniques with real-time data processing to improve efficiency, risk control, and execution. The overarching message is not that technology replaces human judgment but that it augments it, enabling more informed decisions in an increasingly complex and fast-moving environment.

A Cautionary Note on Use

Despite the promise of AI-driven trend analysis and predictive indicators, it is essential to approach such tools with a balanced perspective. No system guarantees profits, and past performance is not a reliable predictor of future results. The risk of losses remains, especially in volatile markets where sudden regime shifts can render even sophisticated models less effective. Investors should treat AI-assisted signals as one component of a comprehensive trading plan, incorporating robust risk controls, position sizing, and clear objectives aligned with long-term goals.

A Timely Reflection on Market Simplicity and Complexity

The narrative around simple versus complex investment strategies sits at the intersection of practicality and sophistication. The Buffett-Bezos anecdote, in which Buffett emphasized that “Nobody wants to get rich slowly,” underscores a preference for straightforward and durable approaches to wealth creation. Yet, modern markets require attention to risk, cost, and the evolving toolkit of strategies that can complement traditional investing. The practical takeaway is to manage risk actively, avoid overcomplication when it does not add enduring value, and remain open to evidence-driven innovations that align with one’s risk tolerance and investment horizon.

Buffett, Simplicity, and the Bottom Line

A well-known origin story in investing features a conversation between Jeff Bezos and Warren Buffett. Bezos once asked Buffett why more people did not simply copy his simple, long-term approach to wealth creation. Buffett’s reply has become legendary: “Nobody wants to get rich slowly.” The message is not a criticism of complexity but a reminder that the most effective strategies, over time, tend to be anchored in clear, repeatable economics and disciplined risk management. The core principle remains: focus on the bottom line, manage risk proactively, and avoid the lure of overengineered schemes that promise outsized gains without commensurate risk control. The practical implication for contemporary traders is to ground investment decisions in solid fundamentals, measure performance after costs, and be mindful of the trade-offs inherent in any strategy.

The Practical Implication for Modern Investors

In the current market landscape, the emphasis on simplicity paired with disciplined risk management has a strong foothold. Investors can draw insights from the contrast between broad-market indexing and active management, recognizing that low-cost passive exposures often deliver more reliable outcomes over extended periods. Yet the appeal of targeted, risk-managed approaches—such as covered call strategies or AI-enhanced trend analysis—persists for those who seek to supplement passive holdings with additional income, downside protection, or tactical tilt in response to evolving market conditions. The critical takeaway is that investors should calibrate their portfolios to their objectives, time horizons, and risk tolerance, while carefully assessing costs, potential rewards, and the likelihood of sustaining performance in various market regimes.

Risk, Reward, and Strategic Alignment

Ultimately, the conversation about hedge funds, market benchmarks, and innovative investment products centers on risk, reward, and strategic fit. While the broad market often outperforms many active strategies after fees, there remains a legitimate space for intelligent risk management, diversified approaches, and data-driven decision-making. Investors who can reconcile cost efficiency with strategic nuance stand to build resilient portfolios capable of weathering market volatility. The ongoing evolution of investment tools—be it traditional indexing, income-focused ETFs, or AI-powered trend signals—offers a spectrum of options. The challenge is to design a coherent strategy that integrates these elements in a way that aligns with personal financial goals and risk tolerance.

Conclusion

The landscape of hedge funds, active management, and index-based investing reveals a clear, data-driven truth: the broad market often outperforms many active strategies after costs, especially over extended periods. The 2/20 fee barrier helps explain the hurdle faced by hedge funds in delivering net alpha to investors. At the same time, novel approaches such as covered call ETFs demonstrate how income generation and downside protection can coexist with equity exposure, offering resilience in tougher markets like 2022. The data on performance, including the standout performance of a covered-call ETF during a difficult year, emphasizes the importance of understanding strategy characteristics, risk profiles, and the implications of fee structures.

Beyond raw returns, investors can gain meaningful insight by examining drawdowns and the role of risk-management tools—whether traditional hedges or AI-driven trend-analysis frameworks. The case for embracing a balanced approach that blends simplicity with strategic innovations becomes compelling in today’s market environment. The Buffett anecdote reinforces the enduring truth that straightforward, robust risk management and sustainable bottom-line focus remain central to successful investing. As technology and data analytics continue to augment decision-making, investors should remain disciplined, cost-conscious, and aligned with long-term objectives, recognizing that every strategy carries trade-offs and that thoughtful combination can yield a resilient, well-structured portfolio.